COH and CPU are blue-chip stocks which the investors may wish to include to their portfolio. Let us know about these two stocks.

Computershare Limited

Computershare Limited (ASX: CPU) forms a part of the information technology sector and is a share transfer company that provides corporate trust, stock transfer as well as employee share plan services in different countries.

The company is located in 21 different countries with 12,000 employees and 16,000 clients.

Georgeson a Computershare ltdâs brand which aids the user to prepares for shareholders meeting and various other allied transactions, help in getting seamless feedback from shareholders, members and investors. Further, Georgeson increases shareholder participation rate.

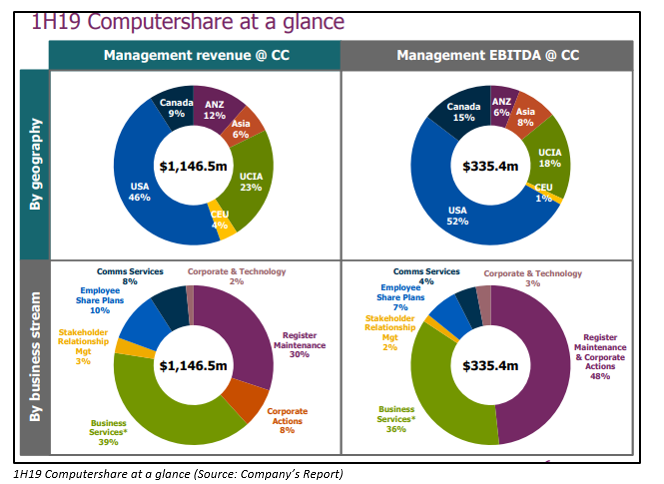

Computershare Limited has given a solid 1H FY2019 results which ended on 31 December 2018. There was an increase in the revenue by 1.7% to $1,146.5 million, EBITDA by 14.3% to $335.4 million and EPS by 35.37 cents per share. CPU declared an interim dividend of twenty one cps.

On the balance sheet front Computershare Limited reported an increase in the net asset base as a result of an increase in the total asset during the period. The total shareholdersâ equity for the period was $1,474.133 million. By the end of the first half of FY2019, the Computershare Limited had net cash and cash equivalent worth $509.981 million.

By the closure of the market on 17 May 2019, the closing price of the shares of CPU was A$17.70. Computershare Limited holds a market capitalization of A$9.65 billion with approx. 542.96 million outstanding shares.

Cochlear Limited

Cochlear Limited (ASX: COH) belongs to the health care sector and is engaged in the manufacture and sale of Cochlear implant systems. Cochlear Limited helps people to hear and be heard.

The company provides outstanding hearing solutions that are designed to give the user, the best hearing possible. At Cochlear, the leading medical professionals, scientists and engineers of the world work together to provide the best hearing possible based on the requirement of different users which suits best to their needs and their lifestyle.

On 10 May 2019, the company hosted analyst to its annual Capital Markets Day at its global headquarters at Macquarie University where the company highlighted its mission, its global footprint, strategic priorities which include retaining market leadership, grow the hearing implant market and also deliver revenue and earnings growth.

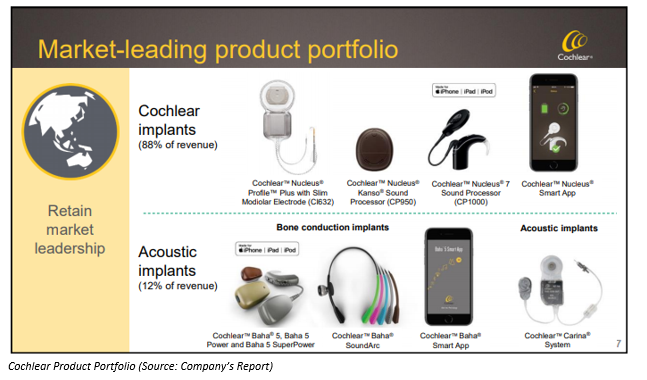

The market-leading product portfolio of the company includes Cochlear implants which contribute 88% of the revenue and Acoustic implants, the remaining 12% of the revenue. For adults and seniors, the goal of the company is to build a clear and consistent referral pathway. The DTC, HA channel referrals and standard of care programs of the company are driving the growth of adult and the senior segment.

On 16 April 2019, the company announced the release of Nucleus® Profile⢠Plus Series cochlear implant. Nucleus® Profile⢠Plus Series cochlear implant was designed for routine one and a half and three Tesla magnetic resonance imaging scans without removing the internal magnet.

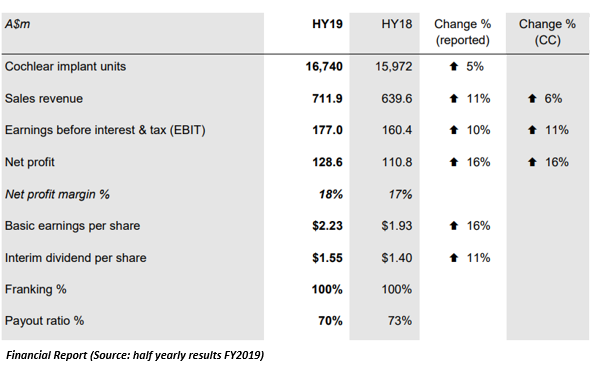

In 1H FY2019, there was an increase in the sales revenue by 11% to $711.9 million. Cochlear implants unit increased by 5% to 16,740. Cochlear Limited made a net profit of 16% to A$128.6 million as compared to its previous corresponding period. Cochlear Limited declared an interim dividend of $1.55 per share.

By the end of the trading session on 17 May 2019, the closing price of the shares of Cochlear Limited was A$200.98, up by 2.41% as compared to its previous closing price. Cochlear Limited holds a market capitalization of A$11.33 billion and approximately 57.72 million outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.