Usually, investors prefer to keep consumer discretionary stocks as a part of their broad portfolio, as these stocks move in synchronisation with the economic upswing and downswing. This makes it quite easier for investors to predict the performance of such stocks. Besides consumer discretionary stocks, an investor generally has a preference for stocks that can pay dividends or come with high Price -earnings (P/E) ratio.

Though a stockâs high P/E ratio suggests that investors expect higher earnings from that stock; however, this does not certainly imply that it is a better form of investment. A high P/E ratio can also mean that the stock is overvalued. Therefore, before making an investment decision, an investor should also consider the other factors that could possibly affect the performance of a stock.

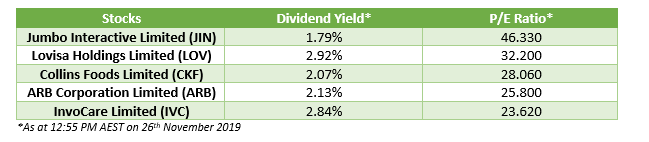

There are several consumer discretionary stocks listed on the ASX, but some of them are dividend paying and come with high P/E ratio. The below table summarises the list of five such stocks, along with their dividend yield and P/E ratio:

Jumboâs Recent Acquisition Got Approved by the UK Gambling Commission

Australiaâs leading digital retailer of official government and charitable lotteries, Jumbo Interactive Limited (ASX: JIN) has recently notified that the UK Gambling Commission has approved its recent acquisition of Gatherwell Limited, enabling the purchase to proceed.

The company informed about signing a conditional Share Purchase Agreement on 12th November 2019 to acquire Gatherwell for ~$9.1 million.

The company notified that 1st December 2019 will be the effective date of the acquisition. Moreover, the company expects the acquisition to result in ticket sales of ~$ 8.6 million, the revenue of ~$ 1.6 million and net profit before tax of ~$0.5 million for the seven months to 30 June 2020.

The company has delivered strong financial performance during the 12 months ended 30th June 2019. It reported an increase in TTV (Total Transactional Value) and Revenue by 75 per cent and 64 per cent to $321 million and $65.2 million, respectively. The scalability of the business delivered a 107 per cent rise in EBITDA to $40.2 million and a 124 per cent increase in NPAT to $26.4 million.

The share price of the firm improved by 303 per cent over 12 months to $20.15 at 30 June 2019. As at 12:55 PM AEST on 26th November 2019, JIN is trading at $20.79, with a rise of 2.21 per cent relative to the last closed price. The stock has delivered a return of 179 per cent on a YTD basis.

Lovisa Delivered Decent Financial Results in FY19

Lovisa Holdings Limited (ASX: LOV) is known for bringing brilliantly affordable fashion jewellery to the world. The company has recently reported its financial results for the 12 months ended 30th June 2019.

Lovisa attained a rise of 2.8 per cent and 3 per cent to $52.5 million and $37 million in EBIT and NPAT, respectively during the financial year. The total sales of the company were 15.3 per cent up on the prior corresponding period (pcp), while the comparable store sales were 0.5 per cent down on pcp during the year. In addition, the companyâs gross margin remained strong, rising 50bps to 80.5 per cent.

The company continued its global rollout strategy during the year, opening a net 64 stores, with 24 stores in 2H19 on top of 40 in 1H19. The rollout in the US and France markets is currently ongoing, with operational structures in place to drive momentum. Moreover, the US market rollout has been expanded into Texas and Florida.

The companyâs balance sheet stayed strong with investment in fitout and inventory for new stores. The companyâs e-commerce implementation got funded from existing cash, and its net cash stood at $11.2 million at year end.

LOV is trading at $11.36, with a rise of 0.53 per cent relative to the last closed price (as at 12:55 PM AEST on 26th November 2019). The stock has delivered a return of 82 per cent on a YTD basis.

Collins Foods Updated on Taco Bill Issue

The operator of food service retail outlets, Collins Foods Limited (ASX:CKF) has recently notified that it has been served with Federal Court proceedings by Australiaâs Taco Bill Mexican Restaurants Pty Ltd, to which it will defend vigorously with strong support from the Taco Bell Brand.

Taco Bill Mexican Restaurants intends to stop Collins Foods from operating Taco Bell restaurants in Albury areas of New South Wales and Victoria against perception that members of the public will be deceived or misled to trust that the Taco Bell restaurants are run by Taco Bill Mexican Restaurants, affiliated or connected with these restaurants or functioning with its approval or sponsorship.

In September this year, the company also informed about entering into binding documentation to refinance its existing syndicated debt facilities. As per the company, the existing facilities of $270 million and â¬60 million will be refinanced under a new syndicated facility agreement consisting of $265 million and â¬80 million revolving facilities.

CKF is trading at $9.58 on 26th November 2019 (12:55PM AEST), with a rise of 1.7 per cent relative to the last closed price. The stock has generated a YTD return of about 57 per cent.

ARB 4x4 Accessories Announced Collaboration with Ford Performance

Manufacturer and distributor of 4X4 accessories, ARB Corporation Limited (ASX:ARB) informed in a recent update that it had developed and designed a winch capable bumper in conjunction with the Ford Motor Company for the USA Ford Ranger in North America.

On 1st November 2019, the company notified about the release of this compatible bumper at the SEMA show on 5th November 2019. Moreover, the company mentioned that the compatible bumper will be commercially available in 2020.

Consistent with ARBâs formerly announced strategy of pursuing Original Equipment Manufacturer opportunities overseas, Ford and ARB are working together to develop further Ford accessory options for pick-up and SUV models.

ARB is trading at $18.61, with a rise of 0.32 per cent relative to the last closed price (at 12:55 PM AEST on 26th November 2019). The stock has delivered a return of ~24 per cent on a YTD basis.

InvoCare Announced Acquisition of BBMDF and Broulee

Funeral services provider, InvoCare Limited (ASX:IVC) has recently entered into two separate sales agreements to acquire the assets and business of Broulee Memorial Gardens (Broulee) and Batemans Bay & Moruya District Funerals (BBMDF) in Australia. The company is likely to complete the proposed acquisition by the end of November 2019.

The acquisition comprises all freehold properties containing the main facility at Batemans Bay which includes a fully equipped funeral home with mortuary, chapel and offices.

The announcement represented an exciting opportunity for InvoCare to enter a new market on the South Coast of NSW where the company does not currently have a presence. The transaction represents an extension of the companyâs regional strategy via the acquisition of the highest-grade businesses in the expanding market.

IVC is trading at $13.095 on 26th November 2019 at 12:55 PM AEST, with a rise of 0.42 per cent relative to the last price. The stock has generated a YTD return of 27.5 per cent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.