Growth investing strategy is one of the most popular strategies amongst investors, wherein funds are parked towards purchasing shares of those companies that are characterised in terms of revenue growth, profitability growth, branding, product launch, patents, acquisitions, among other aspects. Also, these companies are expected to witness significant growth above the average growth of the market.

PBH, HMD, LSH, NVX, 9SP - Are These the Best ASX Growth Stocks? Must Read

Capital appreciation is the reward for investors, as these companies believe in reinvesting their income in the business. At the same time, making investments in growth shares might not be favourable for few investors, as these stocks come with a higher risk as compared to stocks of companies that are stable and high quality in nature.

In this backdrop, let us discuss few growth stocks listed on ASX, covering their performance on ASX and recent market updates.

Altium Limited (ASX: ALU)

Despite the prevailing COVID-19 market conditions, electronic design software company Altium Limited (ASX: ALU) is well placed operationally and commercially, continuing to close sales of its electronic design tools, including Altium Designer, Altium 365 and NEXUS. However, the Company expects its Q4 performance to be impacted by the continuation of restrictions and lockdowns due to the COVID-19 pandemic.

The Company is in a profitable and financially strong position with a solid balance sheet comprising a cash balance of over US$77 million. Since ALU is focused on cash flow management, it would leverage its strong balance sheet to support customers, as well as to continue making investments in Altium 365 and digital sales platform.

At the close of trading session on 13th May 2020, stock of ALU settled at $35.030 per share, indicating a decline of 0.877% against its previous closing price. The market capitalisation of ALU stood at $4.63 billion and the stock has provided shareholders with a return of 12.76% and 6.99% within the time span of one month and six months, respectively.

Do Read: Portfolio Immunity through Digital Disruption and Tech Titans

Nanosonics Limited (ASX: NAN)

Infection control and decontamination solutions provider, Nanosonics Limited (ASX: NAN) released a business update, wherein, it stated that unaudited sales for Q3 FY20 witnessed a decent growth against PCP. This reflects continued underlying growth momentum for the business as well as a growing awareness and understanding of the importance of ultrasound probe decontamination. The Company is closely managing supply chain and is currently well placed for continuity of supply to customers.

At the end of third quarter, NAN’s consumables sales were in line with its pre-COVID-19 expectations. The Company is continuing with the practice of investment in its strategy, as its business fundamentals are sound. NAN boasts a strong balance sheet comprising of cash reserves of $82.0 million and zero debt as at 31 December 2019.

Must Read: How these Healthcare Stocks are Performing amid COVID-19 Pandemic- NAN, RMD, RHC

At the close of trading session on 13th May 2020, stock of NAN settled at $7.070 per share, indicating a rise of 0.569% against its previous closing price. The market capitalisation of NAN stood at $2.11 billion and the stock has provided shareholders with a return of 12.66% and 2.93% within the time span of one month and six months, respectively.

Pushpay Holdings Limited (ASX: PPH)

Pushpay Holdings Limited (ASX: PPH), a donor management system provider, recently released its operational and financial performance update for the full year ended 31st March 2020, highlighting the following:

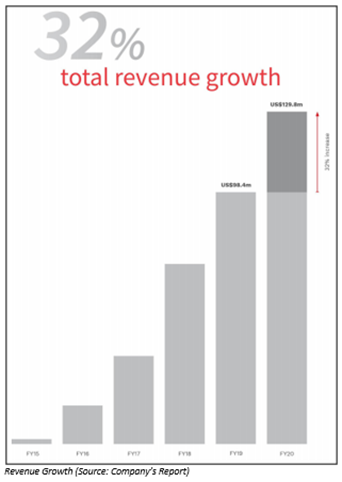

- PPH reported total revenue and EBITDAF amounting to US$129.8 million and US$25.1 million, reflecting a rise of 32% and 1,506%, respectively.

- These strong results indicate innovative products, dedication of teams in the US and New Zealand, and culture of continuous improvement.

- PPH continuous to focus on future-proofing the business.

On the outlook front, the Company anticipates witnessing continued revenue growth, on the back of strategy implementation, in addition to the business attaining increased efficiencies and boosting presence in the US faith sector.

At the end of trading session on 13th May 2020, stock of PPH closed at $6.18 per share, indicating an increase of 1.15% against its previous closing price. The market capitalisation of PPH stood at $1.68 billion and the stock has provided shareholders with a return of 52.37% and 87.42% within the time span of one month and six months, respectively.

Aristocrat Leisure Limited (ASX: ALL)

Gaming provider and games publisher, Aristocrat Leisure Limited (ASX: ALL) is engaged in the design, development, manufacturing and marketing of numerous products and services, such as including casino management systems, electronic gaming machines and digital social games.

Amid the COVID-19 situation, the Company’s priority revolves around health and wellbeing of staff, families, customers, and suppliers. Continuing to implement a comprehensive COVID-19 response, ALL is focused on protecting and leveraging its strategic advantages while placing the land-based business to respond quickly as demand returns. Moreover, in order to drive savings and optimise cash reserves, the Company has undertaken considerable operational steps.

Meanwhile, its digital business continues to perform strongly, with higher bookings and player engagement evident across most of the portfolio.

However, the Company has decided to suspend its interim dividend to support liquidity and place the Group for post COVID-19 recovery. Aristocrat has a strong balance sheet with more than $1 billion in available liquidity.

At the close of trading session on 13th May 2020, stock of ALL settled at $25.980 per share, inching upward by 1.564% against its previous closing price. The market capitalisation of ALL stood at $16.33 billion and the stock has provided shareholders with a return of 10.19% and -20.24% within the time span of one month and six months, respectively.

Domino's Pizza Enterprises Limited (ASX: DMP)

Domino's Pizza Enterprises Limited (ASX: DMP) is a food retailer, which operates pizza chain. The Company recently announced that Mitsubishi UFJ Financial Group, Inc. made a change to their holdings in DMP on 3rd April 2020 with a current voting power of 7.32% against the previous voting power of 8.98%.

In an update concerning COVID-19, the Company announced during end-April 2020 that all its stores in operating markets have adapted various support measures, changes in customer behaviour, community expectations, and local trading conditions. In few countries, it has started reopening stores, while in few markets, it is registering strong sales performance.

At the close of trading session on 13th May 2020, stock of DMP settled at $57.620, indicating a rise of 1.39% against its previous closing price. The market capitalisation of DMP stood at $4.9 billion and the stock has provided shareholders with a return of 14.62% and 10.89% within the time span of one month and six months, respectively

Did You Read: Investors to relish the resilience of ASX listed Fast-Food Operator