How is Australiaâs lithium industry responding to the disturbance in prices and demand?

Australiaâs Lithium Industry has entered a troublesome phase due to a sharp decline in concentrate prices. As a result of the fall in prices, local lithium producers have held back plans for expansion and product upgradation due to the chemicalâs oversupply coupled with demand uncertainty. Global consumption of lithium has been impacted by policy changes in China putting pressure on Australiaâs lithium exports.

Altura Mining Limited (ASX: AJM)

Altura Mining Limited is engaged in the construction of mine and processing plant at its 100% owned Pilgangoora Lithium Project.

Resource and Reserve Estimate:

The company recently provided an update on the revised resource and reserve estimate for its flagship project on the back of improvement in mining methods in the past 12 months.

- Mineral resource estimate stood at 45.7 million tonnes at 1.06% Li2O and 483,000 tonnes of contained Li2

- Ore Reserve estimate was reported at 37.6 million tonnes at 1.08% Li2O and 407,000 tonnes of contained Li2

The stock settled the dayâs trade at $0.067, down 1.47% on 11 October 2019.

Pilbara Minerals Limited (ASX: PLS)

Pilbara Minerals Limited is engaged in the exploration, development and operation of the Pilgangoora Lithium-Tantalum Project.

The company recently announced that the Peopleâs Republic of China provided a nod for the Share Subscription Agreement for the strategic placement of $55 million worth Pilbara Mineralsâ shares to Contemporary Amperex Technology (Hong Kong) Limited. The placement will comprise of two tranches as under:

- $20 million in tranche 1, to be settled by 11 October 2019

- $35 million in tranche 2, to be settle 2 business days after receiving shareholder approval

The stock settled the dayâs trade at $0.310, up 3.33% on 11 October 2019.

Galaxy Resources Limited (ASX: GXY)

Galaxy Resources Limited is engaged in the production of lithium concentrate and exploration of minerals.

Half Yearly Results (Period ended 30 June 2019):

- Lithium concentrate production reported at 98,334 dry metric tonnes, up 7% on pcp.

- Lithium concentrate sales stood at 44,630 dry metric tonnes.

- Group EBITDA amounted to US$9.4 million and underlying net profit after tax stood at US$4.9 million.

- As at 30 June 2019, the company had cash amounting to US$176.3 million.

The stock settled the dayâs trade at $0.940, up 3.86% on 11 October 2019.

Orocobre Limited (ASX: ORE)

Orocobre Limited is engaged in the exploration and production of lithium at the flagship Olaroz Lithium Facility and the operation of Borax.

The company recently appointed Hersen Porta to the position of Chief Operating Officer.

FY19 Highlights:

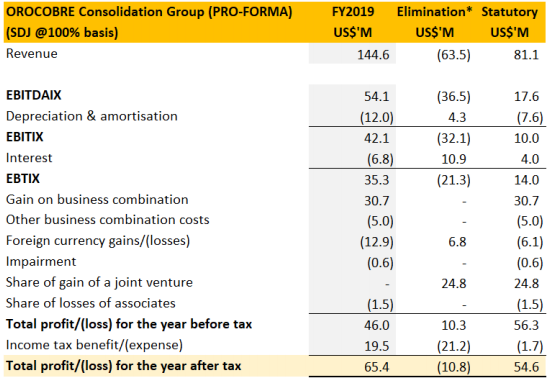

- During the year ended 30 June 2019, the company reported total lithium carbonate production of 12,605 tonnes.

- Revenue for the Olaroz Lithium Facility stood at US$124.7 million and EBITDAIX amounted to US$60.9 million.

- Statutory Group net profit was reported at US$54.6 million and underlying NPAT amounted to US$24.8 million, down on pcp value of US$25.7 million.

- Cash at the end of the period stood at US$279.8 million.

P&L Statement (Source: Company Reports)

Guidance: In FY20, full year production for Olaroz Liithium Facility is expected to be at least 5% higher than FY19. Production forecast for Borax Argentina has been forecasted to be between 45,000 â 50,000 tonnes.

The company stock settled the dayâs trade at $2.430, up 3.4% on 11 October 2019.

Lithium Australia NL (ASX: LIT)

Lithium Australia NL is engaged in project acquisition, exploration and development in relation to lithium.

Update on wholly owned subsidiary: The company recently updated that VSPC Ltd, its wholly owned subsidiary produced high-quality cathode material using refined lithium phosphate, proving the viability of lithium phosphate produced by Lithium Australia as an ideal feed for VSPC technology.

During the year ended 30 June 2019, the company generated revenue amounting to $0.18 million as compared to $0.11 million in pcp. Loss for the year amounted to $11.57 million as compared to pcp loss of $8.09 million.

The stock settled the dayâs trade at $0.047 11 October 2019.

Galan Lithium Limited (ASX: GLN)

Galan Lithium Limited is engaged in mineral exploration, acquisition and evaluation.

The company recently updated that the maiden drilling program at Rana de Sal and Pata Pila which is a part of the Western Basin projects has resulted in discovergy of high grades of more than 900 mg/l Lithium.

As per another update, mineral resource of 684,850 tonnes of contained lithium carbonate equivalent @ 672mg/l Li was identified was North Zone, Candelas Project. The resource estimate exceeded the companyâs expectations providing a strong foundation to advance the Pre-Feasibility Study at Candelas.

The stock of the company settled the dayâs trade at $0.205, up 7.89% on 11 October 2019.

Lake Resources N.L. (ASX: LKE)

Lake Resources N.L. is engaged in exploration and development of lithium brine projects and lithium hard rock projects.

Debt Funding Update:

- The company is planning to secure US$25 million in debt funding for initial production of lithium products and pre-production definitive feasibility studies.

- Recently, SD Capitial Advisory Limited has been appointed as the financial advisor for raising the money.

During FY19, the company identified a large JORC Mineral Resource of 4.4 million tonnes Lithium Carbonate Equiivalent at its fully owned Kachi Lithium Brine Project. In addition, the company completed a drilling program at the Cauchari Lithium Brine Project and has planned drilling at the Olaroz project in FY2020.

The stock settled the dayâs trade at $0.040, up 2.5% on 11 October 2019.

Core Lithium Limited (ASX: CXO)

Core Lithium Limited is primarily engaged in the exploration of lithium and base metal deposits in Northern Territory and South Australia.

The company recently provided an updated on mineral resource growth drilling and exploration at the Finniss Lithium Project.

Drilling at the project resulted in discovery of high-grade spodumene intersections and is expected to expand the current resources of the company providing substantial addition to the reserves and mine-life of Finniss Lithium Project.

The companyâs stock settled the dayâs trade at $0.037, down 2.6% on 11 October 2019.

Mineral Resources Limited (ASX: MIN)

Mineral Resources Limited is primarily engaged in the supplying the resources sector with goods and services.

In August 2019, the company acquired the Parker Range Project in WA, from Cazaly Resources Limited. Total consideration for the transaction amounted to $20 million.

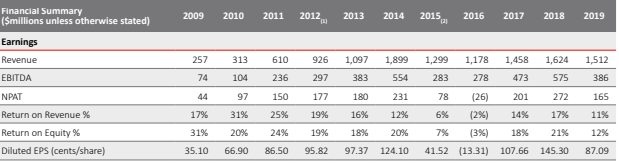

FY19 Financial Highlights:

- During the year ended 30 June 2019, the company reported revenue amounting to $1,512 million, as compared to $1,624 million in pcp.

- Normalised EBITDA for the year stood at $433 million and normalised NPAT amounted to $205 million.

Historical Earnings (Source: Company Reports)

The companyâs stock settled the dayâs trade at $13.050, up 4.06% on 11 October 2019.

Hawkstone Mining Limited (ASX: HWK)

Hawkstone Mining Limited is involved in lithium exploration on the Big Sandy and Lordsburg projects in USA.

The company recently updated that it has issued 125 million shares to the vendors of the Big Sandy Lithium Project and Lordsburg Lithium Project. Significant vendors comprise of the companyâs management team including Managing Director and CTO. The announcement came in after the discovery of maiden mineral resource of 32.5 million tonnes at the Big Sandy Lithium project.

The company has also planned for a stage 3 drilling program for converting the reported exploration targets in 2020.

The stock of the company stock settled the dayâs trade at $0.011, reporting no change on the previous trading price on 11 October 2019.

Lepidico Limited (ASX: LPD)

Lepidico Limited is engaged in mineral exploration and development & licensing of the L-Max Technology.

During the year ended 30 June 2019, the company became the operator of the Karibib Lithium Project in Namibia. The period was characterised by production of high purity lithium hydroxide using a new proprietary process, LOH-MaxTM. The integration of LOH-MaxTM into the Phase 1 Plant design resulted in capital and operating cost savings.

During the year, the company reported a net loss of $5.11 million as compared to $7.22 million in prior corresponding period.

The companyâs stock settled the dayâs trade at $0.019, up 11.7% on 11 October 2019.

Mali Lithium Limited (ASX: MLL)

Mali Lithium Limited is focussed on developing a project in Mali- Goulamina Lithium Project in West Africa. In July 2018, the company released the results of its Pre-Feasibility Study and is currently in process to complete its Definitive Feasibility Study.

- The company recently provided an update on the development of the Definitive Feasibility Study for the companyâs 100% owned Goulamina Lithium Project in Mali.

- The company received the water license from Malian Authorities to pump in water from Selingue Dam.

- Alternative to diesel power generation were also identified that will help in operational cost savings in the final DFS.

- Optimisation of the projectâs key infrastructure substantially reduced project risks resulting in a reduction on operational costs.

The companyâs stock settled the dayâs trade at $0.083, up 2.4% on 11 October 2019.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.