Australia is the worldâs driest inhabited continent, and water scarcity is a persistent issue in Australia amid dry and variable climate. The agriculture production in Australia is not just limited by suitable fertile land but also by the availability of irrigational water.

Water is a valuable commodity amid its vast usage in agriculture, industrial, and many other sectors of an economy, which makes investing in the water a well-established trend in Australia, where water rights are considered as separate property rights.

Australia hosts a variety of well-developed water markets, and the framework of the Australian water market allows two tradable property rights, i.e., water entitlements and water allocations. The water markets in Australia allows efficient allocation of scarce water resources between competing uses in response to variability in demand and supply.

Water entitlements are rights upon a portion of water in the underlying reserve such as a river, storage, or underground aquifer.

The high-security water entitlements are typically water rights closer to the bottom of a reserve, and more reliably contains water, while the low-security (aka general security) water entitlements are the water rights closer to the surface, which may or may not contain water depending upon the seasonal conditions.

Water allocations are typically independent tradable rights to access a volume of water, issued under water entitlement rights in a given water year, and the water allocation rights vary from year to year depending upon factors such as storage levels, climate conditions, recharge status of an aquifer, etc.

Water allocations represent physical water, which can be used by the end-users such as irrigators, and the water allocations that have not been used or transferred by the end of the water year(30 June) is either surrendered or redistributed (subject to entitlement-specific carryover rules) as allocation, among the entitlement holders for the following season.

How Water Entitlement Allocation Represent Investment Opportunities and Ensure Efficient Distribution?

In Australia, while the reservoir is full, all the entitlement holders get 100 per cent water allocation, and if the reservoir is half-full, all the entitlement holders get 50 per cent water allocations. Thus, different entitlement security types have different long-term average annual allocation (or reliability) depending upon the availability of water in a reservoir.

The investment opportunities in the Australian water market circulates around acquiring the water entitlements and leasing or selling the corresponding water allocations rights to generate high returns.

How is Efficient Distribution Ensured?

In Australia, the allocation of water entitlements is capped and depend upon the available volume in reserve, which generally does not suffice for all the irrigational needs amid water scarcity in Australia.

Now, the irrigators, with high capacity to pay for the water-supported by selling the crop at high prices, could pay for the allocated water by high crop gross margin per unit of water or through any other means. Such irrigators could outbid other irrigators for water allocations, which in a cascade ensure allocation of water to the highest contributor to the system.

Australia Water Distribution

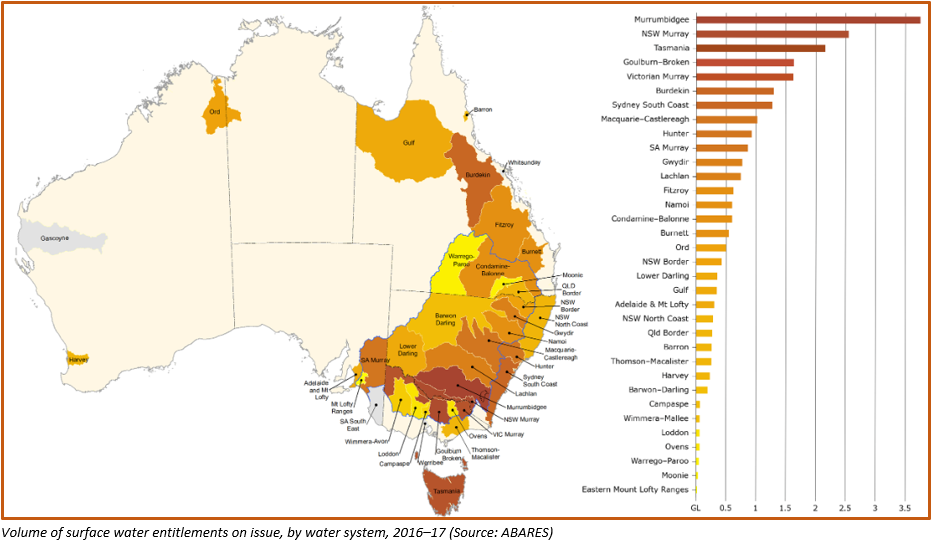

In Australia, the water entitlements vary according to their geographical regions; however, the Murray-Darling Basin encapsulate about 90 per cent of the trade and is responsible for about 65 per cent of Australiaâs irrigated farmland, and approx. 40 per cent of the gross value of agricultural production in Australia.

Water Allocations Trend Across Murray-Darling Basin in Australia

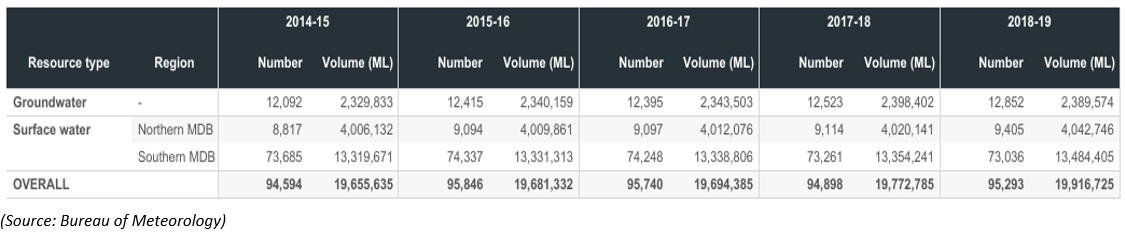

The Murray-Darling Basin in Australia, which accounts for a significant portion in water trade, is further divided into the Northern Murray-Darling Basin and Southern Murry-Darling Basin.

The entitlement on the issue from the Murray-Darling basis is as below:

The number of entitlements in the Murray-Darling Basin is witnessing a surge from 2014, while the volume of entitlements being steady around the average level of 19.6 gigalitres, which in turn, is self-evident to justify the increasing interest for water entitlements in Australia.

Australian Southern Murray-Darling Basin

The Australian water market witnessed low opening allocations at the beginning of the allocation period from 2019-20 amid drought conditions, which led to significantly lower storage volumes. However, water availability in 2019-20 was supported by the reserve carryover of approx. 31 per cent of 2018-19 supply, which represented 1,600 gigalitres.

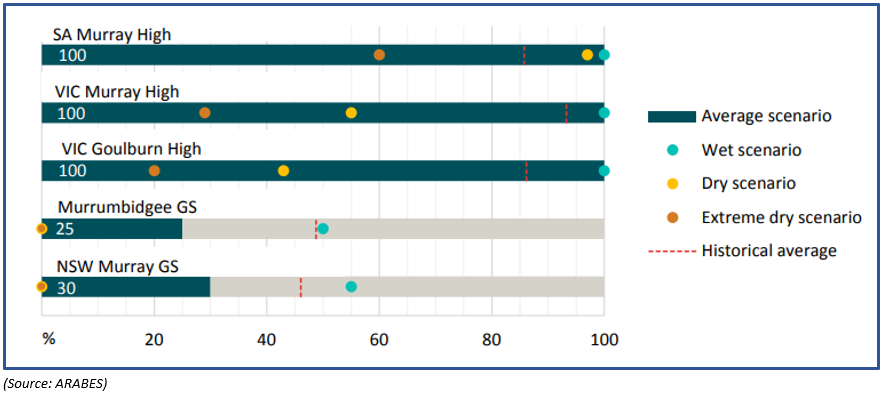

The ABARES anticipates that about 3,442 gigalitres of water would be available for irrigation use in the dry case scenario by the end of 2019-20 across the southern Murray-Darling Basin, which further includes the carryover and excludes the environmental water.

The forecast by the ABARES underpins a decline of 25 per cent against the available water in 2018-19; however, better as compared to the average availability of 2,590 gigalitres during the worst of the Millennium drought between 2007-09

The ABARES also anticipates the water allocations to increase as high as 6,112 gigalitres at the end of 2019-20 under the average and wet conditions at the southern Murray-Darling Basin.

Allocation Prices are Forecasted to Surge

From 2018 to 2019, the water allocation prices increased dramatically from the level of $250 per megalitre in July 2018 to over $500 per megalitre in June 2019, an increase of 100 per cent. The ARABES anticipates the average annual water allocation price for 2019-20 to stand at $526 per megalitre under the dry case and $651 per megalitre under the extreme dry case for the Murray below Barmah trading zones.

The water allocation prices shift drastically down in case of average or wet scenarios to $332 per megalitre and $258 per megalitre for 2019-20.

Water Market Scenario at the Southern Murray-Darling Basin

The ABRRES forecasted the water allocation at the Southern Murray-Darling Basin for four cases, i.e., dry, extreme dry, average, and wet for the period of 2019-20 as below:

The ownership of water entitlements in Australia is heavily distributed among the Commonwealth and the private farmland owners. For now, the non-landholding water investors in Australia are limited; however, the numbers are slowly witnessing a growth as evident above, which further justifys the term âEmergingâ in the title of the article.

With the inclusion of emergence being addressed, now let us take a look over another word âAlternative Assetâ.

Water investors play a vital role in the Australian water markets by providing an alternative capital source to the irrigators and by also providing liquidity in the water market.

Water- as an alternative asset class could be named so amid its non-dependency on factors commonly related to traditional assets such as exchange rate, stock market performance, etc. The factors which generally drive the water prices include climate conditions, storage levels, irrigated commodity prices, etc.

The growth in agricultural productivity along with the efficiency in an economy to store the rainwater are among many other factors which impact water prices over the long-run.

The underlying factors which impact the water prices differ from the factors of traditional assets; thus, water prices act as an alternative asset class and demonstrate a negative correlation with the traditional assets.

To summarise, water entitlements are the new alternative assets emerging in Australia, and the investment in water entitlements would lack positive beta with the factors of the traditional asset classes. Water entitlements are an intriguing asset class; however, the question over the sustainability of its negative beta against the traditional assets class under certain conditions such as â when irrigators increase their capacity to pay, and many other is still unresolved.

The market operators and stakeholders of the water markets in Australia are adopting various measures to manage many challenges, and the water market remains a whole new play for the investors, growth of which would depend upon the relative interest of the global market to diversify their portfolio in the trend of fishing for the alternative investments.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.