Liontown Resources Limited

Liontown Resources Limited (ASX: LTR), based out of West Perth, Australia, is engaged in the exploration and development of mineral properties such as lithium, gold, vanadium, and nickel deposits in Australia.

The companyâs current market cap stands at around AUD 126.85 million, and it has ~ 1.53 billion outstanding shares. With the end of the market trading on 17th May 2019, the LTR stock price settled the trading session at AUD 0.084, edging up 1.21% by AUD 0.001, with ~ 16.55 million shares traded. Moreover, the LTR stock has also generated a positive and high YTD return of 221.77%.

In its recently released March 2019 Quarterly Activities Report, Liontown Resources reported that the successful resource expansion and metallurgical test work drilling at Kathleen Valley Lithium Project in Western Australia had confirmed the potential to significantly expand the maiden Mineral Resource estimate of 21.2Mt @ 1.4% Li2O and 170ppm Ta2O5.

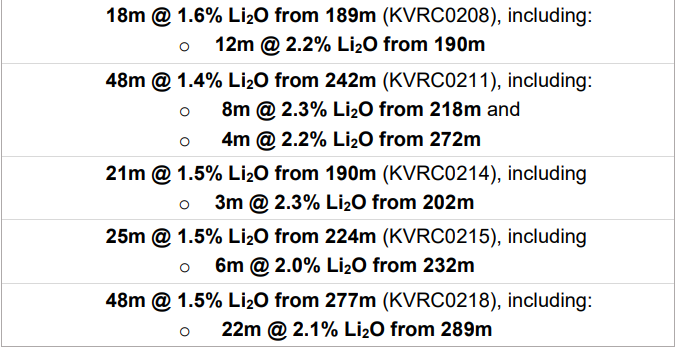

On 9th May 2019, the company posted new results from the ongoing resource expansion drilling whereby thick zones of high-grade, mineralised pegmatite had been intersected. The new intersections include:

Source: Companyâs ASX announcement dated 9 May 2019

Source: Companyâs ASX announcement dated 9 May 2019

Galaxy Resources Limited

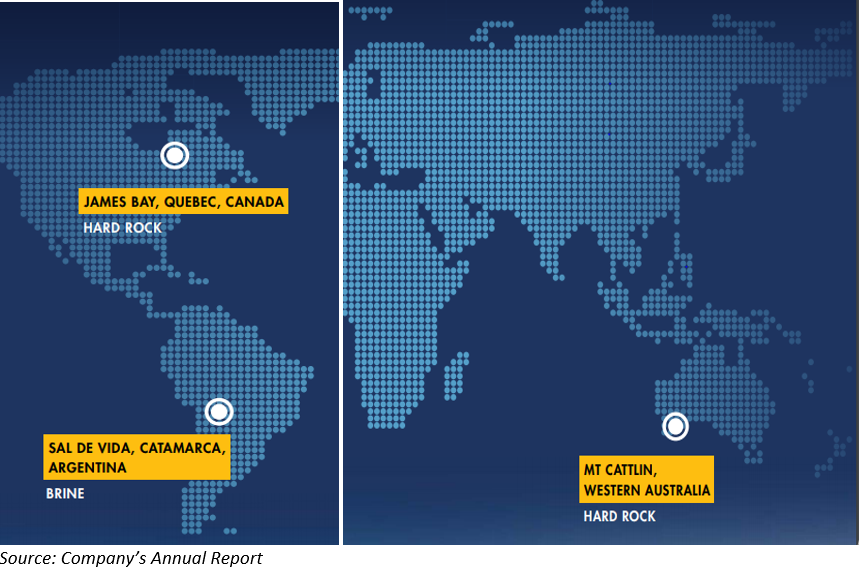

The Perth-based Galaxy Resources Limited (ASX: GXY) is metals and mining sector player engaged in the production of lithium concentrate, as well as the exploration of other minerals in Argentina, Australia, and Canada.

With a market capitalisation of around AUD 668.34 million, and approximately 407.52 million outstanding shares, the GXY stock price closed the trading session flat on 17th May 2019 at AUD 1.640 with around 1.91 million shares traded through the day.

With a market capitalisation of around AUD 668.34 million, and approximately 407.52 million outstanding shares, the GXY stock price closed the trading session flat on 17th May 2019 at AUD 1.640 with around 1.91 million shares traded through the day.

On the same day, Alliance Mineral Assets Limited (ASX:A40) announced on 15th May 2019, that it had entered into separate subscription agreements to raise total gross proceeds of AUD 32.5 million at a price of AUD 0.20 per placement share with Galaxy Resources (AUD 22.5 million) (Institutional Placement), and the second with Weier Antriebe und Energietechnik GmBH (AUD 10 million) (Conditional Placement).

Both placements are conditional, and the proceeds will be utilised for funding capital expenditure in the continued upgradation of the processing facilities at the Bald Hill Lithium and Tantalum Mine in Western Australia. Besides, it would also support future exploration and general working capital requirements.

Orthocell Limited

Orthocell Limited (ASX:OCC) is a medicine regenerative company based out of Murdoch, Australia. The healthcare sector player develops and commercialises cell therapies and products for the repairment of soft tissue injuries, thus promoting movement for patients.

With a market capitalisation of around AUD 65.3 million and ~ 122.06 million outstanding shares, the OCC stock closed the market session at the last trading price of AUD 0.490, down 8.411% by AUD 0.045 with ~ 6.36 million shares traded on 17th May 2019.

Recently, AustralianSuper Pty Ltd became a substantial shareholder in the company upon purchase of 7,570,000 fully paid ordinary shares, reflecting a voting power of 6.20%.

In its March 2019 quarterly report, Orthocell reported that the Year-to-date total product revenues for the 9 months to 31st March 2019 had increased by a staggering 80%, relative to the months to 31st March 2018.

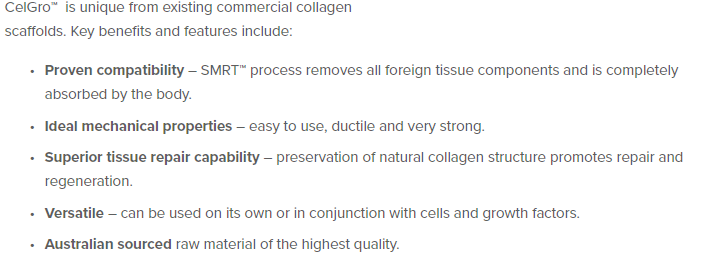

Source: Companyâs website

Source: Companyâs website

Besides, the studies required by the FDA for CelGro® to receive 510(k) clearance in the US were successfully accelerated with top-line results expected in 2Q CY 2019. The key features and benefits of CelGro, manufactured at Orthocellâs quality controlled Good Manufacturing Practices facility in Australia, are given in the figure above. The cash balance at the end of the quarter stood at AUD 3.24 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.