Australia witnessed lower grains output due to the drought conditions, and coupled with weaker demand in the international market, amid the ongoing trade tensions, impacted the profitability of the ASX-listed agribusiness player- GrainCorp Limited (ASX: GNC).

Also Read: Australian Water Entitlement- An Emerging Alternative Asset

The FY19 earnings of the company were adversely affected by one of the worst droughts on record in eastern Australia. The underlying net loss after tax of the company stood at $82 million, which was significantly down against FY18 net profit after tax of $71 million.

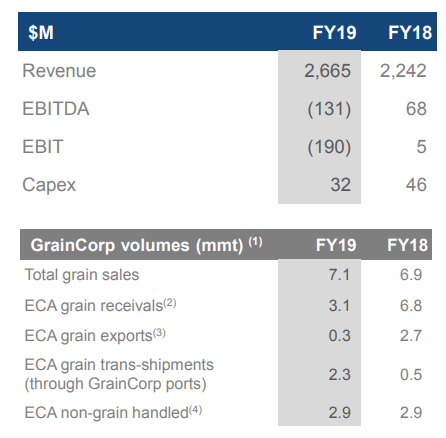

The financial metrics remained substantially weak in FY19 as compared to the previous financial year, and remained as below:

- The Underlying EBITDA for FY19 stood at $69 million, which marked a fall of over 74 per cent against the EBITDA of $269 million in FY18.

- GNC recorded a statutory net loss after tax of $113 million in FY19 as compared to a $71 million in profit after tax in FY18.

- GrainCorp distributed no dividends in the financial year 2019 as compared to the total dividend distribution of $0.16 in the previous financial year.

Segment Performance

The malt segment of the company performed relatively well as compared to the other segments, as the demand for malt remained solid during the year with high capacity utilisation and improved operational efficiency.

The overall revenue of the malt segment stood at $1,317 million in FY19, up by over 14.30 per cent against the revenue of $1,152 in the previous financial year. The FY19 EBITDA of the malt segment stood at $176 million, up by over 3.50 per cent against FY18.

GCN witnessed large skew in earnings in the second half, which further reflected higher beer consumption in the northern hemisphere in the summer months and lower ECA barely supply.

The company witnessed a strong growth in malt sales during the second half of the year 2019 and progressed across its malt capacity expansion projects in Scotland. The expansion included an upgrade of Bairds Maltâs Arbroath facility and construction of a new malting plant at Inverness, which would further increase the Bairdsâ total annual capacity to over 300,000 tonnes.

GrainCorp announced a demerger of the malt business in April to unlock significant value for the shareholders of the company by creating two high-quality ASX-listed agribusiness companies.

The grains segment of the company was adversely impacted by the drought conditions in Australia and global trade dispute. The east coast Australian (or ECA) grain production of five core grains (including both winter and summer) stood at 7.7 mmt in FY19, down by almost 54 per cent against the previous year production of 16.7 mmt.

The Global trade tensions disrupted grain trade flow and impacted the EBITDA by $65 million.

GNC managed to sell 7.1 mmt of grains during the year, which remained slightly higher against the previous year; however, the grains receivals stood 54.42 per cent lower in FY19 against FY18.

The port supply chains were reversed by the company amid the shortage in production of grains in Australia, which reduced the exports by 88.89 per cent in FY19 against FY18.

(Source: Companyâs Report)

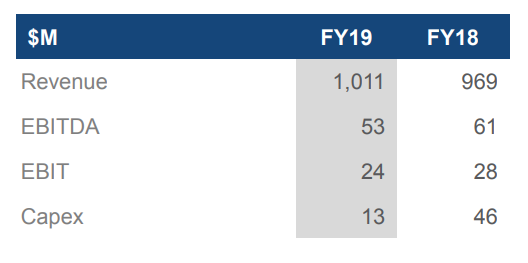

The oil segment revenue witnessed a 4.33 per cent increase to stand at $1,011 million in FY19 against the revenue of $969 million in FY18.

However, the EBITDA declined by 13.11 per cent in FY19 to stand at $53 million.

The crush margins remained in pressure amid ECA droughtâs impact on canola supply and freight costs. The freight cost during 2018-19 stood at 2.1 mmt (ECA 0.4mmt, WA/SA 1.7mmt), while the same cost stood at 3.8 mmt in 2017-18.

(Source: Companyâs Report)

FY2020 Outlook

The company forecasts that the winter crop would remain significantly below the average in eastern Australia, and GNC further anticipates the production to remain below average in both Western Australia and South Australia.

Due to the drought conditions, GNC anticipates low levels of grain carry-in in eastern Australia and a continuation of supply deficits in certain regions in eastern Australia.

The 2019-20 global barley production stood at 154 mmt, up by 10 per cent against the 2018-19 production of 140 mmt.

GNC anticipates high capacity utilisation of malt plants in FY20 and solid demand for base and speciality malts, and other craft and distilling products. The company is expected to benefit from efficient warehousing and the distribution networks and would also expand more on distribution network to support fulfillment into more countries in FY20.

In FY20, GNC expects minimal grain exports and higher imports from Western Australia, Southern Australia and Victoria into GrainCorp ports.

The new rail contacts would be effective from FY20, and the company anticipates that it would provide flexibility to align with grain volumes with minimal take-or-pay requirement.

Managing Variability

GNC entered a 10-year crop production contract, which would be effective from FY20, to manage the risk associated with the volatility of eastern Australian winter grain production. The company also entered a contract that would help in smoothing the cash flow, which would further allow for longer-term capital allocation and business planning through the cycle.

The contract entered by the company comprises a production payment threshold, which would allow it to receive a payment when annual grain production drops below a certain threshold; however, above the threshold, GNC would be liable to pay.

Below 15.3 mmt is the threshold for payment by White Rock and above 19.3 mmt is the threshold for payment by GNC.

Stock Actions and Shareholders Return

GNC traded in a downtrend from the level of $8.360 (Dayâs high on 17 September 2019) to the level of $7.175 (Dayâs low on 1 November 2019), further it recovered to the level of 8.500 (Dayâs high on 15 November 2019, AEST: 2:30PM).

On 14 November 2019, post the announcement and investor briefing, the stock witnessed a large buying interest with spiked volumes, and the prices rose to settle over 4 per cent higher against the previous close on ASX.

The stock has delivered a return of -2.28 per cent over the period of one year and a return of 6.62 per cent over the last six months.

GNC delivered a negative return of 14 on a YTD basis; however, the stock managed to deliver a positive return of 2.79 per cent over the last five days (returns as on 14 November 2019 prices).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.