Now that 2019 is finally over, investors have started to look for stocks to invest in the new year. We have screened few stocks for investors which have been performing decently for quite some time now. Let us look at these stocks in details.

BHP Group Limited (ASX: BHP)

A world-leading resources company, BHP Group Limited (ASX: BHP) has witnessed an increase of 21.23% in its share price over the last one year. This tale of providing increased returns to its shareholders has been going on for several years now, as depicted in the below figure.

BHP Performance Over four Years (Source: Company Reports)

In 2019, this mining and metal giant continued to travel on its path of on simplification, workforce capability and technology. The company is of the view that these transformation efforts will make BHP safer and its operations more efficient as well as predictable.

Because of BHP’s Management team efforts, the company is:

- Simpler - with a portfolio focused on high quality assets in the right commodities;

- Stronger - with a robust balance sheet, which gives it more financial flexibility;

- More efficient - through a relentless focus on productivity; and

- More disciplined - with a rigorous and transparent capital allocation process.

Major Highlights of FY19 Results

- EBITDA of US$23 billion at a margin of 53 per cent

- Free cash flow of US$10 billion

- Return on capital employed of 18 per cent

- Returned a record US$17 billion to shareholders

- Six major projects under development

The company recently appointed Mike Henry as new CEO of the company. “Mike Henry’s deep operational and commercial experience, developed in a global career spanning the Americas, Europe, Asia and Australia” said Chairman Ken MacKenzie on his appointment and expressed his belief that Mike’s discipline and focus will deliver a culture of high performance and returns for BHP.

By AEDT 3:22 PM, BHP stock was trading at a price of $39.260 with a market cap of around $115.33 billion.

Rio Tinto Limited (ASX: RIO)

Metal and mining company giant, Rio Tinto Limited (ASX: RIO) works in about 35 countries. The company has a market cap of around $37.63 billion and is currently trading at a price to earnings multiple of 8.860x. In the last one year, RIO’s stock has provided a return of 38.41% to its shareholders. Further, the stock is currently trading near to its 52 weeks high price.

On 31 October 2019, the company had assured that it is well positioned to continue generating strong returns, building on a track record of $32 billion returned to shareholders since 2016, while strengthening its relationships with its customers and with other partners, both of which are crucial for our future success.

In order to expand its current operations, the company is making some investments. Most notably, the company recently approved a $1.5 billion investment (100 per cent basis) to continue production at its Kennecott copper operation in the United States to further extend strip waste rock mining and support additional infrastructure development in the second phase of the South Wall Pushback project.

The company recently started the process of resuming operations at Richards Bay Minerals (RBM) in South Africa and expects to return to full operations in early January, leading to regular production in early 2020.

The company believes that Kennecott is uniquely positioned to meet strong demand in the United States and delivers almost 20 per cent of the country’s copper production and it will be supplying customers across North America with products that are not only produced in the region but responsibly mined with a significantly reduced carbon footprint.

Growth & Innovation Highlights for Rio

- Rio Tinto spends $200m each year on early stage R&D;

- In studies and construction, innovation and digital design is helping Rio Tinto to achieve improvements in safety and cost as seen most recently at Amrun and at Koodaideri;

- Partnering to develop innovative technology to tackle critical industry challenges is leading to advances in tailings management and handling, emissions reductions as well as improved water usage and recycling;

- Investment in exploration continues in 18 countries and seven commodities. By taking a sophisticated approach to data and technology to improve targeting, Rio Tinto has uncovered opportunities in areas that have been well explored in the past.

At the time of writing Rio stock was trading at a market price of $100.800.

WAM Research Limited (ASX: WAX)

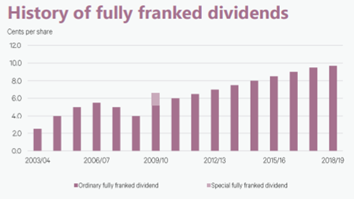

In the last five years, the stock of WAM Research Limited, a leading investment management company, has provided a return of 29.87% to its shareholders. Further, the company has strong history of paying fully franked dividend, as demonstrated in below figure.

Fully Franked Dividends Summary (Source: Company Reports)

In the last one year (as at 30 November 2019), WAX investment Portfolio provided a return of 18.7% to its shareholders. Emeco was one of major contributor to the Portfolio in the November Month.

By AEDT 3:22 PM, WAX stock was trading at a price of $1.495, near to its 52 weeks high price.

Judging a stock by merely looking at the historical performances might not work in every case. Investors must keep in mind that sometimes, the current operations of a company might build up for a better future.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)