Penny stock refers to micro-cap companyâs stock, which trades at a very low price, often more or less equal to a penny; hence, they are named as âpenny stockâ. Generally, these are very high risk and high reward stocks with less liquidity. However, when it comes to a surge in a penny stock, it often takes the stock 2x-3x in a very short span of time.

Let's have a look at two of the penny stocks, listed on ASX as follows:

- Yojee Limited (ASX: YOJ) is an ASX listed information technology company which is working on creating a logistics and supply chain management through the use of its blockchain secured software.

On 17th May 2019, the company released a statement regarding the appointment of David Morton to its Advisory Board team (announced previously). He is an experienced corporate banker with 40 years of experience at Westpac and HSBC. He also has a strong track record for building and restructuring businesses to cope with volatile environments.

On 30th April 2019, the company released its March 2019 quarterly activity report. During the quarter, three software customer contracts were signed, including one national leader and 2 SMEs. It also launched Power Planner in March, for planning and modelling logistics businesses and networks. Further, the company used a total of A$1.35 million of net cash for operating activities and was left with A$4.65 million of net cash at the end of the reporting period.

The company has a market capitalisation of A$105.93 million, and the stock had touched a 52-week high and low of A$0.175 and A$0.055 respectively. The last one-year return of the stock is 8.7%, and the YTD return stands at 104.92%. The stock of the company was trading at a price of A$0.120, down by 4% (as on 21 May 2019, 2:05 PM AEST).

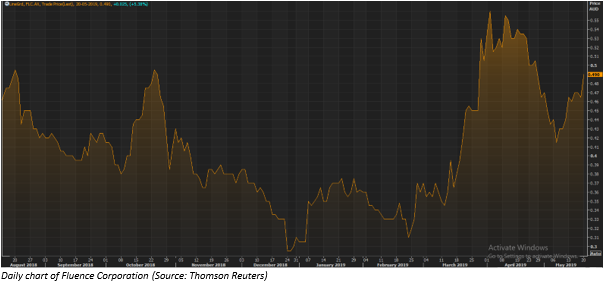

- Fluence Corporation Limited (ASX: FLC) is from the industrial sector and is an established player in wastewater treatment. The company offers integrated solutions across the complete water cycle. Some of the companyâs products are Aspiralâ¢, NIROBOX⢠etc.

On 13th May 2019, the company released a statement stating that it has signed a contract for designing and constructing a seawater desalination plant having a capacity of 12,000 m3 /day for a total amount of US$10 million. The construction work is anticipated to be concluded by 4Q of 2020.

On 29th March 2019, FLC released its 1HFY19 report to the market. The company posted revenue of $101.12 million, and total comprehensive income stood at negative $77.17 million. Due to negative income, the loss per share increased from $0.07 to $0.14, as compared to pcp. On the balance sheet, the total assets decreased from $204.65 million to $141.79 million and total liabilities decreased from $101.05 million to $90.72 million.

The market capitalisation of the company is A$263.31 million, and the stock has a 52-week high and low of A$0.585 and A$0.029 respectively. During the last one-year period, the stock has given a yield of 8.89%, and the YTD return stands at 60.66%. The stock of the company was trading at a price of A$0.480, down by 2.041% (as on 21 May 2019, 2:05 PM AEST).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.