Letâs have a look at two stocks that are trading on opposite side of ASX ladder on 20th May 2019.

GrainCorp Limited

- GrainCorp Limited (ASX: GNC) is an ASX listed agricultural services business based in Australia and provides various agriculture related services including handing and freight services on Australiaâs east coast, grain storage etc. The company primarily deals with three grains; wheat, canola and barley.

On 4th March 2019, the company announced that it had proposed the sale of its Australian Bulk Liquid Terminals to ANZ Terminals. The proposed agreement was subject to certain conditions which needed to be satisfied and was the reason that GrainCorp did not enter into a change of control transaction before 10th May 2019. On 10th May 2019, the company declared that the condition was satisfied.

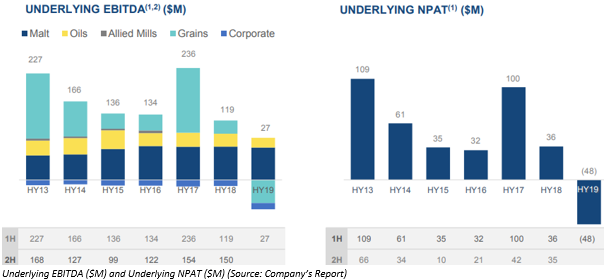

On 9th May 2019, the company announced 1HFY19 results for the period ended March 2019. Some of the highlights were; the underlying EBITDA was reported at $27 million and underlying net loss after tax stood at $48 million. Recordable injury frequency rate (RIFR) was reported at 10.6 from the past several years. Canola revenue was reported at $471 million, lower as compared to $490 million generated from pcp, due to lower canola supply.

The market capitalisation of the company is A$1.08 billion. The stock has 52-week high and low of A$9.96 and A$7.17, respectively. The stock of the company is currently trading at A$7.890 (as on 20 May 2019, 2:02 PM AEST), up by 0.254%. In the last one-year the stock has given a return of 0.51%, and the YTD return stands at negative 12.85%.

Bravura Solutions Limited

- Bravura Solutions Limited (ASX: BVS) is an ASX listed information technology company. It has a key strength in the financial technology and provides administration and transaction processing software for its wide range of customers like retail clients, investment banks, wealth management organisations etc. The company operates in different parts of world like North America, Europe etc.

On 9th May 2019, the company announced that its major shareholder Wellington Management Group LLP (WMG) had reduced its existing stake in the company. Before the notice, WMG had a total of 24.09 million shares with voting rights of 11.23%. After the share sale transaction of 127,426 and 2,105 shares on 6th May and 7th May 2019 respectively, the total shares left with the holder were 23.96 million with reduced voting right of 9.86% effective 7 May 2019.

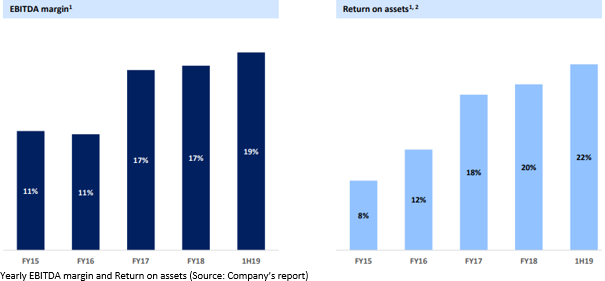

Recently in April 2019, the company released its investor presentation, wherein a revenue of A$246 million was recorded over the last 12 months with 5-year revenue CAGR of 12%. Continued improvement in the margins was also seen with current EBIDTA merging of 19% for the reporting period. The company has also maintained its winning streak of increasing return on assets with the current return being 22%.

The market capitalisation of the company is A$1.48 billion. The stock of the company is currently trading at A$5.900 (as on 20 May 2019, 2:03 PM AEST), down by 3.279%. The stock has 52-week high and low of A$6.27 and A$2.95, respectively. The last one-year return of the stock is 92.43%, and the YTD return stands at 60.53%.

The market capitalisation of the company is A$1.48 billion. The stock of the company is currently trading at A$5.900 (as on 20 May 2019, 2:03 PM AEST), down by 3.279%. The stock has 52-week high and low of A$6.27 and A$2.95, respectively. The last one-year return of the stock is 92.43%, and the YTD return stands at 60.53%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.