Summary

- In the recently held AGM 2020, CSR’s Chairman addressed the stakeholders and stated that the Company’s senior executives ensured the well-being of their staff members, amid COVID-19 through strategising for longstanding resilience of their business.

- BLD concluded the execution of debt facilities in June by issuing USSP of US$200 million, and finalising 2 years bank loan facilities amounting to AU$365 million.

- Recently, JHX raised guidance for Q1 2021 closing June this year, wherein it mentioned North America Exteriors volume to be in between flat to more than 2% increase on pcp. Moreover, housing market activity in North America progressed in the past 7 weeks (as on 22 June) amid coronavirus pandemic.

The construction industry of Australia is one of the prominent industries, which provides major contribution in the development of its economy. The industry includes companies, that are involved in the businesses of building products and construction services.

BPIC (Building Products Industry Council) plays a significant role as it is dedicated to Australian building and construction Industry. BPIC mainly concentrates on promoting regulatory reform, harmonised standards, as well as code compliance in the Australian building and construction product industries.

A few factors that can affect building products’ stocks are as following:

- Fluctuation in housing demand has a major impact on the business of building products’ stocks. Moreover, housing demand is influenced by higher income, high rents, low interest rates, etc.

- Population growth also creates space for rising demand for houses resulting in elevated construction activity.

Do Read: How housing market is reviving in Australia?

CSR Limited

CSR Limited (ASX:CSR) is involved in the manufacturing and supply of building products in Australia and New Zealand.

Results of CSR’s AGM 2020-

On 24 June 2020, during AGM 2020, CSR’s Chairman John Gillam mentioned that the Company’s management team guided and made sure about the well- being of staff members amid coronavirus pandemic. The Company’s MD Julie Coates stated that sustainability has been essential part of their plan in terms of operation and growth.

Softness in Residential Building Activity

Recently, the Company updated the market with the operational and financial performance for FY20 ended March 2020 and outlined the following:

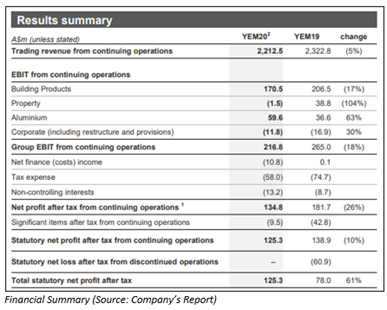

- The Company recorded a net profit after tax amounting to AU$125.3 million, reflecting a rise from AU$78.0 million of previous year.

- NPAT from continuing operations stood at AU$134.8 million, indicating a fall from AU$181.7 million in the prior year.

- The Company experienced a fall in building products revenue of 6% to AU$1.6 billion due to continued softness in residential building activity, which went down 21% on average.

- CSR managed to close the full year, with strong balance sheet comprising net cash of AU$95 million. The Company secured an additional facility of AU$200 million in the month of May 2020 in order to further strengthen the liquidity position.

- The Company has decided not to pay final dividend for FY20, considering the uncertain economic environment. Total dividend for the year stood at 14 cents per share, which comprises of interim dividend of 10 cents per share and special dividend of 4 cents per share.

The Company experienced a minimal impact from COVID-19 on FY results. In response to COVID-19, CSR has finished extensive scenario planning to maximise productivity and align production with changes in market activity.

Do Read: What’s latest with theses ASX-listed companies?

At the close of trading session on 25th June 2020, the stock of CSR settled at AU$3.685 per share, with a fall of 1.995% against its previous closing price. The stock of CSR has delivered returns of 2.17% and 29.66% during the period of one month and three months to shareholders.

Boral Limited

Boral Limited (ASX:BLD) is involved in the manufacturing and supply of building and construction materials in Australia, the USA and Asia. The Company recently announced that Perpetual Limited and its related bodies corporate has made a change to their substantial holding in the company on 11th June 2020, by increasing their current voting power to 6.53% from the earlier 5.49%.

The Company appointed Zlatko Todorcevski as its Chief Executive Officer (CEO) & Managing Director (MD), which will come into effect from 1st July 2020.

Execution of Debt Facilities

- As per the release dated 1st June 2020, the company has successfully completed US$200 million new US Private Placement (USPP) note issue, which comprises two tranches with 5 and 7-year bullet maturities with an average coupon of 4.49% and terms and conditions in line with the its existing USPP notes.

- Moreover, BLD has also finished new bilateral two-year bank loan facilities amounting to around A$365 million and wrapped up its new bilateral loan facilities of US$740 million (to mature by June 2024)

Do Read: Why Value investors are looking at these material stocks?

During the first four months of 2H FY20, BLD experience a fall in revenue in most of its businesses because of volume and cost pressures related to bushfires in Australia that took place in January followed by COVID-19 impacts more broadly. The Company continues to take decisive actions to preserve cash and optimise outcomes considering the impacts of COVID-19 measures.

At the close of trading session on 25th June 2020, the stock of BLD settled at AU$3.66 per share, with a fall of 3.939% against its previous closing price. The stock of BLD has delivered returns of 40.07% and 113.45% during the period of one month and three months to shareholders.

James Hardie Industries plc

James Hardie Industries plc (ASX:JHX) is in the manufacturing of fiber cement siding and backerboard. The Company recently announced that AustralianSuper Pty Ltd has made change to their substantial holdings in JHX, by expanding their current voting to 7.03% from 6.15% held previously.

During FY20 for the period closed 31 March this year, the Company reported net sales from ordinary activities amounting to US$2,606.8 million, reflecting a rise of 4%. During the same period, net profit attributable to shareholders stood at US$ 241.5 million with an increase of 6% on YoY basis.

During Q4 FY20, net sales of the Group stood at US$673.2 million, reflecting a rise of 8% on pcp. During the same quarter, the Asia Pacific segment of the Company delivered decent financial returns, with revenue growth of 2% and Adjusted EBIT growth of 4% in local currency at an Adjusted EBIT margin of 20.5%.

On outlook front, the Company anticipates volumes growth for North America Exteriors in the range of flat to 2% in Q1 FY21. JHX has upgraded guidance for leverage ratio from less than 2.0x at 30 June 2020, to less than 1.80x at 30 June 2020.

On 25th June 2020, JHX last traded at AU$26.54 per share, with a fall of 3.841% against its previous closing price. The stock of JHX has delivered returns of 10.75% and 63.60% during the period of one month and three months to shareholders.