In a recent article, we introduced our readers to the world of derivatives. In that article, we discussed the types of derivatives, including various OTC and exchange-traded derivatives.

In this article, we will try to walk you through-Swap Derivative. Before diving into swap derivative directly, letâs start with the definition of the derivative for a better understanding and then discuss the complex swaps.

About Derivative:

A derivative is a contract between a buyer and seller whose value depends on the price of an underlying asset. Derivatives are used by the investor for mitigating the risk of adverse price movement. There are majorly 4 kinds of the derivatives agreement. These are forward, future, options and swaps.

Amongst these four derivatives contracts, in this article, we will discuss swap derivatives.

Swap:

Swap is a derivative contract under which cash flows or liabilities from 2 distinct financial instruments are exchanged between 2 participants, and in most of the cases, swaps involve cash flows centred around the notional principal amount like bond or loan. The institutions are the major players in the swap market. Swaps are relatively modern derivatives, which were first used in 1970.

Swaps are traded outside the stock exchange and happen over the counter. In swaps, the parties involved in the contract exchange the cash flow in future based on the present formula. One party pays a fixed price while the other pays a floating rate or variable rate. To explain the concept of swap more precisely letâs consider an example.

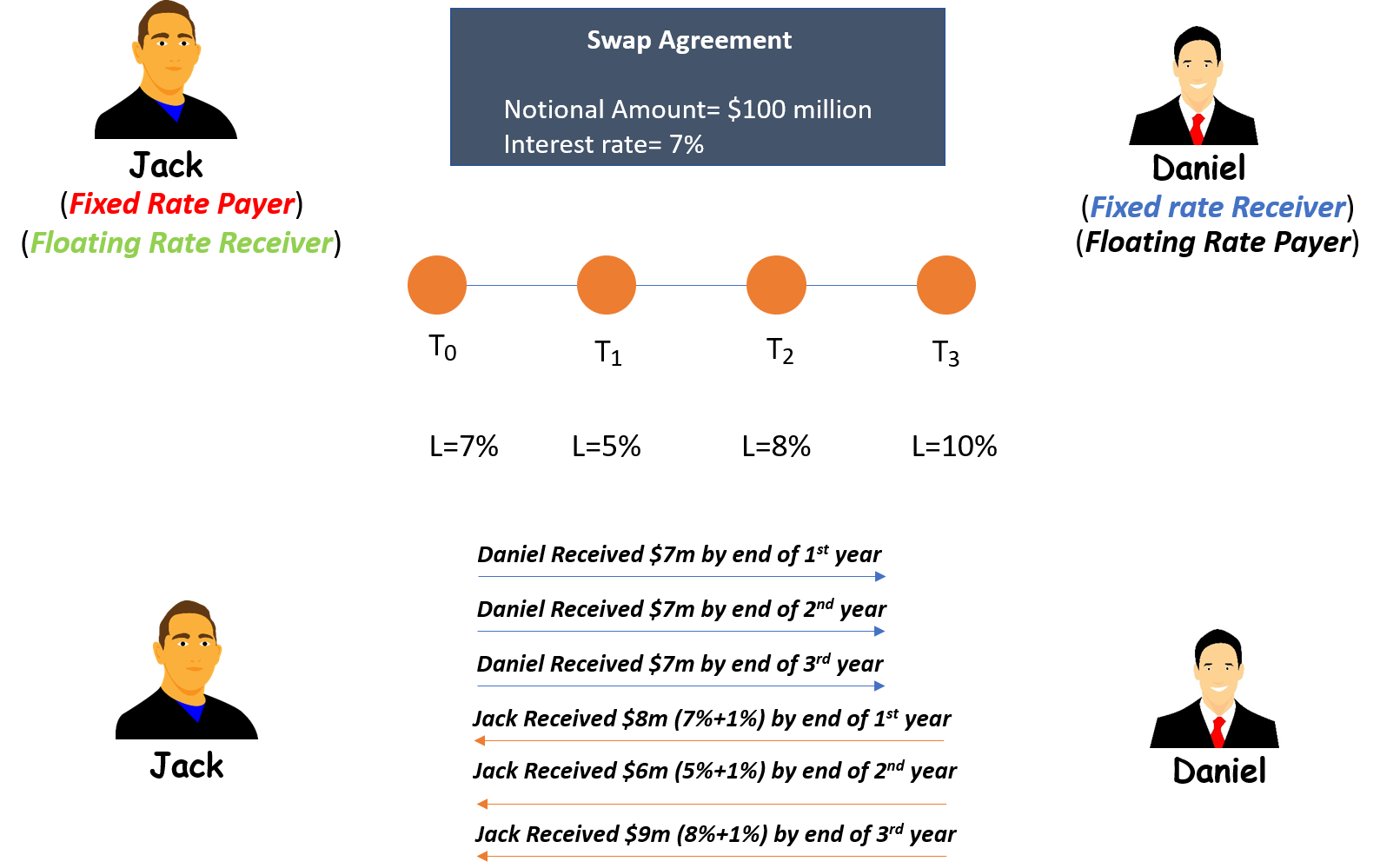

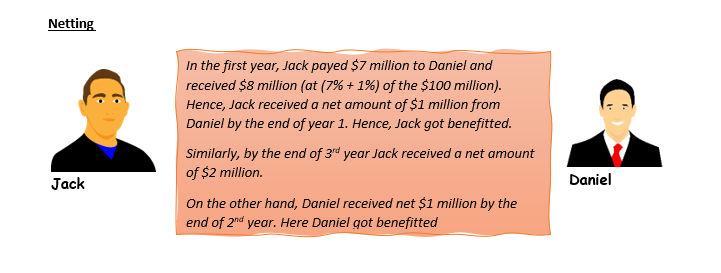

Letâs say there are two parties (say X and Y) two have entered into a swap agreement for a period of three years. Party X is the fixed rate payer, and Party Y is the fixed-rate receiver. Letâs assume that the swap agreement states a notional amount of $100 million at a price of 7%. In this transaction, party X is the fixed rate payer who agrees to pay party Y at a fixed interest rate of 8% while party Y agrees to pay party X at a floating interest rate of LIBOR+1%.

Now consider, at the time the agreement, i.e. t0 the LIBOR rate was 7%. Next year, i.e. t1 the LIBOR rate was 5%, and in t2 and t3 the LIBOR rate was 8% and 10% respectively. Letâs begin with an example followed by the calculation.

Now, the next question which can strike is whether there is any risk associated with the swap? The response to this question is: Yes. Swap being a derivative product involves risk and to overcome this risk is difficult. Thus, to minimize risk, the parties involved in the transaction conduct credit check of each other.

Another way to minimize risk is through the central counterparty or the CCP that works in a similar way the exchange works, where both the parties need to deposit certain deposit margin. Risk in the swap can be minimized but cannot be eliminated.

Different types of swaps:

Plain Vanilla Swap:

Plain Vanilla Swap is the most basic type of swap and is similar to those involving currencies and commodities. In this type of swap arrangement, the counterparties associated exchange the payment on a periodic basis based on certain parameters using the interest rate as the foundation for the agreement.

Parties basic objective behind entering into plain vanilla rate swap is to hedge against the floating-rate exposure. But it can also be used to get benefited from the declining rate environment by shifting from a fixed to a floating rate. Both the legs, i.e. fixed, and the floating are denominated in the same currency.

The concept explained through the diagram above is an example of a plain vanilla swap. Interest rate swap is the most popular type of plain vanilla swap.

Currency Swaps

The currency swap, which is also known as the cross-currency swap involves the exchange of interest and sometimes the principal amount in one currency for an equivalent amount in the other currency. Organisations having a business in foreign countries take advantage of cross-currency swaps to get a more suitable loan rate in the local currency than if it was lent from the local bank.

Interest rate fluctuations for currency swaps comprises of floating-rate to a floating rate, fixed rate to fixed-rate or fixed rate to floating rate.

How does cross currency swap operate?

Suppose there are two companies A and B. Company A is an Australian company, and company B is a US company. Company A has its subsidiary in the US while company B has its subsidiary in Australia.

Now, company Aâs subsidiary requires USD to fund its business. So, if company A which is situated in Australia, is looking to raise US$1 million. Company A can borrow the loan amount at 6% (AUD) and 10% (in USD)

Similarly, Company B is looking to raise $1.45 million to fund the business requirement of its subsidiary company situated in Australia. Company B can borrow the amount at fixed rates in the US at 5% while if it takes a loan in Australia, it might have to pay the interest of 9%.

Letâs say, the spot rate is US$1= A$1.45. Assuming that the contract is valid for 1 year, letâs see how it work.

Seeing the scenario and the funding requirement of the companies, letâs say both the companies enter into a currency swap agreement. Now, company A and B are counterparties will be raising the loan amount from the bank in their local currency at a particular interest rate. Precisely, company A will raise A$1.45 million on behalf of its counterparty at an interest rate of 6% and provide the loan to the subsidiary of its counterparty B. Similarly, company B will raise US$ 1 million on behalf of its counterparty at an interest rate of 5% and provide the loan to the subsidiary of its counterparty A. Thus, both the companies successfully swapped the principle amount and funded their businesses.

Now by year-end, these companies have to pay the interest to the bank. So, both the companies pay the interest to the bank and get them reimbursed from the respective subsidiary of its counterparties. It means company A which paid an interest of A$0.087 million to the bank will take the interest amount from company Bâs subsidiary and Company B which paid an interest of US$0.06 million will take the amount from the subsidiary of company A.

Both the companies by the end of the agreement, swap back the principles as they did not continue the contract. Company A will pay B A$1.45 million and receive US$1 million, and company B will pay US$ 1 million to A and receive A$1.45 million.

The biggest advantage of a currency swap is that the loan is available to both the counterparties at the lowest available rate in the market.

Commodity Swaps

Commodity swap occurs within the companies using the raw material to produce a finished product. The profit from the product is directly proportional to the prices of the commodity. For example, the Price of petrol will be impacted if the price of crude oil influences.

Commodity swap works on the similar principle of interest rate swap. The only difference between the two swaps is that in an interest rate swap, the floating interest is LIBOR while in commodity swap, the floating leg is the price of the underlying asset.

Credit Default Swaps

Credit default swaps provide insurance against the scope of the default by a borrower.

For example, Borrower A requires $20 million to fund his business. He goes to the bank and borrows $20 million against an interest rate of suppose 10%. Now, the bank would run a risk of loss, if the borrower fails to pay the bank its principle and interest amount. To mitigate such risks, there is a third party (insurer) which takes the risk to pay back the entire amount taken by the borrower in case the borrower defaults. This service is rendered to the bank by the insurer for a fee. This complete arrangement is called the credit default swap.

Zero Coupon Swaps

A zero-coupon swap refers to the exchange of cash flows in which the floating interest rate payment is made periodically while just like plain vanilla swap, but the stream of the fixed-rate payment is made as one lump-sum payment.

The zero-coupon swap is used by the companies to reduce risk on a loan in which interest is paid at the time of maturity. Banks issue such bonds to meet interest payments- end of maturity payments.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.