Liontown Resources Limited

The West Perth-based Liontown Resources Limited (ASX: LTR) explores and evaluates mineral properties in Australia. It has a primary interest in gold, vanadium, lithium, and nickel deposits. With around 1.53 billion outstanding shares and a market capitalisation of ~ AUD 126.85 million, the LTR stock settled the dayâs trading at AUD 0.084, climbing up 1.21% by AUD 0.001 on 17th May 2019. Around 16.55 million shares exchanged the hands of shareholders. Besides, the LTR stock has also generated a positive YTD return of 221.77% so far.

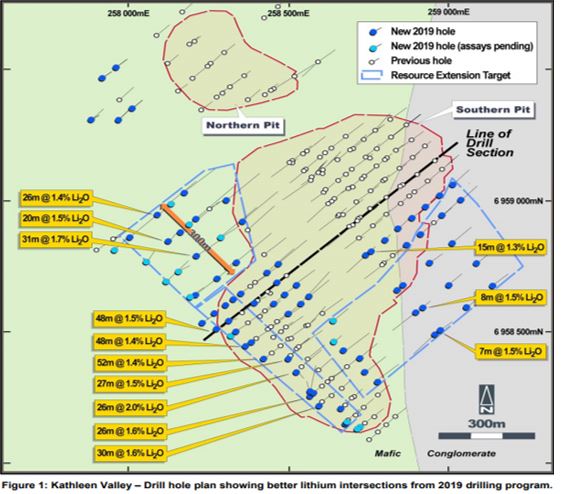

On 9th May 2019, the metals and mining sector player updated the market with new results from the resource expansion drilling currently underway at the Kathleen Valley Lithium-Tantalum Project (100%-owned) in Western Australia. The thicker intersections at KVRC0211 and KVRC0218, i.e., 48m @ 1.4% Li2O from 242m and 48m @ 1.5% Li2O from 277m respectively, confirm the north western strike continuity of the recently reported, best-ever intercept of 52m @ 1.4% Li2O in KVRC0204.

Source: Drilling update (ASX, 9TH May 2019)

The latest assays indicate the potential to substantially increase the current Mineral Resource Estimate (MRE) of 21.2Mt at 1.4% Li2O and 170ppm Ta2O5. A further 2,600m of Reverse Circulation drilling is planned with three RC rigs now operating and it is expected to last for 1-2 weeks.

Orthocell Limited

The Murdoch, Australia-based Orthocell Limited (ASX:OCC) is a medicine regenerative company engaged in the development and commercialisation of cell therapies and products to repair various soft tissue injuries, and promote mobility for patients. The company has a market cap of around AUD 65.3 million and ~ 122.06 million outstanding shares. The OCC stock closed the market trading on 17th May 2019, at the last price of AUD 0.490, dipping down 8.41% by AUD 0.045 with ~ 6.36 million shares traded until the end of the session. In addition, OCC has also generated a positive YTD return which stands high at 245.16%.

The company recently reported that it had concluded the clinical trial for CelGro® nerve regeneration in which around four patients successfully participated. The results obtained were affirmative for the patients as they went through the surgery with CelGro®. Subsequently, the patients regained muscle function as well as experienced sensation in affected limbs. As a result, they could continue with their daily activities including work, sports and others. The company believes CelGro® represents a breakthrough in soft tissue reconstruction, thereby expecting growth due to the surgeonsâ preference for quality and functional bio-absorbable membranes.

Source: OCCâs ASX announcement (8th May 2019)

Liquefied Natural Gas Limited

Liquefied Natural Gas Limited (ASX:LNG), based out of Sydney, is engaged in the identification and progression of liquefied natural gas (LNG) development projects to facilitate the production and sale of LNG. Its project portfolio in includes the Magnolia LNG project in Lake Charles, Louisiana, the US; and the Bear Head LNG project situated in Point Tupper, Richmond County, Nova Scotia, Canada. With a market cap of ~ AUD 225.87 million, the LNG stock settled the dayâs trading at AUD 0.385, down 2.532% by AUD 0.010 with ~ 2.54 million shares traded on 17th May 2019.

As per LNGâs March 2019 Quarterly Highlights, Magnolia LNG received a grant notice from the United States Department of Energy for the expansion its export capacity to 8.8 million tonnes per annum (mtpa). Besides LNG continued to examine technical improvements in the OSMR® technology and plant modular design to further reduce costs. As of 31st March 2019, the net operating cash outflow was AUD 7.9 million. The companyâs energy link strategy is explained as follows:

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.