Generally, companies engaged in the Materials and Industrials space require higher capital expenditure to fund the progress of their respective projects. Here, we are discussing the five ASX listed stocks with decent fundamentals and market capitalisation of over A$1 billion.

Orora Limited

Orora Limited (ASX: ORA) provides a wide range of customised packaging and visual communications solutions which include the designing & manufacturing of packaging products. The company has footprints in 7 countries with 43 manufacturing plants, 91 distribution sites and 6.8k team members.

Announcement of the Significant Item: The company, on 2 August 2019, updated that it will recognise after tax expense amount to $55.8 million as significant item in the statutory financial results for FY19 which are scheduled to be announced on 15 August 2019. Additionally, ORA reaffirmed that earnings in constant currency (CC) for FY19 are likely to be higher than reported in FY18.

The company also notified that Perpetual Limited (ASX: PPT) and its related bodies corporate have raised their voting power from 7.42% to 8.45% in ORA on 24 July 2019.

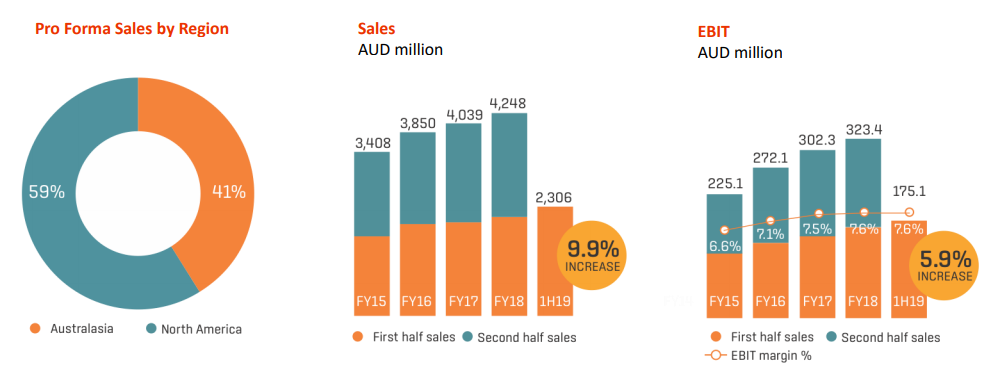

1H19 Performance Highlights: On 13 February 2019, the company came up with decent earnings growth, increased dividends and higher returns in the first half of FY19 period. Pursuing growth, the company has enjoyed strong balance sheet.

Topline at ~$2,306 million revenue recorded an increase of 9.9% on pcp during 1H19 period. Statutory PAT (profit after tax) for the period came in at $113.7 million, posting a growth of 9.5% as compared to $103.8 million in the prior corresponding period. ORAâs EBIT (earnings before interest and tax) saw a growth of 5.9% from $162.6 million to $175.1 million during the period. The capital expenditure during period was incurred at $73.9 million with 108% depreciation. The balance sheet was leveraged at 1.8x, witnessing an increase of 0.3x, during the period.

Looking at the segment wise performance, Australasia accounted for 59% or ~$1,088 million of the total revenue, whereas the remaining 41% or US$882 million came in from North America. The sales revenue from Australasia and North America posted a yoy growth of 4.4% and 7.2%, respectively.

Overview of sales and earnings (Source: Companyâs Report)

Overview of sales and earnings (Source: Companyâs Report)

On 5 August 2019, the stock of the company was trading flat at A$3.310 (at AEST 2:02 PM) with market capitalisation of A$3.99 billion. The companyâs annual dividend yield stands at 3.93%. The stock is currently available at the price to earnings multiple of 17.990x.

Boral Limited

Boral Limited (ASX: BLD) manufactures and supplies the construction materials related to buildings in Australia, the USA, Asia & Middle East.

Boral signed agreement with Mirvac: The company, recently on 21 June 2019, notified that it has inked a deal related to property development management with Mirvac Group (ASX: MGR) regarding its Scoresby site in Victoria. Mirvac would take the responsibility to develop the 171 hectares site over a multi decade period. The development includes a proposed substantial new parklands and housing community.

BLD is expected to receive ~$66 million of EBITDA through to FY26 which includes $3 million in FY19. The company expects additional substantial earnings to be incurred from the development of Scoresby from FY27 through with expected project completion in 2035. Scoresby is expected to record earnings in excess of $300 mn over the life of the project, pursuant to condition. In FY19, BLD is likely to see ~$30 million EBITDA from Property earnings, as guided earlier.

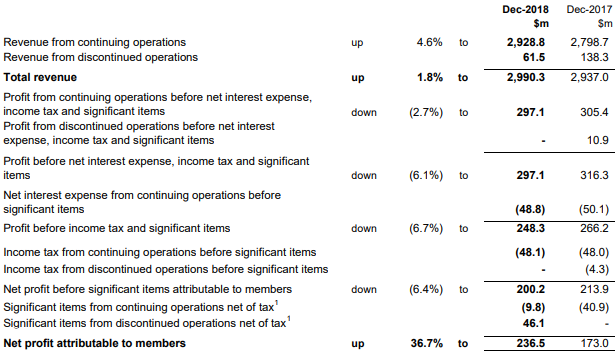

As per 25 February 2019 release, the company during 1H19, recorded the revenue of $2,990.3 million which was up by 1.8% on $2,937.0 million in H118 period. Bottomline during the period, grew by 36.7% to $236.5 million as compared to $173.0 million in H118 period.

1H19 Results Summary (Source: Companyâs Report)

Going forward, in FY19, Boral Australia is likely to see broadly similar EBITDA of FY18 period, excluding property in both the years. Property earnings are expected to be ~$30 million as compared to $63 million in FY18. EBTIDA growth for FY19 from Boral North America is expected to come in at 15% in USD, owing to volume growth, further synergy delivery and operational improvements. FY19 earnings for USG Boral are likely to be slightly lower as compared to FY18.

On 5 August 2019, at the market price of A$5.16, down by 1.338 percent (at AEST2:23 PM) the stock is available at the price to earnings multiple of 12.16x. The Market capitalisation for the stock stands at $6.13 billion with annual dividend yield at 5.16%. The stock is currently trading towards the lower end of its 52-week range of A$4.400-$7.420. The stock has given a negative return of -21.35% in the last 1-year period.

Incitec Pivot Limited

Incitec Pivot Limited (ASX: IPL) is into production and distribution of industrial explosives and chemicals, fertilisers along with the provision of associated services. The Group operates in four main countries which are Australia (country of domicile), USA, Canada and Turkey.

Central Petroleum Updated on JV Project with IPL: On 31 July 2019, Central Petroleum Limited (ASX: CTP) provided the update related to the drilling operations on Project Range which is a Joint Venture (50:50) with a 100% owned subsidiary of Incitec Pivot Limited in ATP 2031. The release mentioned that the drilling program was progressing well with Range 2 (the fourth well in the Project Range exploration program) spudded on 30 July. Also, the Dukas 1 well saw a resumed drilling in 9-1/2â hole on 31 July and further drilling work is going on.

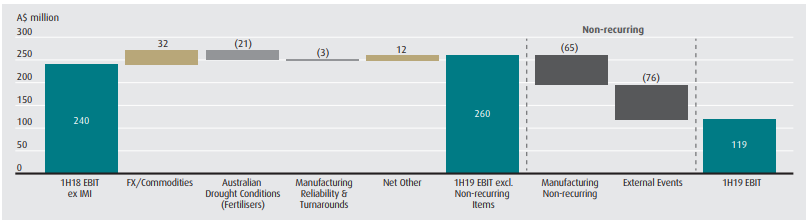

1H19 Results Highlights: On 20 May 2019, the company released half-year report for the period ended 31 March 2019, during which it saw an EBIT (Earnings Before Interest and Tax) ex-IMIs of $119 million which declined by $121 million as compared to pcp. Excluding the $141 million impact from non-recurring items in 1HFY19, EBIT witnessed a growth of 8% to $260 million.

1H19 Business Review, ex-IMIs (Source: Companyâs Report)

1H19 Business Review, ex-IMIs (Source: Companyâs Report)

On 5 August 2019, at the market price of A$3.385, down by 2.45 percent (at AEST 2:43 PM) the stock was trading at price to earnings multiple of 23.690x. The market capitalisation of the company stands at A$5.57 billion with annual dividend yield of 2.16%. The stock has provided a negative return of -7.96% in the last one-year period and is currently trading towards the lower end of its 52-week range of A$3.030 - A$4.280.

Fletcher Building Limited

Fletcher Building Limited (ASX: FBU) is one of the most diversified building materials companies in the world. In FY18, the company came up with new strategy to improve its performance with focus on simplifying the business. The company aims to become an undisputed leader in NZ and AU building solutions with key focus areas being refocus on the NZ core, stabilise Construction, Strengthen Australia, and exit non-core businesses.

New Appointment: The company recently informed about the appointment of Andrew Clarke to be positioned at Group General Counsel and Company Secretary with the joining date of 30 September 2019.

On 19 July 2019, the company also notified that Ellerston Capital Limited (Primary Person) and its associates has ceased to be a substantial holder in the company effective 18 July 2019.

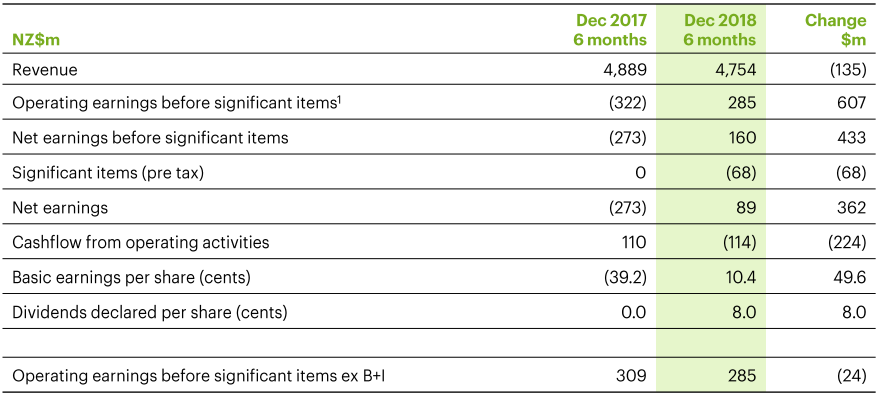

1H19 Performance: On 20 February 2019, the company released half-year outcome, with topline witnessing a decline of revenue from ordinary activities of 3% to ~NZ$4.8 billion during the period. The lower sales were anticipated by the Management, which was outcome of reduced Construction revenue. Group EBIT stood at NZ$285 million as compared to a loss of NZ$322 million in 1H18. However, adjusting for the impact of B+I, EBIT was 8% lower for HY19.

1H19 Overview (Source: Companyâs Report)

1H19 Overview (Source: Companyâs Report)

Going forward the company intends to achieve modest profit growth in FY20 despite ongoing expected contraction in residential market. The Management aims to continue the business generating 7% EBIT margin in the medium term.

At the market price of A$4.665, the stock is available at the price to earnings multiple of 21.220. The stock has generated a return of -25.36% in the last 1-year duration. The Market capitalisation of the company stands at A$4.02 billion.

Monadelphous Group Limited

Monadelphous Group Limited (ASX: MND) is a diversified entity providing services related to the resources, infrastructure and energy.

Contractsâ Update: On 5 August 2019, MND updated the market on obtaining a contract with Origin for the construction of the Talinga Orana Gas Gathering Station, situated in Queensland region. MND further notified that it has obtained an order within an existing panel agreement with BHP Mitsubishi Alliance. MND has gained a fresh 3-year contract for the supply of shutdown in Western Australia region and mechanical services at South32âs Worsley Alumina Refinery in Collie. Further, MND notified that it has received 2 new contracts with Rio Tinto.

The company, on 2 August 2019, notified that it has received a construction contract with Rio Tinto, related to the West Angelas Deposits, situated in the Pilbara area of Western Australia region. The work on it would start immediately and is likely to be completed in April 2021.

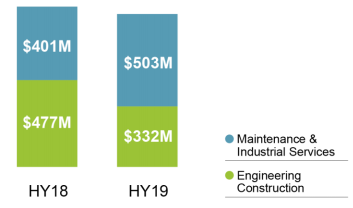

1H19 Highlights: On 19 February 2019, in the six months results ending 31 December 2018, MND had recorded revenue from contracts with customers of $830.5 million, down 5%, but in-line with the guidance provided earlier. EBITDA for the period stood at $55.8 million which was 10.2% lower on pcp. On the balance sheet front, the company enjoyed strong cash balance of $193.5 million, with cash flow from operations, during the time frame standing at $15.5 million. Maintenance & Industrial sector posted a record revenue of $503.2 million, up 25%. Revenue from Engineering Construction stood at $332 million and the segment saw a successful completion of its largest ever project, Ichthys Project Onshore LNG Facilities and executed a number of projects under panel contract with BHP in the Pilbara, during the period.

Break-up of 1H19 Revenue (Source: Companyâs Report)

At the market price of A$17.91, down by 2.769 percent (at AEST 3:29 PM), the stock of the company was trading at price to earnings multiple of 26.81x and trading towards the higher end of the 52-week range of $12.510 - $20.070. The market capitalisation of the company stands at A$1.74 billion with annual dividend yield at 3.09%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.