Lithium stocks have become increasingly popular due to the rise in the demand for lithium-ion batteries. Letâs take a look at three stocks which are involved in the development of lithium.

Lithium Australia NL (ASX:LIT)

A Perth based lithium developer, Lithium Australia NL (ASX: LIT) is heavily invested in the battery industry with lithium assets around the globe.

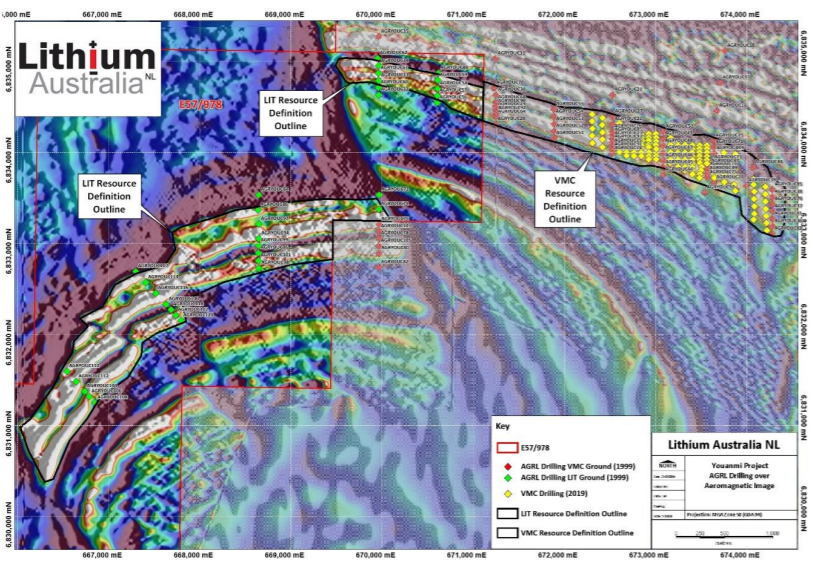

In an announcement made on 22 May 2019, the company announced that it has completed Mineral Resource Estimate for a portion of the Youanmi Complex and has also outlined a strategy to use its vanadium assets to enhance value for shareholders. The Inferred Mineral Resource at Youanmi has been estimated at 185 Mt at 0.33% V2O5 which comprises oxide resources of 96 Mt at 0.34% V2O5 and fresh resources of 88 Mt at 0.33% V2O5.

Aeromagnetic image of part of the Youanmi Complex, showing drill hole locations and Mineral Resource outline (Source: Company Reports)

Aeromagnetic image of part of the Youanmi Complex, showing drill hole locations and Mineral Resource outline (Source: Company Reports)

The company is going to evaluate the metallurgical characteristics of the oxide mineralisation at Youanmi and it is planning a drilling programme to enable a reasonable quantity of oxide material to be recovered over the full depth of the oxidised profile.

The share price of Lithium Australia NL has decreased by 7.53% in the last six months as on 21 May 2019. The companyâs shares traded at $0.087, with a market capitalisation of circa A$41.21 million as on 22 May 2019.

Jadar Lithium Limited (ASX:JDR)

Jadar Lithium Limited (ASX:JDR) is progressing well with the development of its most promising Serbia projects, including Cer, Rekovac and Vranje-South. In 2019 March quarter, the company had announced that it is going to initiate follow up field activities in April 2019, with the objective of defining the source of the B and Li anomalies defined on the Vranje-South project. Further, the company is going to conduct further work on the Rekovac project to narrow in the zones of interest.

In 2019 March quarter, the company completed initial soil and rock chip sampling on the Weinebene â Wolfsberg lithium project. The rock chips samples returned high-grade Li values (up to 3.39 % Li2O) with an average value of 1.61% Li2O.

In the last six months, the share price of Jadar Lithium Limited decreased by 25.00% as on 21 May 2019. Today, JDRâs shares closed the dayâs trade at $0.010, up by 11.11% during the intraday trade, with a market capitalization of $4.32 million.

Kidman Resources Limited (ASX:KDR)

Kidman Resources Limited (ASX: KDR) recently agreed with SQM that the Mine & Concentrator and Refinery would be one vertically integrated project, enabling the company to produce premium, battery-grade lithium hydroxide for sale to the electric vehicle market. The company also has entered into an offtake Heads of Agreement with Mitsui & Co. and a memorandum of understanding with LG Chem.

In the last six months, the share price of Kidman Resources Limited increased by 0.267% as on 22 May 2019. Today, KDRâs shares closed the dayâs trade at $1.880, up by 0.267% during the intraday trade, with a market capitalization of $759 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.