Today, on May 24, 2019, Artemis Resources Limited (ASX:ARV) announced that is has agreed for the restructuring of its debt (funding package) with Riverfort Global Capital Limited, a London institutional group. The present outstanding balance under the funding package is US$4.67 million.

As per the agreement (variation deed), ARV and Riverfort have agreed on the number of mutually beneficial terms, which allows Artemis to advance its plans to list on the London AIM market. As per the salient terms, the company will make a payment of US$500,000 to the investor group within three days of signing the Variation Deed. The maturity date has been extended to January 31, 2020. Once the company redeems at least 350,000 convertible securities by June 30, 2019, then the investor group may only issue conversion notices specifying the variable conversion price after September 30, 2019. The company shall redeem at least 2,100,000 convertible securities (of US$1 each) by September 30, 2019. Artemis has undertaken to apply funds received from asset sales and 30% of any capital raised on the Australian Stock Exchange to redeem convertible securities and amendment of the Fixed Conversion Price from $0.21 per share to $0.08 per share. The company has undertaken to issue the Convertible Note investor 18,652,175 options with an exercise price of $0.08 and expiry date three years from the date of issue, subject to the shareholder approval, and a further 100,000 convertible notes in satisfaction of restructuring fees.

Ed Mead, ARVâs Executive Director, stated that this is a positive outcome for the company as the management has now structured way to manage its repayments under the Funding Agreement, which removes a potential overhang of their securities and paves a clear way towards the planned AIM listing.

In a previous update, ARV announced the change in its management team with the appointment of current Executive Director, Mr Ed Mead as Interim CEO, as Mr Wayne Bramwell has resigned to pursue other professional opportunities. Mr Bramwell will remain with the company to ensure a smooth transition until August 6, 2019.

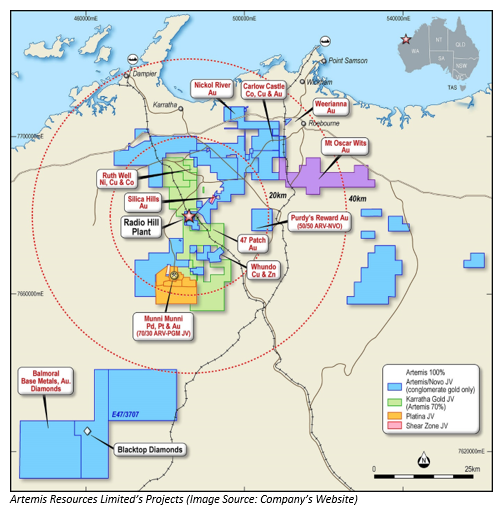

In another update, ARV highlighted its Nickel and Copper Resources update at Ruth Well in the West Pilbara region of Western Australia. It is 70% owned by Artemis. The resources estimates are based on 37 Reverse Circulation drill holes for 2,839 meters and one diamond drill hole of 84.3 meters. The resource estimate in December 2018 comprised sulphide resource classified as an Indicated Mineral Resource, which totalled 152k tonnes at 0.63% Ni and 0.47% Cu.

On the stock information front, at the time of writing (on May 24, 2019, AEST 2:45 PM), the stock of Artemis Resources was trading at $0.037, up 2.778% with a market capitalisation of ~$23.83 million. Today, it reached dayâs high at $0.040 and dayâs low at $0.036, with a daily volume of 416,683. Its 52 weeks high price stands at $0.235 and 52 weeks low at $0.033, with an average volume of 1,184,790 (yearly). Its absolute returns for the past one year, six months and three months are -82.00%, -76.00%, and -50.68%, respectively.

On the stock information front, at the time of writing (on May 24, 2019, AEST 2:45 PM), the stock of Artemis Resources was trading at $0.037, up 2.778% with a market capitalisation of ~$23.83 million. Today, it reached dayâs high at $0.040 and dayâs low at $0.036, with a daily volume of 416,683. Its 52 weeks high price stands at $0.235 and 52 weeks low at $0.033, with an average volume of 1,184,790 (yearly). Its absolute returns for the past one year, six months and three months are -82.00%, -76.00%, and -50.68%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.