Macquarie Group Limited

Macquarie Group Limited (ASX:MQG), offers banking, financial advisory, life insurance, investment and funds management services, along with real estate development financing, corporate debt financing, securities brokerage, and foreign exchange services to clients globally. With a market capitalisation of AUD 40.9 billion and ~ 340.38 million outstanding shares, the MQG stock price was trading at AUD 118.320, down 1.531% (as on 14th May 2019, AEST 1:05 PM).

Recently, the financial services giant informed that during the month of April 2019, pursuant to the Macquarie Group Employee Retained Equity Plan, around 4,056 unlisted Deferred Share Units were granted. Besides, Macquarie also released its Annual report for the year ended 31st March 2019, posting the net operating income for the period at AUD 12,754 million, up 17% on prior year. The net profit also increased 17% to AUD 2,982 million and the assets under management stood at AUD 551 billion, higher than AUD 497 billion noted on 31st March 2018.

Australia And New Zealand Banking Group Limited

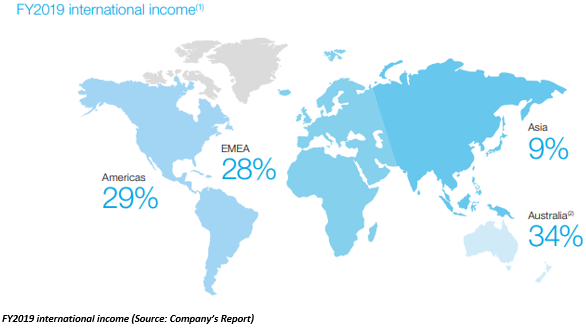

Australia and New Zealand Banking Group Limited (ASX:ANZ), based out of Docklands, Australia, offers various banking and financial products and services. With a market capitalisation of AUD 74.88 billion and ~ 2.83 billion outstanding shares, the ANZ stock was trading at AUD 25.935, diving 1.873% by AUD 0.495 with ~ 2.99 million shares traded until now (as on 14 May 2019, 1:07 PM AEST). Moreover, ANZ has generated a positive YTD return of 10.77%. The company has an annual dividend yield of 6.05%.

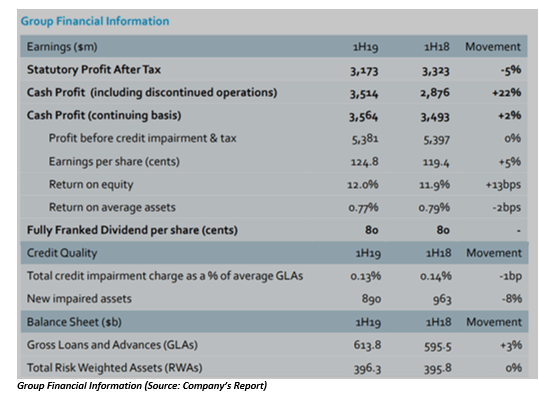

On 8th May 2019, ANZ announced that it would pay its proposed fully franked 2019 Interim Dividend of 80 cents per share in three different currencies, namely Australian Dollars, Pounds Sterling and New Zealand Dollars. The payment date for the dividend is 1st July 2019. For the half-year ended 31st March 2019, the Group reported statutory profits of $ 3,173 million and a CET1 ratio of 11.5%.

The complete results are illustrated as follows:

Commonwealth Bank of Australia

Commonwealth Bank of Australia (ASX:CBA), based in Sydney, offers banking, life insurance, and allied services like international financing, institutional banking, stock broking and others for small and medium sized businesses as well as individuals. On 14th May 2019, 1:17 PM AEST, the CBA stock was trading at AUD 72.300, down 1.633% by AUD 1.200 with ~ 1.79 million shares traded. CBAâS market capitalisation is around AUD 130.11 billion with ~ 1.77 billion outstanding shares.

Recently, Commonwealth Bank increased its shareholding in Flexigroup Limited from 4.88% to 5.92% and executed changes to its management including the retirement of Sir David Higgins as the Non-Executive Director, effective 31st December 2019.

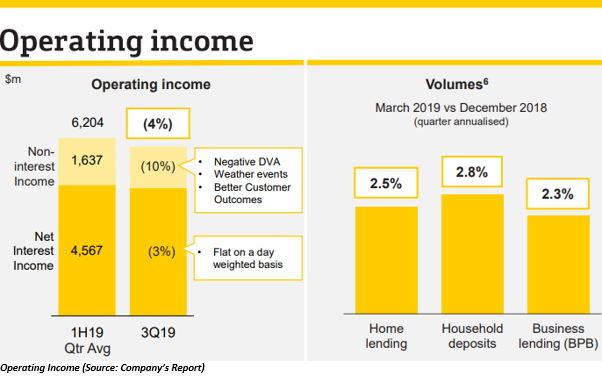

As per CBAâs trading update for the quarter ended 31st March 2019, there was a sustained growth in core franchise, with home loan growth in line with system and continued growth in household deposits and business lending. The unaudited statutory net profit was approximately $ 1.75 billion, the operating income reduced by 4% and the operating expenses increased by 1% with further strengthening of the balance sheet as depicted in the figure above.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.