On 8 October 2019, the Australian benchmark index S&P/ASX200, by the end of the trading session was at 6593.4 points, up by 0.5 percent from the last close. In this article, there are four stocks under discussion, belonging to the diversified sectors, namely- FINEOS Corporation Holdings PLC, Bapcor Limited, Adairs Limited and Hansen Technologies Limited.

Letâs go through each of of the stocks mentioned above in detail:

FINEOS Corporation Holdings PLC

FINEOS Corporation Holdings PLC (ASX: FCL) is an IT company which is engaged in the development and sale of enterprise claims and policy management software for life, accident, and health insurance industry. The group develops and sells its solution to enable greater flexibility, efficiency, and profitability within business operations.

Repayment of bank debt:

FINEOS Corporation Holdings PLC has confirmed that the company has fully repaid its outstanding debt of â¬15 million at an effective fixed interest rate of 7% with the European Investment Bank with an interest component of â¬1.6 million.

FY19 Operational Results (as at 30 June 2019):

- The charter client, a Tier 1 US insurance carrier, went live on FINEOS Policy and Billing which means all modules of the FINEOS AdminSuite were in production. A new base in Spain to support R&D capabilities and in Hong Kong to establish a sales presence in Asia was opened.

- Three significant deals with Tier 1 US insurance carriers were closed in the fourth quarter of the financial year. These contract wins were in addition to several smaller new contracts secured during the year, giving rise to strong revenue growth in both subscriptions and services revenue.

- The workforce was also increased with the rise in revenue by 11% in FY19 to 664 and an employee retention rate of over 90% was observed reflecting the positive healthy culture.

- The companyâs commitment to significant Research and Development program to expand the FINEOS Platform to provide a more comprehensive core product suite for the clients, and it invested more than â¬90 million in total R&D spend over the past five years.

FY19 Financial Results (as at 30 June 2019):

- A 16.8% growth in total revenue to â¬62.8 million was observed versus FY18 total revenue of â¬53.8 million. Subscription revenue increased by 30.8% relative to FY18.

- Earnings before interest, tax and depreciation (EBITDA) of â¬8.1 million, as well as a loss before tax of ⬠(1.7) million, were both slightly down on last year, due primarily to the investment committed to R&D to support the future growth and success of the business.

Outlook:

The Company expects to achieve revenue of â¬74 million and a strong debt-free balance sheet from the use of funds from the IPO.

Stock Performance:

The stock of FCL last traded at $2.960 on 8 October 2019, down by 1.333 percent compared to its last closing price. The stock has given a return of -7.69 percent in the last 30 days timeframe.

Bapcor Limited

Bapcor Limited (ASX:BAP) is the leading provider of automotive aftermarket parts, accessories, automotive equipment and services covering trade, specialist, wholesale, retail and service across Australia, New Zealand and Thailand.

Dividend Reinvestment Plan:

Bapcor Limited issued 1,054,992 Fully paid ordinary shares at a consideration of $6.8919 per Share under the Companyâs Dividend Reinvestment Plan in relation to the Companyâs 2019 final dividend.

Confirmation of DRP Issue Price for 2019 Final Dividend:

Bapcor Limited advised that the issue price of the shares to be issued to the shareholders for the 2019 final dividend has been calculated as $6.8919 per share.

Dividend/Distribution â BAP:

Bapcor Limited announced the ordinary fully paid dividend of $0.095 on 23 September 2019, payable on 26 September 2019.

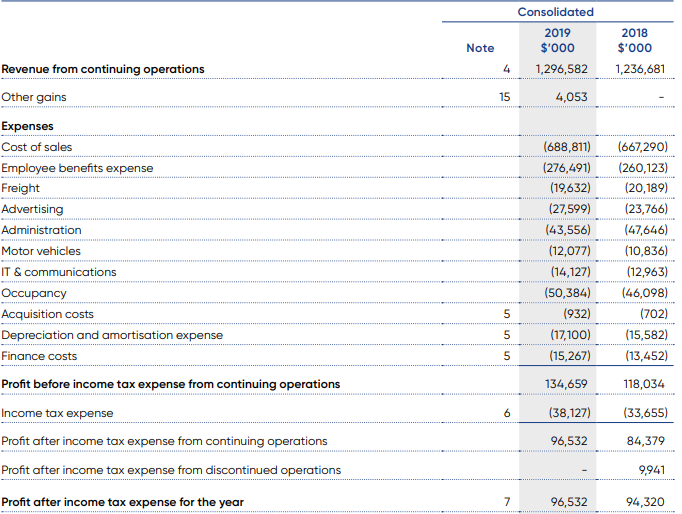

Financial Performance (as at 30 June 2019):

- The 2019 financial year delivered another record performance for Bapcor, which saw exceptional results in the face of softer trading conditions.

- Sales were robust across all Bapcor business segments. Revenue, EBITDA and EPS recorded strong growth, and net profit after tax increased to a record $94.3 million. Net debt at 30 June 2019 was $336.3M representing a leverage ratio of less than 2.0X

- Revenue growth increased by 4.8% to $1,297m, including the acquisition of CTPG and a full twelve months of trade from the FY18 acquisitions of Tricor Equipment and AADi, offset by the divestment of TRS.

- During the year, EBITDA in FY19 increased by 9.8% to $164.6m excluding TRS divestment of 11.7% and NPAT grew by 9.0% in FY19 to $94.3m, representing a four-year CAGR of 42%.

- For continuing operations, EPS grew by 10.3% to 33.45 cents per share in FY19. This increase continues a trend continue a trend of year-on-year growth, which has delivered a CAGR of close to 25% over the last five years.

Outlook:

Financial year 2020 trading has commenced in line with expectations. Revenue and profit growth are expected to continue in FY20, with proforma NPAT projected to grow by mid to high single digits. EBITDA is expected to increase by approximately two percentage points above the forecast NPAT growth due to the higher depreciation charges from the investments.

Stock Performance:

The stock of BAP last traded at $7.170 on 8 October 2019 which is very close to its 52-week high of $7.590. The stock performance went up by 31.12% return in the past 6 months period, earning an annual dividend yield of 2.39% .

Adairs Limited

Adairs Limited (ASX:ADH) is a consumer discretionary company, specialised in home furnishings in Australia and New Zealand, with stores imprint across a number of store format and an online format to present its customers on trend fashion products, quality staples, strong value and superior in-store customer service.

Dividend:

The company announced an ordinary fully paid dividend of 8 cents per share on 26 August 2019, which was to be paid on 25 September 2019. The total dividend for the full year of 14.5 cents per share represents a payout ratio of 81% of the full year earnings, in line with Adairs dividend policy.

Financial Result 2019 (as at 30 June 2019):

- The company had made a record sale of $344m which went up by 9.4%. This growth was largely driven by the online channel where sales rose 41.8%.

- The like for like sales in stores (finished) went up 1.5%.and like for like sales increased by 7.2%, which was mainly led by homemaker and Adairs Kids store. It demonstrates the continued health and appeal of both its retail store formats and online channel, as well as confirming the success of its core strategies.

- Adairsâ balance sheet further strengthened over FY19 period, with net debt reduced to $8.2m. This financial strength means that the company is well equipped to support the growth strategies and provides the flexibility to respond to opportunities and challenges as they emerge.

Operational Performance:

In FY19, the company exceeded capacity in the primary distribution centres and activated overflow capacity in secondary centres, which caused considerable inefficiencies and contributed to materially higher operating costs. These costs fundamentally stem from additional handling and movement of the companyâs inventory, and additional costs associated with the set-up of the secondary facilities.

Stock Performance:

The stock of ADH last traded at $1.950 on 8 October 2019, earning an annual dividend yield of 7.53%. Further, the ADH stock has given a return of +31.85% in the past 3 months.

Hansen Technologies Limited

Hansen Technologies Limited (ASX:HSN) is an IT company, which is engaged in the business of development, integration, and support of billing systems software for the utilities, energy, pay-TV and telecommunication sectors.

Hansen to deliver new meter data management product to Elenia:

The company announced the signing of a multi-year contract with Finnish-based Elenia, for the implementation of the next-generation meter data management product for the Nordic energy market. It is specifically designed to fulfil the industry needs of a new interface, with the energy market datahubs being implemented throughout the Nordic region.

Dividend Reinvestment Plan Price:

The company advices that the application price under the Dividend Reinvestment Plan will be $3.33 per share for the purpose of the final dividend for FY2019.

Dividend/Distribution â HSN:

The company announced the dividend of 3 cents per share on 23 August 2019, which was to be paid on 26 September 2019.

Operational and Financial Highlights:

- During the year ended 30 June 2019, operating revenue for the year was reported to be $231.3m, up by $0.5m in FY18 whilst the lower ex-stigma revenue of $4.5m was observed.

- During the year, EBITDA went down to $55.8m from $60m in FY18. This was majorly driven by lower non-recurring revenue, increase in total remuneration, transaction costs related to Sigma acquisition.

Outlook:

In FY2020, the company is expecting the operating revenue in the range of $305m to $310m and EBITDA in the range of $70m to $76m. This guidance includes the full year contribution from Sigma and excludes the impact of IFRS16 treating operating leases as finance Lease. The company is also planning to enter the FY20, with new logos including new market entries in India and Hong Kong for Sigma.

Stock Performance:

The HSN stock has provided a return of 21.69% in the past 6 months, with an annual dividend yield of 1.67%, and it last traded at a price of $3.600 on 8 October 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.