The coronavirus continues to spread, and it’s been around 4 months since the outbreak was first reported in Wuhan, China back in December last year. As more and more countries are enforcing social distancing and quarantine on people, the fear of infection and income losses is escalating insecurity across the globe. Researchers and Pharmaceutical companies have been continually looking for a cure in the form of drugs and vaccines to curb the COVID-19 impact. However, it will take a minimum of 12 to 18 months to find the cure for this wellness. Also, the outbreak creates a huge task for the government and health officials to gather quick information. In such a circumstance, artificial intelligence (AI) plays huge role to develop an escape strategy from this worldwide lockdown.

For a matter of fact, death toll keeps rising and doctors are on continuous hunt for treatments that will not only reduce the impact of the virus but also lessen its severity. Artificial intelligence can assist in two major ways, that is AI-based antidote search and surveillance.

Here’s how AI is helping to Curb the Global COVID-19 Pandemic

Artificial intelligence algorithms are one of the ways to detect news reports and online content all over the world, assisting experts diagnose irregularities at a very early stage. AI helps researchers to assess data of flight traveller in order to calculate where the coronavirus could next infect people.

Of late, the healthcare professionals around the worldwide are working non-stop to treat COVID-19 patients, often placing their own lives at risk. Artificial intelligence may possibly play a vital role in reducing their workload and at the same time also maintains the quality of care. Leading healthcare facilities are utilising AI in forecasting who among the patients detected with coronavirus need hospitalisation. This in turn, reduces pressure on hospitals during the pandemic and aids critical patients to receive maximum care.

Additionally, AI also supports in boosting surveillance, monitoring and detection abilities. As the government of different countries have imposed lockdown to curb the spread of the virus, AI comes into the picture in maintaining public health, safety and social order. For example, in China, government department trusted on facial recognition cameras to track a man who had travelled to the affected area. Consequently, the local police immediately ordered him for self-isolation.

In other countries of the world, police are using AI-based technology to enforce isolation. Further, officers are taking help of drones to patrol and broadcast audio messages to the public and inspire them to stay at home. Additionally, at this time of global crisis, a surveillance company in the US revealed the expansion of an AI-based thermal camera that helps to identify body temperature.

3 Stocks to Consider

Artificial intelligence has enormous potential in the coming years and many companies are of the opinion that their supercomputers are not being utilised to their deepest capacity. It is to be noted that, AI could use social media data to foresee possible epidemics in the near future. Given such advancements and the benefit AI is offering amid the COVID-19 outbreak, it is sensible to keep a track of these three AI-focused stocks mentioned below:

Telstra Corporation Limited (ASX: TLS)

Telstra is one of the leading telecoms and tech entities of Australia, which is engaged in providing a broad range of services related to telecom and information. The services include of both internet and pay tv apart from mobile. TLS operational division provides manufacturing and construction of Telstra systems, along with the strategising and designing of it.

Also, Telstra remains on track to increase skills in both products and technologies that consists of the machine learning, AI or artificial intelligence, cloud computing etc.

Update on COVID-19 Impact: As on 20 March 2020, Telstra announced that it would defer any additional job reductions and is postponing late payment fees and disconnections, due to COVID-19 impact. The move is expected to deliver support to small businesses.

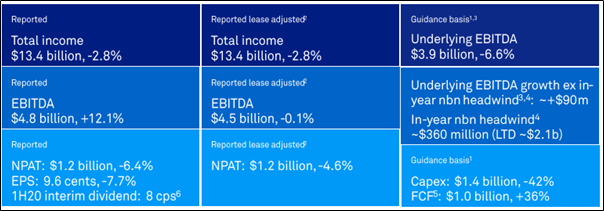

Half Yearly Results for the Period Ended 31 December 2019: TLS reported a total income of $13.4 billion and NPAT of $1.2 billion. During the period, TLS remains on track to continue solid progress in providing its T22 strategy. It also delivered strong growth in customer numbers.

1H20 Financial Highlights (Source: Company’s Report)

What to Expect: COVID-19 outbreak has impacted many businesses across the world and is likely to affect the business of TLS. For FY20, the company anticipates total Income to be between of $25.3 to $27.3 billion. It also expects EBITDA to be at the lower end of the guided range of $7.4 to $7.9 billion. Further, it expects restructuring costs to be ~$300 million. Capital expenditure is expected to be at the higher end of the guided ambit of $2.9 to $3.3 billion.

Stock Performance

The Company’s market capitalisation stands at $37.58 billion and has around 11.89 billion shares outstanding. The Company’s stock price closed at $3.12 on 15 April 2020, down by ~1.266% relative to the previous close.

Appen Limited (ASX: APX)

Australia based entity, Appen is engaged in offering machine learning and artificial intelligence and solutions related to data (quality), along with applications for global tech entities and government agencies and such.

On 15 April 2020, APX notified on its updates related to operations, APX performance and methods undertaken against the coronavirus outbreak that are following:

- APX mentioned that it remains committed towards the well-being of its international workforce;

- The Company is assessing its performance throughout the period and prediction for this year;

- APX performance for this year might shrink a bit due to a slack in digital ad expenditure, decrease in information technology/digital expense etc.

- Also, Appen has a robust balance sheet, with cash resources of more than $100 million.

On 27th March 2020, APX appointed Ms. Vanessa Liu for the designation independent non-executive director of APX w.e.f 27 March, this year.

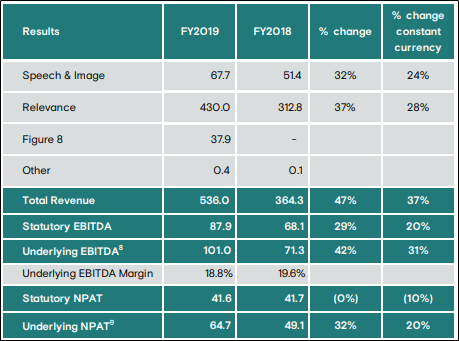

FY19 Key Financial Highlights for the Period Ended 31st December 2019: APX reported revenue of $536 million, which increased 47% on a year over year basis. On a constant currency basis, revenue went up 37% year over year. Underlying EBITDA soared 42% and stood at $101 million in FY19. Organic revenue for FY19 increased a whopping 37% year over year to $498.1 million. Underlying NPAT rose 32% year over year in FY19.

Key Financial Highlights (Source: Company’s Report)

Outlook: For FY20, the Company expects APX underlying EBITDA to be in the range of $125 million - $130 million, given the exchange rate of 1 AUD = 0.70 USD from Feb’20 – Dec’20. The company remains on track to boost its customer base through higher investments in sales and marketing.

Stock Performance

The market cap of APX was noted at $2.93 bn and around 121.65 million outstanding shares. At the end of the market session, APX was at $23.85 on 15 April 2020, declining by ~1.078% from its last close.

Nearmap Ltd (ASX: NEA)

Australia based company, Nearmap offers technology for combined geospatial map for both businesses and governments.

COVID-19 Update: Recently, the Company provided a shareholder update on present trading conditions, owing to the uncertainty related to COVID-19. NEA is taking necessary measures in keeping the health and well-being of its people, customers and suppliers. In doing that, the Company has been following the advice from the Australian and U.S Governments and has allowed its employees to work remotely as a part of its business stability procedures.

During this time difficult time, the Company continues to provide support to its customers by constantly offering them with immediate access to current and historical aerial based imagery and content. At the end of 31 December 2019, NEA had a cash balance of $49.6 million and remains focused on optimum cash management implementation.

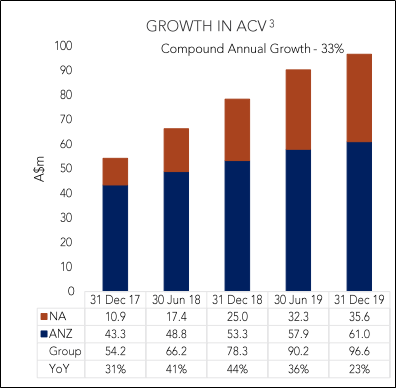

Half Yearly Results for the Period Ended 31 December 2019: During the 6-month period, the Company reported statutory revenues of $46.3 million, up 31% year over year, owing to increase in ACV (Annual Contract Value), which increased 23% year over year. Moreover, group consumer churn rate increased to 11.5 percent versus 5.5 percent noted in 1HFY19 period.

Growth in ACV (Source: Company Reports)

What to Expect: NEA has provided outlook for FY20 and expects to deliver group ACV in the ambit of $102 million and $110 million. The company also remains focused to offer a lower rate of cost in second half of FY20 with an objective to drive higher returns to its shareholders. The company will continue to deliver growth of 20%-40% in ACV in the medium to longer-term with the underlying churn of <10%.

Stock Performance

NEA’s market capitalisation stood at $617.6 million and nearly has 452.46 mn shares outstanding. NEA ended the trading session at $1.29 on 15 April 2020, down by 5.495% from the last closing price.