A leading provider of team collaboration and productivity software, Atlassian Corporation Plc (NASDAQ:TEAM) earned a revenue of US$334.6 million in the fourth quarter of FY19, which is 36% higher than the previous corresponding period. With this, the company has taken its total revenue for FY19 to US$1,210.1 million, 37% higher than pcp.

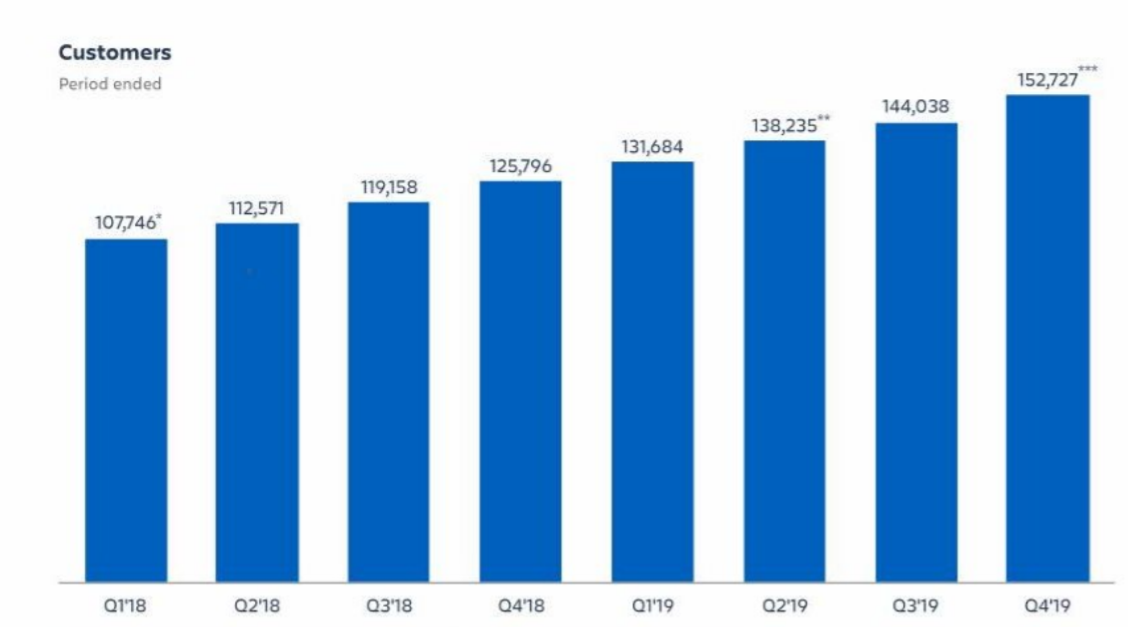

FY19 has proven to be an outstanding year for the company. During the fiscal year, the company exceeded 150,000 customers, which was 3 times higher than the companyâs initial target set when it was founded. During the fourth quarter, the company added 8,689 net new customers.

Customer Growth (Source: Company reports)

With regards to the larger customers, at the end of FY19, the company had 4,091 customers spending US$50,000 annually. Along with that, the company had 171 customers spending more than US$500,000 annually at the end of FY19, up from 124 customers at the end of last year.

In the fourth quarter, the companyâs total operating loss was $32.4 million, which is significantly higher than the loss of $2.5 million in pcp. The net loss for the fourth quarter included a non-cash charge of US$156.3 million recorded in âother non-operating expenseâ and non-cash charge to income tax expense of US$54.7 million. For the fiscal year 2019, the company incurred an operating loss of US$63.4 million as a consequence of which the company had an operating margin of -5% for the full year.

During the fourth quarter, the company spent US$170 million (on IFR basis) on Research and Development, which was substantially higher than pcp. The company also spent US$76.6 million on marketing and sales expenses and US$59 million on general and administrative expenses.

As at 30th June 2019, the company had current assets of US$2.042 million and total current liabilities of US$2.329 million.

Recently in July 2019, the company opened up a new technology center in Bengaluru, India, which expanded its presence in the region. The company is now planning to expand its office in Bengaluru into a world-class R&D and customer support center and intends to more than double its employee base in Bengaluru over the next year.

In FY2019, the company witnessed various important advances in its products. With regards to its product Trello, the company was able to successfully reinforce the status of this product as a go-to collaboration tool in the workplace. This product was regarded as the most widely adopted management app at work. During the year, the company introduced powerful organisation-wide features for Trello Enterprise. The company also made automation a more vital part of Trello with the addition of Butler for Trello.

For its another product Jira family, the company improved the overall user experience by simplifying the interface of new users and enhancing features for advanced users.

During the year, the company also introduced an early access program for cloud premium editions of Jira Software and Confluence, which was focusing on more sophisticated and larger customers. These new editions have advanced end-user features with additional platform capabilities.

In the year, the company witnessed a momentum from one of its newest products, Atlassian Access, which provides company-wide security and policy administration across multiple products of the company.

The company also acquired Opsgenie, which complements Statuspage and the Jira family. The company also acquired AgileCraft and rebranded its Jira Align. During the year, the company stepped back from the real-time communications space, which allowed it to focus on areas with greater long-term growth potential.

In FY2020, the company is planning to invest in the cloud to enterprise as well as migrate its on-premises customers to the cloud and optimise its cloud pricing and packaging. The company has already increased the user limit for Jira Software and Confluence cloud to 10,000 users and plans to increase it more in the future.

To make its Confluence customers move to cloud, the company recently introduced a Confluence Migration assistant and has released a similar assistant for Jira software as well. The company believes that its network of over 500 solution partners will play a valuable role in encouraging the companyâs on-premises to migrate to the cloud. In FY2020, the company plans to introduce free editions at entry levels for some cloud products, which will make them more attractive.

In the first quarter of FY2020, the company is expecting its revenues to be between US$349 million to US$353 million and its gross margin is expected to be around 86% on a non-IFRS basis and 83% on an IFRS basis. It is expected that the companyâs operating margin in the first quarter will be around 21% on a non-IFRS basis. On an IFRS basis, the company is expecting to report a net loss per diluted share of around US$0.08 in the quarter, however, on a non-IFRS basis, the company expects to report a net income per diluted share of $0.24.

For the full year 2020, the company is expecting to earn total revenues in the neighborhood of US$1,540 million to US$1,556 million. The gross margin of the company in FY2020 is expected to be between 82% to 83% on an IFRS basis. At the end of FY2020, the company expects to report free cash flow of US$465 million to US$475 million. The companyâs cashflow for FY2020 assumes capital expenditure to be around $30 million due to investments in new leased facilities. The companyâs free cash flow target also assumes that it will pay higher cash taxes in FY2020 than it did in FY2019. In FY2020, the company expects to pay cash taxes of around US$20 million.

In addition to the financial targets for FY2020 mentioned above, the company anticipates its subscription revenue to grow more than 40% as compared to pcp.

At market close on 26th July 2019, the companyâs stock was trading at a price of US$134.51 on NASDAQ, down by 0.62% during the intraday. The company currently has a market capitalisation of circa US$32.425 billion.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.