The below-mentioned IT stocks have witnessed a significant improvement in their share prices in the last six months. Letâs take a closer look at each one of them.

Appen Limited (ASX:APX)

Appen Limited (ASX: APX) operates in an accelerating AI market and is involved in providing high-quality training data to improve machine learning. The company has been investing in new technology to reduce cost, improve margins and sharpen responsiveness to the evolving customer requirements. The company helps in the training of machine learning and artificial intelligence (AI) applications by large volumes of annotated data, which includes speech, text, image and video.

In 2018, the company delivered strong financial results with growth in revenue and earnings as well as margin expansion. In 2018, the companyâs revenue increased by 119% to $364.3 million and its underlying EBITDA grew from $28.1 million to $71.3 million. During the year, the companyâs underlying NPAT increased from $19.7 million to $49.0 million, 148% up on the prior year. Further, the companyâs statutory NPAT was $41.7 million in 2018, a 192% increase on 2017.

Currently, China is an attractive market for the company. Appen has been making investments to participate in this opportunity with a new office and staff in Shanghai, which is bringing it closer to its customers.

In the last six months, the companyâs shares increased substantially by around 86.98% on ASX as on 16th May 2019. APXâs shares last traded at $25.190, with a market capitalisation of $2.93 billion as on 17th May 2019.

Bravura Solutions Limited (ASX:BVS)

A leading provider of software solutions and services, Bravura Solutions Limited (ASX: BVS) has delivered revenue growth of 24%, EBITDA growth of 28% and NPAT growth of 15% in H1 FY19.

The company recently completed an institutional placement of $165 million, which was strongly supported by both existing institutional shareholders and non-holders.

The funds of the placement will be used to fund growth-related initiatives, such as acquisitions and product functionality enhancements. Further, the funds will also be used to proceed with the proposed acquisition of GBST Holdings Ltd, a specialist financial technology company. GBST is currently conducting a careful assessment of the Indicative Proposal.

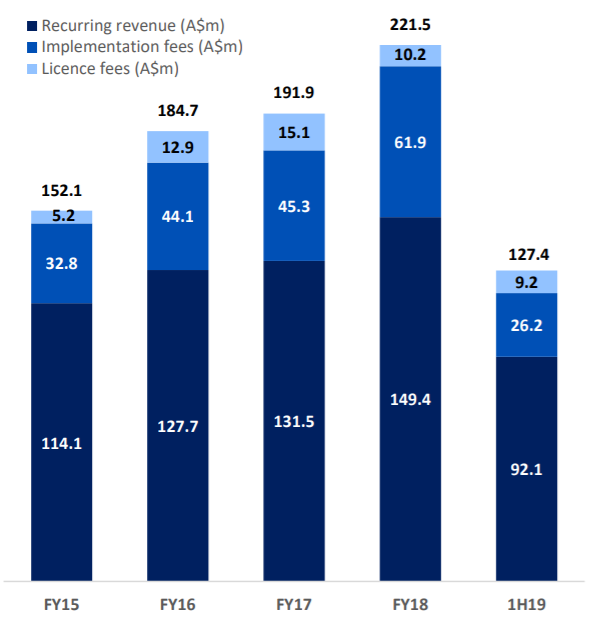

During H1 FY19, the companyâs recurring revenue increased by 31%, as new clients were added and existing clients have broadened their use of functionality, supported by the long term nature of Bravuraâs client contracts. This is providing strong visibility around the companyâs long-term earnings profile and future cash flow expectations.

(Strong Growth in Recurring Revenue Source: Company Reports)

With a strong sales pipeline and increased scale driving operating leverage, the company is well placed for future growth. The company reaffirmed its FY19 guidance with EPS growth in the mid to high-teens.

In the last six months, the companyâs shares increased substantially by 35.98% on ASX as on 16th May 2019. BVSâs shares last traded at $6.100, with a market capitalisation of circa $1.42 billion as on 17th May 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.