The water treatment industry of Australia provides a notable contribution towards developing the economy growth. As per the report by the Australian Industry Standards, the water treatment industry employs more than 31,000 people throughout its sub-sectors such as water supply, sewerage, drainage services and pipeline transport.

When it comes to the major players in the industry, probably below four comes to the mind of investors. Letâs know about them in detail:

Purifloh Limited (ASX: PO3)

Purifloh Limited (ASX: PO3) is involved in the development of free radical generator technology for several applications throughout opportunities such as Indoor air purification, Water sanitation and Medical sterilisation in conjunction with Somnio Group.

A brief on MTB Trials

Recently, on 25th September 2019, the company introduced the market participants via a release, an update on MTB (Mycobacterium Tuberculosis) trials:

- As per the release, the company advised that the hospital trial work has been continuing. It added that isolating the Mycobacterium Tuberculosis from air samples in the in-situ environment happens to be challenging and PO3 has still not been able to successfully receive reliable baseline data.

- PO3 has previously noted the difficulties with rapid contamination of the culture by pathogenic species of mold like Aspergillus flavus and Aspergillus fumigatus.

OTC listing Process

- In another update, the company announced that it has engaged a full service investment bank and B. Riley Financial, Inc.âs subsidiary B. Riley FBR, Inc. in order to act as PO3âs Principal American Liaison as part of its Rule 211 application to FINRA for listing on the OTCQX.

- It added that the hiring of B. Riley FBR, Inc. was required to facilitate an Over the Counter listing in North American region. B. Riley would sponsor PuriflOHâs application to the OTC or OTC Market Group by acting as the companyâs Principal American Liaison.

The stock of PO3 last traded at $5.070, surging up 12.417% from its last close, with the total shares outstanding stands at 31.38 million as on 9th October 2019. The stock has generated returns of 38.77% and -6.24% during the last three-month and six-month, respectively.

Fluence Corporation Limited (ASX: FLC)

Fluence Corporation Limited (ASX: FLC) provides innovative, wastewater, cost-effective decentralised water, as well as reuse solutions for business and communities globally.

Delivery of First SUBRE Project

- Recently, the company updated the market through a release dated 1st October 2019 that it has implemented a contract, wherein the company will be delivering first SUBRE project in China, which would be used to mitigate the higher stringent wastewater standard Class IV Surface Water Discharge.

- It was also mentioned in the release that the total nitrogen of less than 1.5 mg/L, is required to qualify as Class IV standard, which is significantly stricter than the 15 mg/L allowable under the Class 1A Wastewater Discharge standards.

- This contract has demonstrated another important triumph in the development of the companyâs market position in a new province in China, as well as reflecting a number of notable first-time events, as per its MD and CEO Henry Charrabé.

China Volume Commitment

- The company through a release dated 24th September 2019 announced that it has inked an Investment Cooperation Agreement for the establishment of a final assembly facility for its proprietary MABR products, and a volume commitment by Liaoning Huahong in order to purchase AspiralTM as well as SUBRE products with a capacity of 52,500 m3 /day by the end of 2021 period and minimum revenue targets for 2019 and 2020 with The Peopleâs Government of Xinglongtai District and Liaoning Huahong New Energy Co., Ltd.

- It added that the Agreement would make the company as the preferred supplier for wastewater treatment equipment for Liaoning Huahong New Energy Co., Ltd.

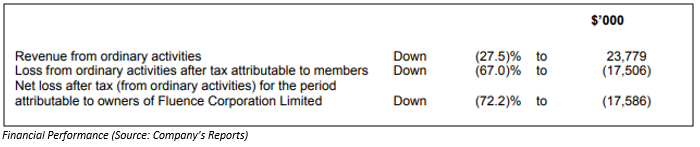

The following picture provides an idea of financial performance for the half-year period, ended 30 June 2019:

The stock of FLC last traded at $0.490, down 2.97% from its previous closing price, with the total shares outstanding at ~537.44 million as on 9th October 2019. The stock has generated returns of 8.60% and -2.88% during the last three-month and six-month, respectively.

Phoslock Environmental Technologies Limited (ASX: PET)

Phoslock Environmental Technologies Limited (ASX: PET) provides solutions for designing, engineering and project implementation for water related projects, as well as water treatment products.

Secured New Order

- The company through a release dated 9th October 2019 announced that it has secured an initial order amounting to$1.3 million for Phoslock® to be utilised in ongoing new projects in and around Florida from its US Licensee in order to commence active remediation as part of the Florida State Four Year plan.

- It added that the order follows the successful wrap up of numerous trials with Phoslock® over the past 12 months, which represented the capacity of the product to decrease Phosphorous levels in wetlands.

Change in Directorsâ Interest

- The company announced that one of its directors Mr Ningping Ma has made a change to his interest in the company by selling 1,646,802 ordinary shares at a consideration of $2,206,714 on 3rd October 2019.

- In another release, it was mentioned that another director, Mr Zhigang Zhang has purchased 153,580 fully paid ordinary shares on 23 September 2019.

Recently, the company announced that it has inked a contract to begin work applying Phoslock® to the East Lake. It added that the new project would prove to be an important application, opening a new field of ecological restoration of the eco-environmental protection in the Yangtze River Economic Belt in China.

The stock of PET last traded at $1.27, up 5.394% with the total shares outstanding at ~562.54 million as on 9th October 2019. The stock has generated returns of -1.85% and 226.31% during the last three-month and six-month, respectively.

SciDev Ltd (ASX: SDV)

SciDev Ltd (ASX: SDV) is a manufacturer and supplier of chemicals for wastewater treatment. It has a market capitalisation of $49.96 million as on 9th October 2019.

Sales to customers rose during Q1 FY20

The company through a release dated 9th October 2019 updated the market on its quarterly activities report for the period ended 30 September 2019, wherein it outlined following key facts:

- The company recorded sales to customers amounting to $2.28 million, reflecting a rise of 93% increase on the June quarter.

- During the quarter there were no sales invoiced and receipted from the recently inked Iluka contract.

- The cash receipts from the customer stood at $1.53 million with an increase of 99% increase against June quarter. However, the cash inflow for the September 2019 quarter was impacted by Typhoon Lekima delaying the delivery of product from China to its North America partners.

- During the period it has inked three-year MaxiFlox® supply contract with mineral sands major Iluka and received first major order amounting to $1.08 million in oil & gas sector via SciDev US (LLC).

- It performed the first activity in the construction & infrastructure sector, NSW and VIC and received Key institutional investment as part of $4.13 million capital raise in order to support growth.

Exercise of Options

- As per the release dated 2nd October 2019, the company announced that 100,000 of the SDVâs $0.25 exercise price options have been exercised by Trevor Jones, Chairman of the company.

- SDV raised a total of $25,000 working capital as a result of the option exercise.

The stock of SDV last traded at $0.465, moving up 14.815% compared to its previous closing price, with the total shares outstanding stands at 123.36 million as on 9th October 2019. The stock has generated returns of 161.29% and 575.00% during the last three-month and six-month period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.