An Initial Public Offering (IPO) comprises of a private company listing its securities on a stock exchange for the purpose of raising funds for expansion, working capital requirements, acquisitions, debt repayments etc. Now let us have a look at few upcoming IPOs on the ASX and their respective purposes for raising money.

Company Description

Damstra Holdings Limited (ASX:DTC) is a provider of workplace management solutions to multiple industry segments with operations in Australia, New Zealand, UK and the United States. The companyâ operations are majorly focused on industries with large workforces such as mining, resources and construction.

Damstra Holdings Limited

Damstra Holdings Limited (ASX:DTC) is a provider of workplace management solutions to multiple industry segments with operations in Australia, New Zealand, UK and the United States.

Business Model: The companyâ operations are majorly focused on industries with large workforces such as mining, resources and construction. Safety and compliance play a major role in such organisations, which is catered to by the companyâs hardware and software solutions that help in reducing staff down-time, injury rates and manual labour. Revenue of the company is generated from payments received for subscription to the hardware and software solutions, offered in advance by the clients.

Product Suite: The companyâs product suite comprises of workforce management, access control, learning management, HSE management and asset management.

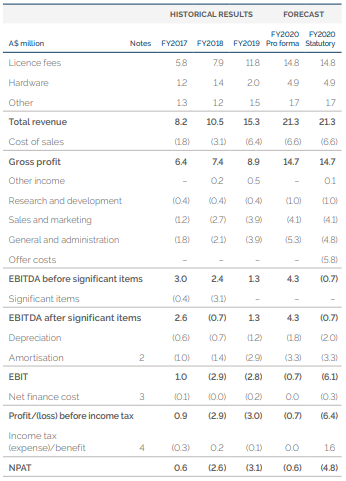

Financial Performance:

- Over a period of three years covering FY17 to FY19, the company generated positive pro forma EBITDA and positive operating cash flow.

- CAGR growth in pro forma revenue over the period covering FY17 to FY20 is expected to be 37.3%.

- In FY19, the company had a pro forma gross margin of 58.2% which is expected to rise up to 69.0% in FY20. Average pro forma EBITDA margin during the 3-year period stood at 22.7% and is expected to be 20.3% in FY20.

- Average operating cash flow conversion for the 3-year period was reported at 82% and is expected to be greater than 150% in FY20.

Financial Results (Source: Company Prospectus)

Offer Details: The company is planning to raise a total amount of $49.3 million through an initial public offering of 54.8 million shares at an offer price of $0.90 per share. The funds will be utilised to reduce the existing debts of the company, consideration in relation to the companyâs acquisition of Velpic and EIFY, payment of offer costs and other general purposes. The offer opened on 01 October 2019 and is expected to close on 10 October 2019, with settlement expected by 15 October 2019.

Company Description

Latitude Financial Group Limited (ASX:LFS) is a digital payments, instalments and lending platform. The companyâs offers its services under two brands namely, L-Pay, comprising its payment and instalments products and L-Money, comprising its lending products. L-Pay extends its services through LatitudePay, Genoapay, GemVisa, GO Mastercard and CreditLine. Offerings under L-Money include credit cards, personal loans and motor loans.

Latitude Financial Group Limited

Latitude Financial Group Limited (ASX:LFS) is a digital payments, instalments and lending platform. The companyâs offers its services under two brands namely, L-Pay, comprising its payment and instalments products and L-Money, comprising its lending products. L-Pay extends its services through LatitudePay, Genoapay, GemVisa, GO Mastercard and CreditLine. Offerings under L-Money include credit cards, personal loans and motor loans.

Revenue Generation: The company generates revenue in the form of net interest income received on instalments products, credit card, personal loan and motor loan balances. Another source of revenue includes merchant service and transaction fees paid by merchant and commercial partners to Latitude. In addition, the company generates net insurance income in the form of premium earned from the Hallmark Insurance credit insurance business.

Key Performance Indicatiors (Source: Company Prospectus)Â

Performance Highlights:

- In FY18, total loan volume amounted to $8,859.4 million, up 4.7% on FY17 volume of $8,458.2 million.

- Cash NPAT witnessed a growth of 15.7% from FY17 to FY18.

- Pro forma net interest income for FY18 stood at $882.9 million as compared to $862.5 million in FY17.

- Volume in 1H19 amounted to $4,358.1 million with full year lending volume expected to be at $9,200.9 million.

- Total active accounts on the companyâs platform in FY18 stood at 1,854,600 and are expected to grow to 1,925,200 in FY19.

Offer details: The company is expecting to offer a total of approximately 622.4 million shares through the IPO. The IPO will comprise issue of 473.3 â 529.1 million primary shares to SaleCo for sale under the offer and 93.3 â 149.1 million secondary shares to the Selling Shareholders under the restructure, that will be subsequently transferred to SaleCo. Funds raised from the IPO will be allocated for payment to Selling Shareholders, repayment of shareholder loans, settlement of cash component of Pre-Completion Equity Plan entitlements, payment of offer costs etc. Closing date of the offer is 14 October 2019 with settlement expected on 22 October 2019.

Company Description

Intega Group Limited (ASX:ITG) is a leading engineering services provider with a focus on Asset and Infrastructure Integrity. The company has been operating as the quality, testing and measurement business of Cardno Limited with operations across Australia, New Zealand, Canada and the United States.

Intega Group Limited

Intega Group Limited (ASX:ITG) is a leading engineering services provider with a focus on Asset and Infrastructure Integrity. The company has been operating as the quality, testing and measurement business of Cardno Limited with operations across Australia, New Zealand, Canada and the United States.

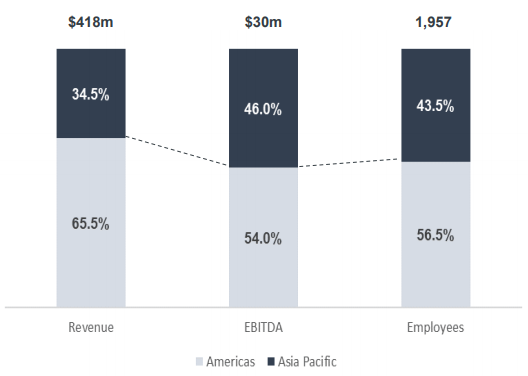

Cardno Limited has recently proposed for the demerger of Intega to form another independent business providing construction materials testing, subsurface utility engineering services and quality assurance for energy companies. In FY19, Intega reported pro-forma revenue amounting to $418 million. Pro-forma EBITDA for the year stood at $30 million. Cardno Consulting reported total pro-forma revenue of $956 million and pro-forma EBITDA of $38 million for FY19.

Key FY19 Statistics â Intega (Source: Company Reports)

Demerger Details: As a part of the demerger, shareholders will be entitled to receive one Intega share for every one Cardno share held. The proposed demerger will be voted upon by Cardno shareholders on 10 October 2019. Upon successful demerger from Cardno Limited, Integar Group Limited is expected to commence trading from early November 2019.

Company Description

Home Consortium Limited (ASX:HMC) is an internally managed property group focused on ownership, development and management. The company is expecting to build a network of 21 operating retail and services centres by the end of 2019. In addition, it is eyeing the redevelopment of 9 centres across New South Wales, Victoria, Queensland and Western Australia.

Home Consortium Limited

Home Consortium Limited (ASX:HMC) is an internally managed property group focused on ownership, development and management. The company is expecting to build a network of 21 operating retail and services centres by the end of 2019. In addition, it is eyeing the redevelopment of 9 centres across New South Wales, Victoria, Queensland and Western Australia.

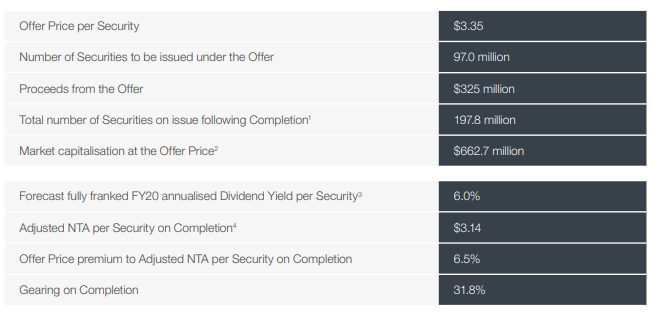

Offer Details: The company is expecting raise a total amount of $325 million through an initial public offering of 97.0 million shares at a price of $3.35 per share. The offer opened on 01 October 2019 and with closing and settlement scheduled for 09 October 2019 and 15 October 2019, respectively.

Key Offer Statistics (Source: Company Prospectus)

Usage of Funds: Proceeds from the IPO will be used to fund working capital requirements, debt refinancing, funding of acquisitions, offer related costs etc.

Financial Information: The company is expecting an annualised fully franked dividend yield of 6% from offer completion to 30 June 2020. It is eyeing a capital structure with gearing of 31.8% and has adopted a target gearing range of 30% - 40%. Post stabilisation of the portfolio, the company is targeting a normalised dividend payout ratio between 80% and 100% of the companyâs Freehold FFO. First dividend is expected to be declared in February 2020.

Company Description

VGI Partners Asian Investments Limited (ASX:VG8) is a new entity being formed through an initial public offering conducted by VGI Partner Limited to act as a support to its new investment strategy for Asia-listed equity investments.

VGI Partners Asian Investments Limited

VGI Partners Asian Investments Limited (ASX:VG8) is a new entity being formed through an initial public offering conducted by VGI Partner Limited to act as a support to its new investment strategy for Asia-listed equity investments.

Investment Philosophy: The new entity will be managed through an investment philosophy similar to its global investment strategy for the last eleven years. On the back of the current investment philosophy, the companyâs investments and funds have seen outperformance during periods of subdued or flat market performance. The new entity will infuse money into businesses that are not fully valued by the market.

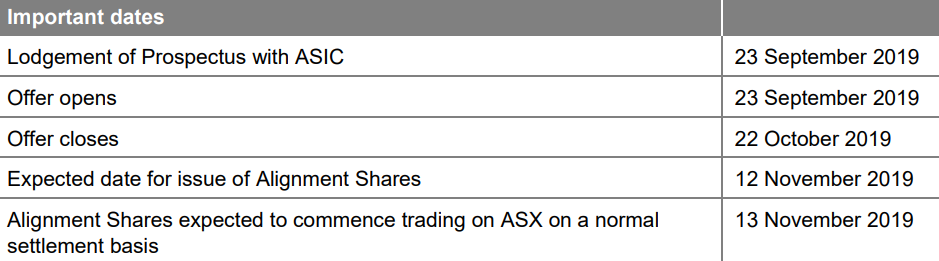

Offer Details: Through the IPO, VGI Partners Limited is seeking to raise a minimum of amount of $250 million and a maximum of $800 million through issue of ordinary shares at an offer price of $2.50 per share. VGI Partners Limited recently notified the exchange that it has arrived at the minimum subscription requirement for the IPO with total applications under the offer exceeding $485 million.

Key Offer Details (Source: Company Prospectus)

Key Offer Details (Source: Company Prospectus)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.