Leading Australian energy infrastructure business APA Group (ASX: APA) has announced the appointment of Mr. Rob Wheals as the new Chief Executive Officer and Managing Director of APA Group. As per the companyâs announcement, Mr. Robâs appointment will take effect on 6 July 2019. Rob Wheals will be getting a total Fixed Remuneration (TFR) of $1,600,000 per annum (inclusive of superannuation.

As part of his appointment, Mr. Wheals will be subject to a minimum securityholding requirement whereby he must build his security holding in APA Group to be equivalent to 100% of his TFR.

In the first half of FY19, the companyâs total revenue increased by $58.2 million or 6.1% to $1,012.9 million as compared to the previous corresponding period (pcp). Further, the company reported net profit after income tax of $157.4 million for the half year period, an increase of 27.0% or $33.4 million on the pcp. The companyâs EBITDA increased by 4.3% or $32.4 million to $787.7 million in H1 FY19 while its net interest and other finance costs paid decreased by 8.8% during the period. The companyâs Operating cash flow was $470.2 million for the six-month period, an increase of 1.7% or $7.7 million on pcp, driven by an increase in receipts from customers and a reduction in interest cost offset by an increase in cash tax paid during the period.

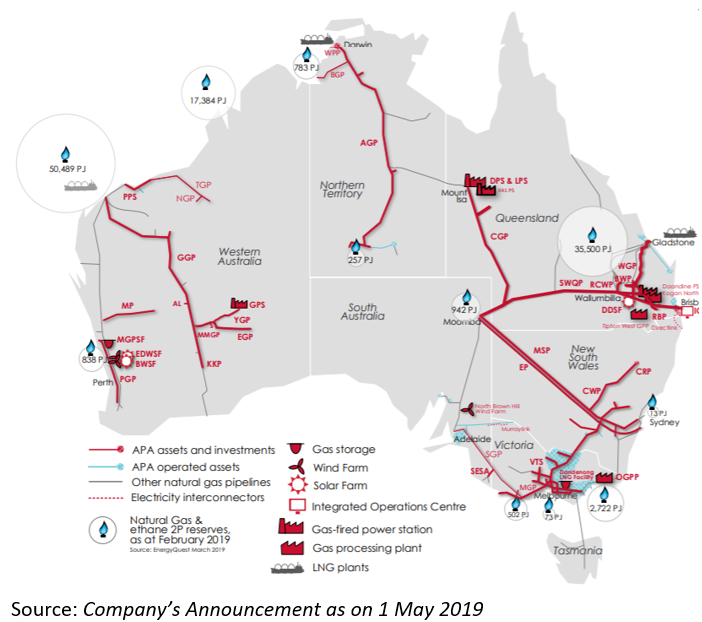

The company is having a unique footprint & solid foundations throughout Australia.

Energy is an essential service and delivering it in accordance with community expectations is what the whole energy industry needs to do every day. APA plays an essential part in Australiaâs energy supply chain, as does each and every producer, generator, pipeline and network operator and retailer.

Energy is an essential service and delivering it in accordance with community expectations is what the whole energy industry needs to do every day. APA plays an essential part in Australiaâs energy supply chain, as does each and every producer, generator, pipeline and network operator and retailer.

APA services a range of customers in Western Australia within the resources, industrial and utility sectors. APA provides asset management and operational services to the majority of its energy investments and to a number of third parties and as per the companyâs 2018 Annual report, its main customers are Australian Gas Networks Limited (AGN), Energy Infrastructure Investments and GDI (EII). Asset management services are provided to these customers under long-term contracts.

APA identifies risks to its business and puts in place mitigation strategies to remove or minimise the negative effect and maximise opportunities in respect of those risks. Material risks are reviewed on an ongoing basis by APAâs Executive Risk Management Committee and the Board Audit and Risk Management Committee, together with the relevant business units and both internal and where appropriate, external, experts.

The stock traded at a price of $10.190, down by 0.196% during the dayâs trade with a market capitalisation of ~$12.05 billion as on 13 May 2019. The counter opened the day at $10.200 and reached the dayâs high of $10.240 and touched a dayâs low of $10.130 with a daily volume of ~ 1,461,397. The stock has provided a year till date return of 19.70 & also posted returns of 11.58%, 8.500% & 5.80% over the past six months, three & one-month period respectively. It had a 52-week high price of $10.310 and touched 52 weeks low of $7.860, with an average volume of ~2,401,984.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.