First Cobalt Corp

First Cobalt Corp (ASX:FCC) is a Canadian-based metals and mining company. It focusses on exploration and refining cobalt in the North American region. In Idaho, FCC has an Iron Creek Cobalt Project.

FCC recently signed an MoU with Glencore AG for the supply of cobalt feedstock. It would finance the recommissioning of Ontarioâs First Cobalt Refinery. Shareholders would benefit out from it, as Glencore would be backing the company financially and provide technical and other support as well.

Source: Companyâs Report

Also, on 10 May 2019, the company had notified that it had applied for voluntary delisting from ASX as it received low average daily trading volume when compared to TSX-V. FCC had experienced issues in raising additional working capital as the registration of CDIâs (CHESS Depositary interests) was held tightly. The company is based in North America and have no interest in businesses outside the region. ASX has approved FFCâs request based on these conditions. Therefore, on the close of the trading session, on 13th June 2019 on ASX, the trading of CDI shares would be suspended. CDI holders would be given options to convert CDIâs to shares.

FCC has a market cap of A$65.9m. On 22nd May 2019, the stock of the company closed at A$0.175, up by 16.667%. The YTD return of the company is -16.67% and its 6-month return are -45.45%.

Australian Mines Limited

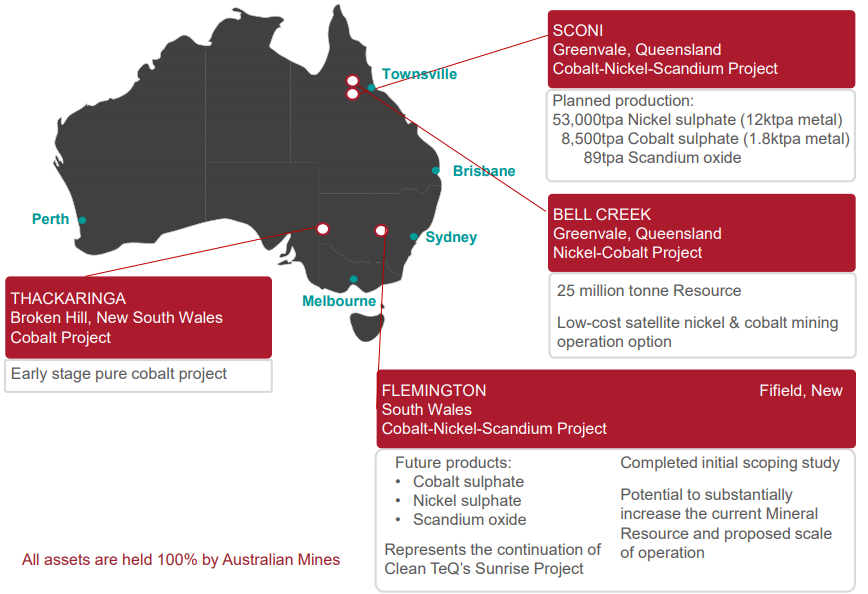

Australian Mines Limited (ASX:AUZ) is an Australian-listed public company. It has a dominant position in the production and supply of battery pertaining to cobalt and nickel chemicals. AUZ caters to the global EV market.

To meet the increase in demand created by the global shift, AUZ is developing the world-class Sconi Project in Queensland, Australia.

AUZâs assets (Source: Companyâs report)

AUZâs assets (Source: Companyâs report)

The company is focussed to become the worldâs lowest cost cobalt-producing nickel operations. It plans to produce 53,000 tonnes of nickel sulphate along with 8,5000 tonnes of cobalt sulphate each year. It would export products to customers from 2022, depending on its finances then.

As declared on 29 April 2019, the companyâs New Mineral Resource Estimate for the Bell Creek Nickel-Cobalt Project was 25.8 million tonnes @ 0.72% nickel and 0.04% cobalt. For the Minnamoolka Project, the estimate was 14.7 million tonnes at 0.03% cobalt and 0.66% nickel. Overall, the tonnage of the companyâs cobalt-nickel projects in Queensland exceeded 115 million tonnes.

As on 22nd May 2019, the company has a market cap of A$53.93m. The companyâs stock closed at A$0.023, up 27.77%. The YTD return of the company is -52.63% and its 6-month return are -64.00%.

Kingston Resources

Kingston Resources (ASX:KSN) is a metals and mining company. It is engaged in developing and exploring mineral resources. The company focusses on lithium and gold production. KSNâs flagship projects are Misima Gold Project situated in Misima Island near the Solomon Sea and the Livingstone Gold Project located in Western Australia.

KSNâs Projects (Source: Companyâs report)

In April this year, the company increased its stake in the Misima Gold Project. The company funds the operations fully in Misima. In accordance to the estimate of expenditure to 31 March 2019, KSN estimated the interest to lift to 75%.

Recently, the company had released its Corporate Presentation and stated that the company has designed programs to explore and drill through to the end of 2019.

Also, on 3rd May this year, the company had issued 276 million shares at $0.016 per share, which raising net proceeds worth $4.3 million.

As on 22nd May 2019, the company has a market cap of A$21.12m. The stock of the company closed at A$0.016, up 14.28%. The YTD return of the company is -11.76% and its 6-month return are -29.41%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.