Rapid technology advancement in the recent world has attracted various investors towards this sector. Two important tech stocks are TechnologyOne Limited (ASX:TNE) and NEXTDC Limited (ASX:NXT). Letâs see how these stocks have performed based on their recent updates.

TechnologyOne Limited (ASX:TNE)

TechnologyOne Limited (ASX:TNE) is a provider of integrated enterprise business software solutions. The appointment of Mr Clifford Rosenberg as an Independent Non-Executive Director has been recently confirmed by TNE. The company intends to increase its Board size by adding the fourth director at the latter part of this year. Mr Rosenberg is the third addition to the Board as an Independent Director. In its Annual General Meeting Presentation, the company reported an increase in total annual recurring revenue of 22% to $169 million. TNE reported 14% CAGR growth in NPAT from $23.6 million in the year 2012 to $51 million in the year 2018. Its net margin improved from 21% in 2017 to 22% in 2018, along with an increase in annual licence fee CAGR of 14% from $43.1 million in 2009 to $139.6 million in 2018.

FY2018 Financial Metrics (Source: Company Reports)

On the stock information front, at market close on 17th May 2019, the stock of TechnologyOne was trading at $9.300, up 3.219% with a market capitalisation of $2.86 billion. Its current PE multiple stands at 55.82x, and its last EPS was noted at $0.161. Its annual dividend yield has been noted at 1%. Today, it touched dayâs high at $9.395 and dayâs low at $9.140, with a daily volume of 1,125,675. Its 52 weeks high and low price stands at $9.395 and $4.097, with an average volume of 885,693 (yearly). Its absolute returns for the past one year, six months and three months are 81.15%, 57.48%, and 22.09%, respectively.

NEXTDC Limited (ASX:NXT)

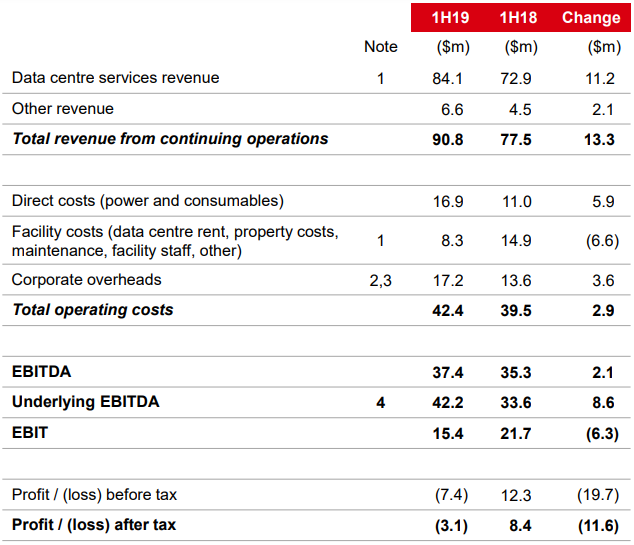

NEXTDC Limited (ASX:NXT) develops and operates independent data centres in Australia. In its H1 FY19 results, NXT reported an increase in revenue of 17% pcp to $90.8 million. Its underlying EBITDA increased by 26% pcp to $42.2 million and the statutory net loss after tax was reported at $3.1 million in H1 FY19 from a net profit of $8.4 million in H1 FY18. On the business performance front, NXTâs contracted utilisation increased by 28% to 50.4 MW as on 31st December 2018 as compared to 39.2 MW as on 31st December 2017. Its customer base increased by 25% to 1,090 as on 31st December 2018 as compared to 875 on 31st December 2017. The companyâs interconnections went up by 34% to 9,982 as on 31st December 2018 as compared to 7,456 as on 31st December 2017. Interconnections revenue represented 7.7% of recurring revenue as on 31st December 2018.

As for the impact of the property acquisitions, current utilisation levels and new customer contracts in H2 FY19, NXT reduced its revenue guidance range for FY19 from $183 million earlier to $188 million to $180 million to $184 million. However, NXTâs guidance remains unchanged for underlying EBITDA and capital expenditure in the range of $83 million to $87 million and $430 million to $470 million, respectively.

H1FY19 P&L Statement (Source: Company Reports)

H1FY19 P&L Statement (Source: Company Reports)

On the stock information front, at market close on 17th May 2019, the stock of NEXTDC was trading at $6.490, up 0.464% with a market capitalisation of $2.23 billion. Today, it touched dayâs high at $6.570 and dayâs low at $6.430, with a daily volume of 1,578,377. Its 52 weeks high and low price stands at $8.190 and $5.610, with an average volume of 2,114,519 (yearly). Its absolute returns for the one year, six months and three months are -15.33%, 9.49%, and -9.42%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.