The constant news flashes pertaining to global fiscal and monetary initiatives, people regularly monitoring the Covid-19 statistics along with businesses adopting advanced tech models as new normal is a clear indication of the growing eagerness to emerge out of the current health and financial crisis.

Life in lockdown and curbs on some of our favourite pastimes/businesses/educational courses has intensified our dedication to get out of the pandemic. Similar zeal to revive the stalled economy has motivated a range of initiatives from different governments and central banks worldwide.

While countries such as Australia and New Zealand appear to be strengthening their control over the clutches of pandemic, many others still await their redemptions.

ALSO READ: Brewing tensions between China and Australia: What could be at risk?

The US remains at the centre of the crisis as varying controversial issues grip the nation. Let us look at the key highlights that are simultaneously channelling positivity and despair concerning the swift economic revival for the US.

A Mix of Hope and Despair Girdling the US Recovery.

The US is reeling from the disastrous impact of Covid-19, which has not only shaken its health system but also unnerved the economic stability. The debate regarding the lockdown continues with many blaming delays in lockdown as the cause of Covid-19 escalation, while others are grumbling the ill-effects of lockdown on the lives.

Markedly, a few days earlier, US President Donald Trump pressing for the economic revival highlighted the country had flattened Covid-19 curve.

However, one cannot ignore that pandemic scenario in the US has taken a gigantic form with confirmed cases in the country surpassing the statistics in all other nations. US has recorded ~ 1.62 million cases that include over 95,000 fatal casualties as on 22 May 2020.

ALSO READ: A juxtaposition of Market Optimism and Investors’ Fear Across the Globe

Federal Reserve Chairman Jerome Powell has indicated that the nation might take more than 18 months to recover from the pandemic. It would mean that the economic recovery in the country could extend to the end of 2021.

At the same time, he stressed on not betting against the US economy, reverberating the Warren Buffet’s long-held confidence in the country’s economic system. Berkshire Hathaway CEO quoted that amidst the uncertain world where we live, the certainty lies in the United States going forward over time.

Powell earlier indicated on stretched period of recession in the US as he hinted on the need for more financial aid from the government as the pandemic endangers the business productivity of the country.

At the same time, warning of US top health expert, Dr Anthony Fauci concentrates on the fact the US reopening is likely to trigger infection in the country. Trump, however, cited the warning as ‘unacceptable’.

Amidst the current scenario, what remains the focal point of discussion is the time when the US would witness a slowdown in the cases or reboot in the economy.

Many states in the US have started reopening, which has rekindled the hopes of restarting the business operations. While, the social distancing norms and people’s apprehensions concerning the future remain deep-rooted as the economy recommences its initial recovery steps.

Despite lifting of the restrictions kickstarting the economy, around 2.4 million Americans last week filed for unemployment insurance, signalling a period of crunch in the upcoming time.

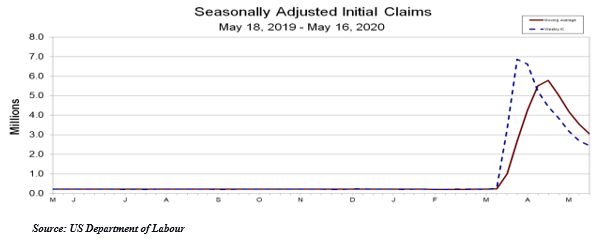

The seasonally adjusted initial claims that skyrocketed during April, however, have declined considerably signifying that the economy has started to stabilise. Yet, the country’s economy undoubtedly has a long journey ahead as the claims remain much higher compared to the previous year.

US-China Virus Spat

Donald Trump, since the initial cases in the country, has pointed China’s fault in handling Covid-19 that caused severe casualties worldwide, with the US demanding enquiry on China for withholding pandemic details from the world.

The weak strings of the trade pact which was earlier signed in January seem to be rupturing as the relationship between countries dwindles further. In one of his most forceful statement against Beijing, Trump mentioned his intention to “cut off the whole relationship with China”.

World’s top two economies are at the trade war for a few years, which has brought worries for the world economy. Trump’s economic policies centric to increasing the purchase of American goods by its citizens conflicts against the vast availability of Chinese products in the US market. The US had imposed a high tariff of the Chinese goods for thwarting the growth of the Chinese goods in its market, has been retaliated by China.

ALSO READ: Are We Prepared for a Trade War with China?

Fast forward to the present condition; the US has warned of further trade barriers to curb Chinese growth. Amidst the worsening bilateral relation, US Senate on Wednesday passed the bill, which would result in the delisting of Chinese firms from the exchanges. It could lead to one of the largest Chinese companies such as Baidu Inc. and Alibaba Group Holding Ltd. being delisted from the US stock exchanges.

Moreover, China designing the national security laws for Hong Kong has further fuelled the tensions.

Lens on Stock Market Amidst the Chaos

The US stock markets have followed a relatively sinusoidal movement amidst the growing volatile market situation. While the effect of fear and uncertainty clouds the economic reopening, Nasdaq Composite gained by around 9% in the past one month on 21 May 2020 while Dow Jones Industrial Average climbed by about 4%.

While the unemployment claims impact investor’s sentiments, key developments such as Covid-19 containment, vaccine/drug discovery and US-China relations would be monitored by the experts to gauge the impact on the market scenario.