What we consider as big is actually very small in the real world. How big is the company? $100 million, $200 million, $1 billion? The companies with even these market cap fall in the category of small cap companies. There are numerous companies listed on ASX which have a market cap of over $1 billion, which often delivered fine returns with over double-digit gains sometimes, but some investors think that these arenât worth a big investment! Of course, investing in small caps is a bit risky due to the price swings but this is also true that even a small investment in small-cap stocks could pay off handsomely. I think that investors should have some exposure to small cap stocks! Let us have a glance on how a few small caps are performing.

Wisr Limited (ASX: WZR)

Lending Milestone Achieved: Wisr Limited (ASX: WZR) is a marketplace lending platform which provides personal loans and retail investment products. The company has recently announced the appointment of Joanne Edwards for the position of Chief Risk and Data Officer with effect from 13 January 2020. The company is one of the most recognised FinTech companies in Australia with 24 nominations and 6 awards in the past one year. Wisr has given the update on FY20 performance wherein it states that it has surpassed $150 million in total loan originations. During the first quarter of 2020, the company launched a new lending product for secured vehicle financing and over 85,000 Australians are now introduced to the Wisr Ecosystem.

Future Expectations: The company is expecting approximately 3 million personal loan applications per annum. It is planning to scale up by diversifying the funding structure and by activating B2B2C channels with strategic partners to reach millions of Australians. Wisr will continue to launch innovative features and products to remain market leading.

Stock information: The stock closed at $0.150, down by 3.226% on December 11, 2019. As per ASX, the stock of WZR gave a return of almost 269% on the YTD basis and a return of 40.91% in the past 30 days. As on date, the market capitalisation of the company stood at $128.11 million.

Collection House Limited (ASX: CLH)

Collection House Limited (ASX: CLH) is Australiaâs leading receivables management company which offers resolutions to companies and individuals that cover the entire credit management. In the recently held Annual General Meeting of the company, the top management addressed its shareholders and stated that revenue of the company stood at $161.1 million, up by 12% on FY18. This was mainly due to the second transaction with Balbec Capital LP, PDL growth and a positive revenue recognition change under AASB 9. This rise resulted in the higher EPS of 22 cents per share. The company also met its profit target with an 8% increase in Net Profit After Tax to $22 million.

What to Expect: The company remains confident of the outlook for Cash Collections, PDL purchases and profit growth. It gave the guidance for cash collection and expects it to be in between $145 million 155 million. It also expects a higher earnings per share ranging between 23¢ps-24¢ps in FY20, equating to growth of up to 23%.

Stock Performance: The stock of CLH closed at $1.065 on December 11, 2019. As per ASX, the stock of CLH gave a negative return of 12.5% in the past 6 months and a negative return of 11.07% in the past 30 days. As on date, the market capitalisation of the company stood at $154.01 million and is trading at a P/E multiple of 4.870x.

Consolidated Operations Group Limited (ASX: COG)

Non-renounceable entitlement Offer: Consolidated Operations Group Limited (ASX: COG) is engaged in the asset and equipment finance sectors with an investment objective to grow EPS from investing in growing existing businesses which focuses on finance broking and accumulation and commercial leases. The company announced to raise approximately $12.4 million under the non-renounceable entitlement including approximately $1.4 million of acceptances from existing shareholders. In the recently held Annual General Meeting, the top management of the company stated that the revenue of the company went up by 32% to $217.2 million with an increase of 32% in NPATA at $7.9 million.

Financial Performance (Source: Companyâs Presentation)

Future Expectations: In FY20, the company prioritises to complete CML âmerger of equalsâ transaction and to expand COGâs in-house financial product portfolio. It will also enhance underlying performance of businesses and is planning to invest in infrastructure and IT systems to support strategic growth objectives in FY20.

Stock Recommendation: As per ASX, the stock of COG gave a return of 6.63% in the last 3 months and a return of 1.99% in the past 30 days. As on 11 December 2019, the market capitalisation of the company stood at $138.14 million and is trading at a P/E multiple of 29.060x.

Bailador Technology Investments Limited (ASX:BTI)

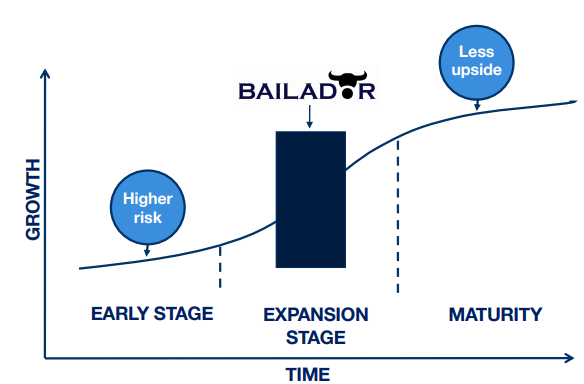

Substantial Rise in After Tax Profit: Bailador Technology Investments Limited (ASX:BTI) is an investment company which will invest in businesses in the information technology sector. In the recently held AGM, the chairman of the company addressed its shareholders and stated that after tax profit tax of the company for the FY19 went up by 362% from $3.6 million in FY18 and stood at $17.1 million. In the first three months of 2020, the company increased its investment in Instaclustr by 30% and expects a revenue growth to continue at around 30% in 2020.

Companyâs Growth (Source: Company Reports)

What to Expect: The company is very well positioned to take advantage of the accelerating business uptake of Software-as-a-Service and expects that there will be cash realisations from one or more investment positions in the BTI portfolio in FY20. It further anticipates valuation uplifts across a number of portfolio companies in FY20.

Stock Performance: The stock of BTI closed at $1.010, up by 1% on December 11, 2019. As per ASX, the stock of BTI gave a return of around 35.14% in the last one year and a return of 5.26% in the past 6 months. The market capitalisation of the company stood at $120.25 million and is trading at a P/E multiple of 7.050x.

Gowing Bros Limited (ASX:GOW)

Sells Moonee Market Shopping Centre: Gowing Bros Limited (ASX:GOW) is an investment and wealth management company which manages a diversified portfolio of various asset classes like long-term equity, Real Estate, various alternative investments, etc. Gowing Bros Limited has recently revealed that it has signed an agreement to sale Moonee market shopping centre to a fund managed by Primewest Funds Limited for a consideration of $30.5 million.

Stock Performance: As per ASX, the stock of GOW gave a negative return of 14.62% on the YTD basis and a negative return of 1.33% in the past 30 days. The stock closed at $2.23, up by 0.45% on December 11, 2019.

Conclusion: As mentioned above the small cap stocks are volatile but can offer higher returns as in the case of WZR, which gave a return of over 250% in the year to date. Some stocks offer a decent outlook that drive long term growth prospects. Thus, it is important to conduct good research before choosing a small cap stock.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.