Salary packaging is an arrangement done between an employer and an employee. In this arrangement, the employee sacrifices part of their pre-tax income to get benefits of a similar value from the employer. The types of benefits provided in lieu of part of salary include fringe benefits (cars, property, payment of expenses, etc.), exempt benefits (any electronic device, computer software, tools, etc.), and super (benefits to associate or spouse). For employers, this arrangement is a cost-effective way of attracting as well as retaining staff with high caliber.

In this article, we will discuss two Australian companies, McMillan Shakespeare Limited and Smartgroup Corporation Ltd, which are the providers of salary packaging or total remuneration packaging, in addition to several other services.

McMillan Shakespeare Limited

On 21 August 2019, McMillan Shakespeare Limited (ASX:MMS) released its financial results for the 12 months ended 30 June 2019 and made an announcement regarding its off-market buy-back of shares worth $ 80.0 million.

Off-Market Buy-Back: The company unveiled its plan of returning $ 80.0 million to shareholders through the buy-back, for which it would be paying from its existing cash reserves. It would provide tender discounts in the range of 10% to 14% to the VWAP Market Price. The buy-back price would comprise of a capital component of $ 1.78 and the rest of the buy-back price would be treated as a fully franked dividend. The component of both is however subject to the ruling of ATO class.

The shareholders have the option to participate in the buy-back of shares. McMillan Shakespeare expects that there will an increase in earnings per share in the range of 7.4% to 7.8% on a FY19 Proforma basis due to buy-back. Moreover, there would be an increase in the return on equity on the back of reduction in the number of shares on issue after the buy-back of shares.

The company has set the record date for the buy-back to be 29 August 2019. The buy-back tender period is scheduled to open on 11 September 2019 and close on 11 October 2019. Moreover, the company would tender the shares on the condition that the buy-back price should be more than a specified minimum price. The company would scale back the tenders that are successful only if the number of shares that are tendered are at tender discounts that are more than or equal to the buy-back discount. Further, it would be scaled back when the final price tenders would be more than the total value of shares that MMS has planned to buy back.

Additionally, MMS has planned to keep conservative gearing to underpin its business model and expand its off-balance sheet funding to 30% of fleet book. Moreover, returns to the shareholders in the form of dividend would be maintained in the range of 60% to 70% of UNPATA.

Current Position: The company currently has net cash of $ 106.3 million after excluding the debt meant for funding the fleet. MMS, at the end of FY19, maintained Net debt to EBITDA of 1.4x, while reducing its group gearing to 34% in FY19 compared to 39% in FY18. Its interest cover in FY19 is 12.4x times compared to 12.5x times in the corresponding period last year.

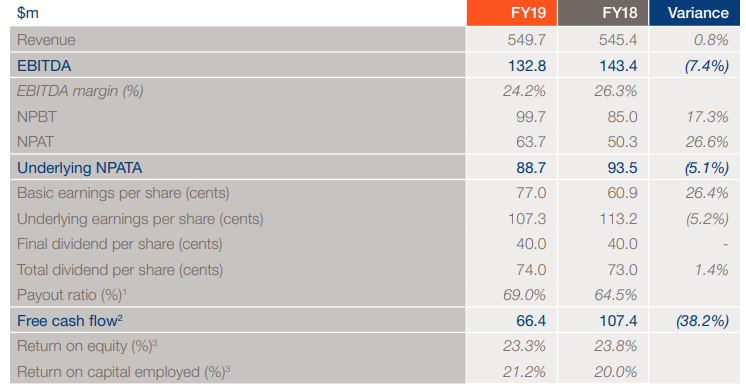

Subdued FY19 Performance: MMS reported a 5.1% decline in underlying net profit after tax and acquisition amortisation (UNPATA) to $ 88.7 million for FY19, while EBITDA margin contracted to 24.2% in FY19 versus 26.3% in FY18. There has been a 0.8% rise in group revenue in FY19 to $ 549.7 million.

Source: Companyâs Report

Source: Companyâs Report

At the operational level, for groupâs core GRS business, there has been a 2.5% rise in salary packages and a 7.4% increase in novated leasing units in FY19. Moreover, Plan Partners business reported its maiden full year profit contribution in FY19 and expects to grow strongly in FY20 and beyond. For Groupâs Asset Management (AM) business, the company experienced challenging environment in the UK, Australian and New Zealand markets.

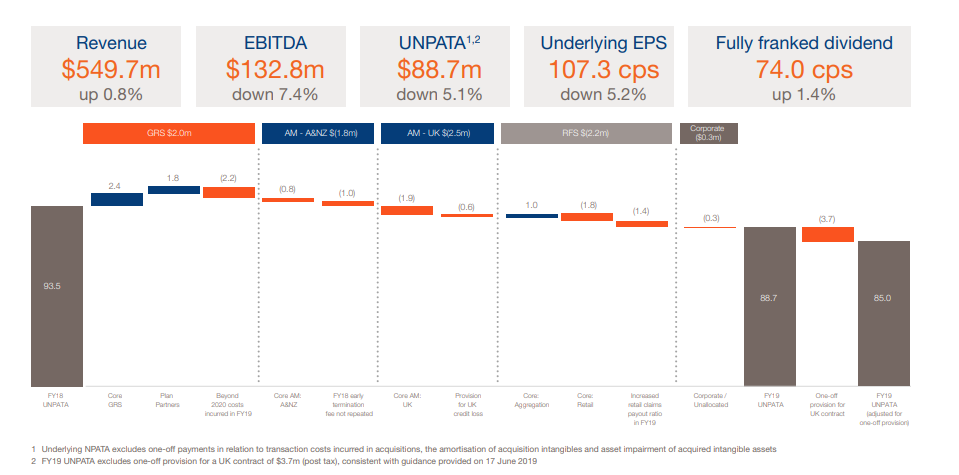

Group UNPATA Bridge (Source: Companyâs Report)

Group UNPATA Bridge (Source: Companyâs Report)

Stock Performance: Stock of McMillan Shakespeare Limited was trading at AUD 15.935 on 22 August 2019 (AEST 11:46 AM), up 3.006% from its previous closing price, with a market cap of AUD 1.29 billion, approx. 83.2 million outstanding shares and an annual dividend yield of 4.78%. The stock has given returns of 21.72% and 25.77% in the last three months and six months, respectively.

Smartgroup Corporation Ltd

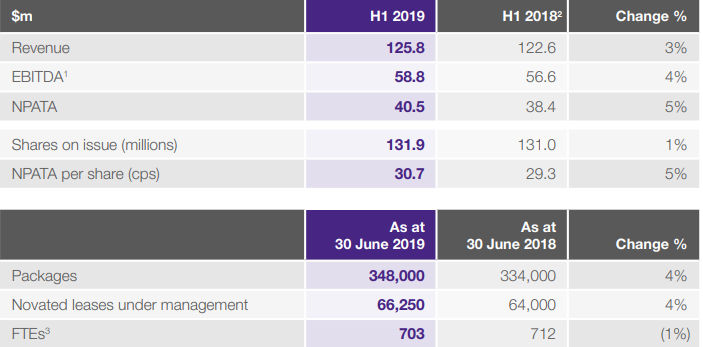

Smartgroup Corporation Ltd (ASX:SIQ) released its half year results to June 2019 on 16 August 2019. The company reported a 5% year-on-year rise in NPATA to $ 40.5m, a 4% y-o-y increase in EBITDA to $ 58.8 million and a 3% y-o-y growth in revenue to $ 125.9 million compared to the corresponding period last year.

Financial and Operational Metrics (Source: Companyâs Report)

Financial and Operational Metrics (Source: Companyâs Report)

The company at the end of 1H 2019 had a net debt balance of $ 32.5 million with leverage of 0.3x. SIQ posted strong cashflows with adjusted operating cashflows after-tax to be at 103% of NPATA at 30 June 2019 to $ 41.7 million. The company has declared an interim dividend of 21.5 cents per share (fully franked), which is an increase of 5% from the corresponding period last year. The company has already paid a special fully franked dividend of 20 cents per share on 6 May 2019.

Success in Client Servicing: Moreover, during 1H 2019, the company was successful in servicing clients with net growth of c.5,000 salary packages and c.1,000 novated leases, while fleet vehicles under management remained stable at c.22,000. The company has now secured third largest client until 2022 and has top 3 clients under its portfolio. Additionally, there has been a 20% year-on-year growth in the clients, as 180 clients are now using two or more service offerings.

Business Highlights: In the first half of 2019, Smartgroup Corporation has signed 5 new partnerships, bringing the total number of partnerships to seven. Its Integration of Pay-Plan (newly acquired) is on track. Moreover, the company has retired two systems, Salary Solutions and Mylease, while consolidating premises from 17 to 6 over the past one and half year. SIQ also bought the assets related to novated leasing of Mylease. For the acquisition that was made from iNovation Pty Ltd, the company made a cash payment of $ 6.9 million, which also included $ 1.0 million that was retained in escrow. The company had also acquired 100% of Pay-Plan Pty Ltd and Set Leasing Pty Ltd for a total consideration of $ 2.2 million in cash in June 2019.

Stock Performance: On 22 August 2019 (AEST 11:51 AM), the SIQ stock was trading at AUD 11.080, down 2.722% from its previous closing price, with a market cap of AUD 1.5 billion, approximately 131.89 million outstanding shares, an annual dividend yield of 3.94% and a PE multiple of 22.78x. The stock has delivered 34.79% and 36.47% in the last three months and six months, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)