The below mentioned energy stocks belong to penny space. One of the characteristics of penny stocks is that they are highly volatile, therefore there is always a chance of gaining higher returns in less time with these stocks. However, they are also considered riskier due to their high volatility. Letâs take a closer look at 4 Energy Stocks in penny Space -

Senex Energy Limited (ASX:SXY)

Senex Energy Limited (ASX:SXY) recently agreed to a domestic gas sales agreement with leading manufacturer Orora Limited for an initial two-year contract under which Senex will supply Orora with 1.1 PJ commencing 1 January 2020 and 2.2 PJ commencing 1 January 2021. The company is committed to building long-term, mutually beneficial relationships with domestic commercial and industrial customers.

In the last six months, the stock price of Senex Energy Limited decreased by 24.10 percent as on 20 May 2019. SXYâs shares last traded at $0.320, up by 1.587% during the dayâs days with the market capitalization of circa $457.69 million.

Cooper Energy Limited (ASX:COE)

Oil and gas exploration company, Cooper Energy Limited (ASX: COE) is moving closer to the transformational growth coming from its gas business. Recently during the March quarter, the company completed the construction phase of the offshore element of the Sole Gas Project and advanced the negotiation of new gas contracts for the start-up of Sole and for 2020. In 2019 March quarter, the company reported sales revenue of $20.6 million, up 43% on the previous corresponding period.

In the last six months, the share price of Cooper Energy Limited increased by 27.91% as on 20 May 2019. COEâs shares last traded at $0.540, down by 1.818% during the dayâs days with the market capitalization of circa $891.85 million.

Leigh Creek Energy Limited (ASX:LCK)

Emerging energy company Leigh Creek Energy Limited (ASX: LCK) has made significant progress in the development of the Leigh Creek Energy Project (LCEP) in South Australia with the recently received maiden 2P reserve certification which confirmed that the gas at the LCEP is of considerable value. At the end of March quarter, the company had total cash balance of $6.6 million.

In the last six months, the share price of the company decreased by 96.55% as on 20 May 2019. LCKâs shares last traded at $0.250, down by 12.281% during the dayâs days with the market capitalization of circa $156.22 million.

Carnarvon Petroleum Limited (ASX:CVN)

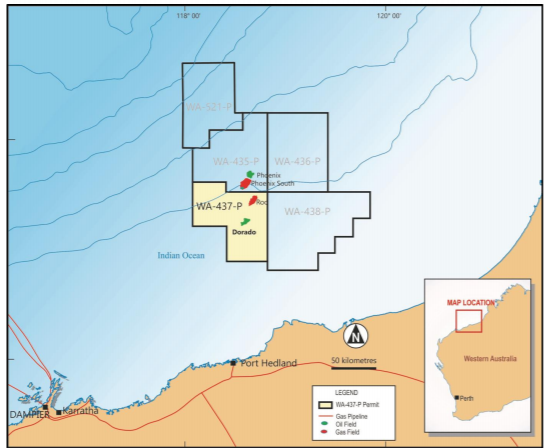

Carnarvon Petroleum Limited (ASX: CVN) is currently preparing to commence coring across the Caley and Baxter members and besides that with plans to acquire around 200 metres of whole bore core across these members. The company recently provided Dorado-2 drilling update in which the company announced that the hole -12-1/4â has been drilled.

Map of WA-437-P showing the Dorado field (Source: Company Reports)

In the last six months, the share price of the company increased by 27.54% as on 20 May 2019. CVNâs shares last traded at $0.420, down by 4.545% during the dayâs days with the market capitalization of circa $590.8 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.