The below mentioned small caps stocks have made significant strategic progress in the recent past. During todayâs intraday session, all these stocks witnessed an uplift in their share prices. Letâs take a look at the recent updates of these stocks -

Zoono Group Limited (ASX:ZNO)

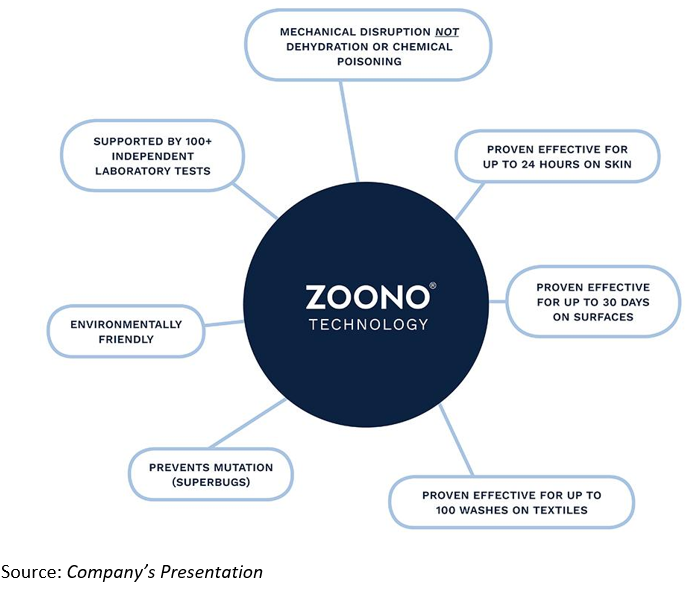

Global biotech company Zoono Group Limited (ASX: ZNO) is primarily involved in the development and distribution of environmentally-friendly antimicrobial solutions suited for skin care, surface sanitisers, and mould remediation treatments.

Today, the company has made an announcement stating that it has signed a distribution agreement with Zoono USA LLC, Zoonoâs USA distribution partner, and MicroSonic LLC (MicroSonic) to supply its innovative antimicrobial products exclusively to Turtle Wax, Inc. (Turtle Wax), the âMost Innovative Brand in Car Care,â for the car wash and automotive industries. The company has also signed a sales and distribution agreement for the supply of its proprietary poultry formulation utilising Zoono Z71 Microbe Shield (ZPP) with New Zealand based The Z Factor Limited (The Z Factor).

Today, the company has made an announcement stating that it has signed a distribution agreement with Zoono USA LLC, Zoonoâs USA distribution partner, and MicroSonic LLC (MicroSonic) to supply its innovative antimicrobial products exclusively to Turtle Wax, Inc. (Turtle Wax), the âMost Innovative Brand in Car Care,â for the car wash and automotive industries. The company has also signed a sales and distribution agreement for the supply of its proprietary poultry formulation utilising Zoono Z71 Microbe Shield (ZPP) with New Zealand based The Z Factor Limited (The Z Factor).

At market close on 13th May 2019, the stock of the company was trading at a price of $0.155, up 98.718% during the dayâs trade with a market capitalisation of circa $12.74 Million.

Pure Alumina Limited (ASX:PUA)

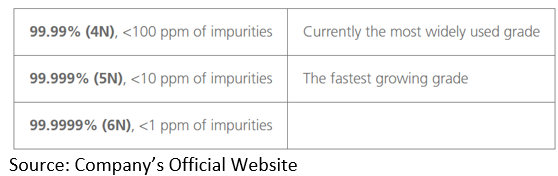

Supplier of High Purity Alumina (HPA), Pure Alumina Limited (ASX: PUA) witnessed an improvement of 24.528% in its share price during the intraday trade. The company is currently in the process of acquiring Canadian HPA producer Polar Sapphire which recently reported growth in the sales of its 5N HPA. This is demonstrating Pure Aluminaâs ability to produce large quantities of top-quality HPA using Polar Sapphireâs patented process. It is expected that the acquisition of Polar will accelerate the companyâs plans of commencing commercial production of premium 99.999% 5N HPA within 1 year of completion. Once the Polar HPA facility is fully constructed, it could create strong free cashflow for the company.

At market close on 13th May 2019, the stock of the company was trading at a price of $0.066, up 24.528% during the dayâs trade with a market capitalisation of circa $9.07 Million.

Orthocell Limited (ASX:OCC)

World leading regenerative medicine company Orthocell Limited (ASX: OCC) helps in facilitating tissue repair and healing in a variety of orthopaedic, reconstructive and surgical applications via its CelGro® platform.

The company recently announced that the first four patients of its CelGro® nerve regeneration clinical trial have successfully completed participation they have regained sensation and muscle function in affected limbs and experienced 83% improvement in muscle power, indicating that CelGro® can be used to guide and support nerve regeneration in severely damaged or severed peripheral nerves.

The companyâs net operating outflows for the quarter were A$113k, with the majority of expenditure allocated to commercial and R&D related activities.

At market close on 13th May 2019, the stock of the company was trading at a price of $0.610, up 45.238% during the dayâs trade with a market capitalisation of circa $50.75 Million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.