We are discussing five stocks which operate in mining and exploration segment. We will be discussing about key performances and as well as recent updates of these companies.

Australian Mines Limited

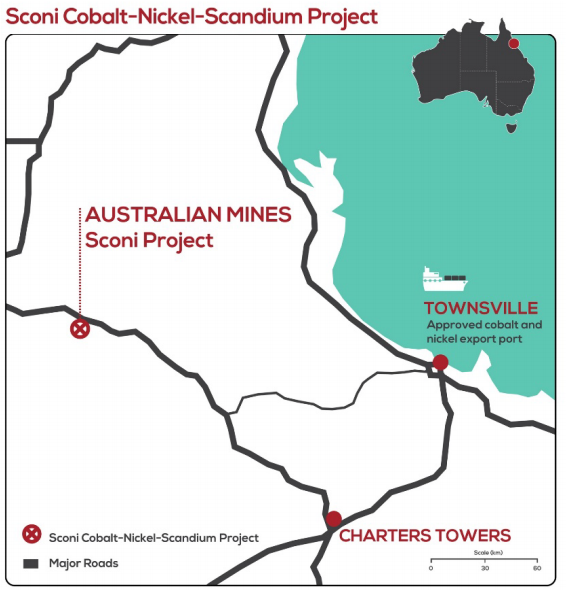

Australian Mines Limited (ASX:AUZ) is a mining and exploration company specializing in cobalt sulphate, nickel sulphate and scandium oxide minerals located across eastern Australia. The company is working on Sconi Cobalt-Nickel-Scandium Project located in North Queensland, Australia.

Sconi Cobalt-Nickel-Scandium Project (Source: Companyâs Reports)

Key Performance Highlights for the year ended 30 June 2019: AUZ announced its full year results for the financial year FY19 wherein, the company reported net loss of $9.8 million as compared to a loss of $5.32 million on FY18. The company reported cash and cash equivalents at $3.36 million and exploration and evaluation assets at $28.03 million followed by net assets at $33.83 million as on 30 June 2019. Net cash used in operating activities stood at $4.56 million, cash used in investing came in at $10.02 million, while cash generated from financing activities were at $8.96 million. During the year, the company notified underwriting of Share purchase plan during June 2019 wherein the company received application of $5.8 million from eligible shareholders. The price of each share was quoted at $0.016.The funds will be used for the Sconi project. It will also be used for mining and exploration purposes.

Stock Update: The stock of AUZ closed at $0.023 as on 3 October 2019, down 4.167% from its previous close along with a market capitalization of $82.67 million. Total outstanding shares of the company stands at 3.44 billion. The stock has generated 14.29% during last three months.

Andromeda Metals Limited

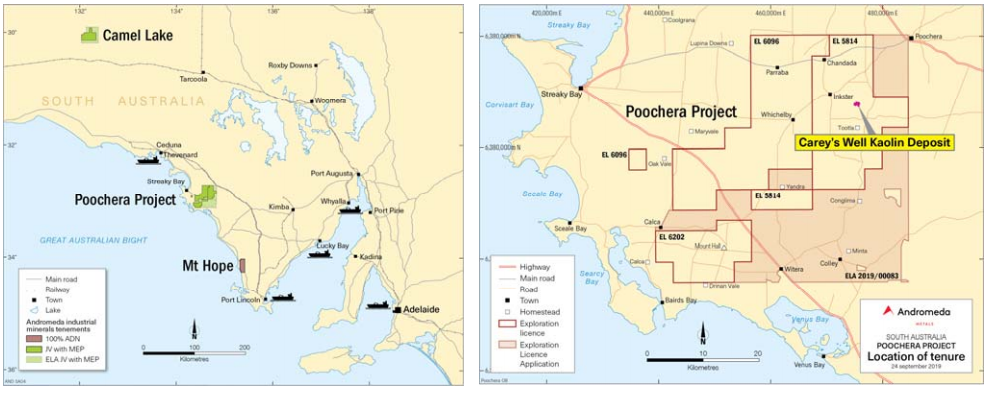

Andromeda Metals Limited (ASX: ADN) is engaged in the advancement of the Poochera Halloysite-Kaolin Project and indulge in third party investment in its current portfolio of gold and copper exploration projects. The company is working on its Poochera Halloysite project located in the western part of the Eyre peninsula of South Australia which is 660 km away from Adelaide and 70km east from Streaky Bay.

Poochera Halloysite project location (Source: Companyâs Reports)

Updates from Poochera Halloysite-Kaolin Project

Recently, the company came up with Scoping study supports of Poochera Halloysite? Kaolin Project wherein the company reported positive results from the technically sound and financially robust venture which can drive positive cash flows for the business. The company highlighted the following:

- AISC averages A$396/tonne of fully refined kaolin with an anticipated selling price of A$700/tons.

- Cost of pre-production is estimated at $9 million along with cash requirement of about $25 million before the receiving initial revenue.

- Payback estimated at 15 months from start of mining with the projected A$28M dry?processing plant funded from cashflow generated from raw material shipping and toll wet?refining operations.

- The mine plan target was set up as per 2019 mineral resource and involves in open cut mining of kaolinized granite at 500ktpa, 7.6 Mt over the LOM, which after processing and refining yields a LOM of 2.8 Mt of premium product.

Stock Update: The stock of ADN closed at $0.055 on 3 October 2019, down 3.509% from its previous close along with a market capitalization of $77.32 million. Total outstanding shares of the company stands at 1.36 billion. The stock has generated stellar returns of 280% and 936% during last three months and six months, respectively.

Celsius Resources Limited:

Celsius Resources Limited (ASX:CLA) is engaged in mineral exploration and mineral extraction in The Opuwo Cobalt Project which is in northwestern Namibia. Celsius holds a 30% joint interest in Carnilya Hill nickel asset in Western Australia and has 100% interest in the Abednegno Hill Nickel Project.

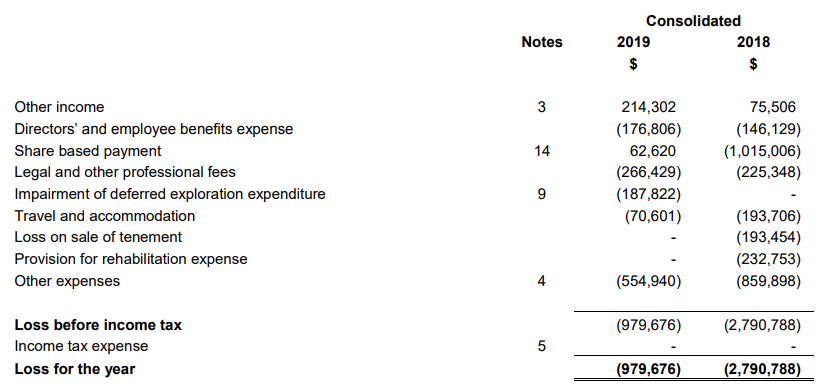

Key Performance Highlights for the year ended 30 June 2019: CLA declared its FY19 results wherein the company reported other income at $214,302 as compared to $75,506 million in FY18. The company reported a loss of $979,676 as compared to $2,790,788 on prior corresponding period. The company reported cash and cash equivalent at $ 6,655,181, total assets at $22,486,586 and net assets at $22,036,352 as on 30 June 2019.

FY19 Financial Highlights (Source: Company Reports)

Stock Update: The stock of CLA closed at $0.017 on 3 October 2019, up 6.25% against its previous close along with a market capitalization of $12.12 million. Total outstanding shares of the company stands at 757.22 million. The stock has generated returns of -50% and -11% during last three months and six months, respectively.

Magnis Energy Technologies:

Magnis Energy Technologies Ltd (ASX:MNS) operates in the lithium-ion battery technology segments and has manufacturing plants in the USA and Australia combined with pre-mine development of its Nachu Graphite project in Tanzania.

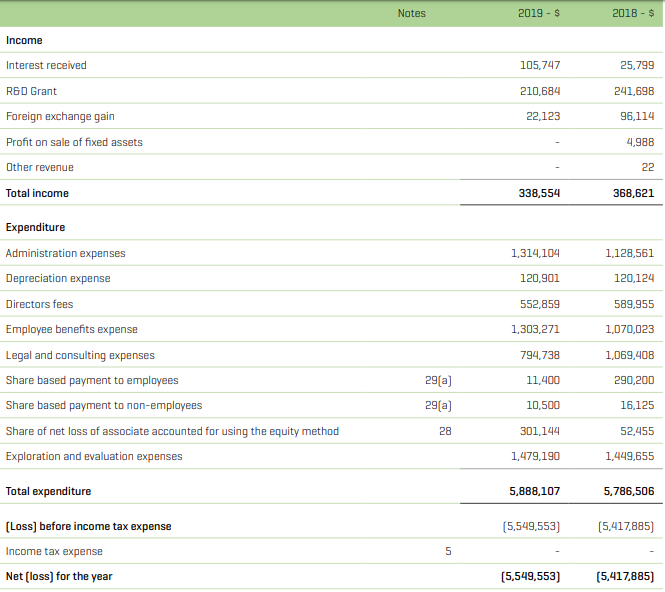

Key Performance Highlights for the year ended 30 June 2019: MNS declared its FY19 results wherein the company reported total income at $ 338,554 as compared to $ 368,621 in FY18 and reported a loss of $5,549,553 as compared to a loss of $ 5,417,885 on previous corresponding period. The company reported cash and cash equivalent at $1,829,817, total assets at $24,791,066 and net assets at $24,021,705 as on 30 June 2019. The company reported net cash used in operating activities at $5,585,400, net cash flows used in investing activities at $4,806,728 and Net cash inflows from financing activities at $10,697,205 for the year ended 30 June 2019.

FY19 Financial Highlights (Source: Company Reports)

Stock Update: The stock of MNS closed at $0.175 on 3 October 2019, up 2.941% from its previous close along with a market capitalization of $103.89 million. Total outstanding shares of the company stand at 611.14 million. The stock has generated returns of 6.25% and -15% during last one month and three months, respectively.

Inca Minerals Limited

Inca Minerals Limited (ASX:ICG) operates in exploration and evaluation process on existing and newly acquired tenements. The company focuses is the exploration of its Peruvian projects with objectives being to find, develop and/or demonstrate the prospectively of projects to potential partners.

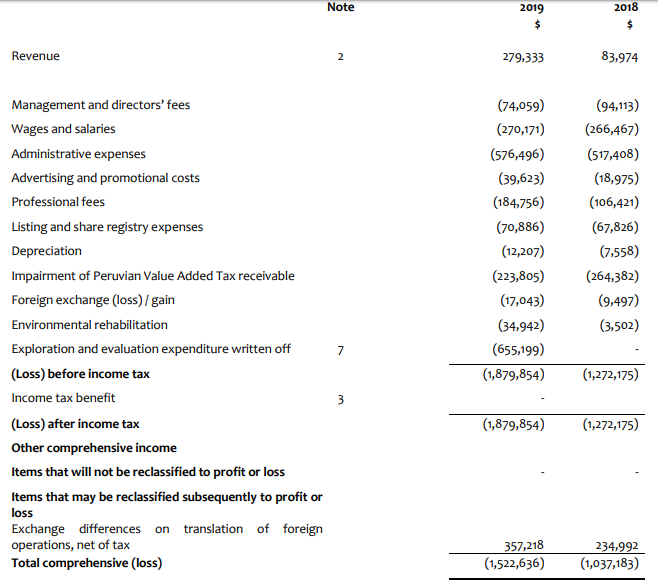

Key Performance Highlights for the year ended 30 June 2019: MNS declared its FY19 results wherein the company reported total income at $279,333 as compared to $83,974million in FY18 and reported a loss of $1,879,854 as compared to $1,272,175 on the prior corresponding period. The company reported cash and cash equivalent at $ 1,377,481, total assets at $ 8,517,164 and net assets at $6,512,208 as on 30 June 2019. The company reported net cash used in operating activities at $863,777, net cash flows used in investing activities at $2,547,560 and net cash inflows from financing activities at $3,995,050 during FY19. ICG completed successfully completed a capital infusion during July and August 2019. The company raised an amount of $193,750 through the issue of 48,750,000 fully paid ordinary shares and 8,750,000 free attaching options.

FY19 Financial Highlights (Source: Company Reports)

Stock Update: The stock of ICG was placed at $0.003 along with a market capitalization of $9.4 million as on 3 October 2019. Total outstanding shares of the company stands at 3.13 billion. The stock has generated negative returns of 8.16% and 19.64% during last one month and three months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.