Recently, NSW Education Minister, Sarah Mitchell communicated that the Government intends to improve the literacy, numeracy and attendance, implying the fact that taxes paid by the people in the country are being used prudently in the school system. During the State Budget as on 18th June 2019, Treasurer, Dominic Perrottet sent a message of his determination for improved educational outcomes from a supplementary $6.4 billion to be spent on NSW schools.

G8 Education Limited (ASX:GEM)

G8 Education Limited (ASX: GEM) owns and operates early education centres with the ownership of early education centre franchises.

Recent Developments - (1) The company recently communicated to ASX that it has redeemed $270,000,000 Singapore Notes (Notes) listed on the Singapore Exchange. The source for this payment was $500 million syndicated bank debt facility, which was announced on 22nd October 2018. (2) The company recently shared the information with investors that Challenger Limited has become a substantial holder with a voting power of 5.01%.

Recently, the Chairman of the company addressed the shareholders in its 2019 Annual General Meeting (AGM) that the sector has gone through a significant change in the year 2018, as a new child care subsidy was presented in the month of July as well as significant challenges brought about by heightened supply in a large number of regions around Australia.

In 2018, the company acquired 16 early education centres and closed eight centres which were underperforming. Consequently, it reached 502 in Australia and 17 in Singapore as at 31st December 2018. With this, the total combined licenced capacity stood at ~41,000 places, servicing ~52,000 children. The company, in the year, remained the largest for?profit provider of early education services in Australia.

In the year 2018, the financials were largely impacted by the changing market environment, along with the implementation of the groupâs strategy. EBIT for the period witnessed a decline of 12.7% to $136.3 million, however, was in line with the management guidance. The weak results were predominantly on the back of weaker occupancy supply pressures in the first half, combined with higher wages from regulatory changes to produce an H1 EBIT of $13 million lower than the prior year.

In 2H18, a more favourable subsidy framework and strategy implementation resulted in EBIT from the organic centre group, which came in largely in line with the pcp and $7 million lower after investment in the support office to facilitate the companyâs strategic plan. Cash flow generation remained strong with cash flow from operation at $105.9 million and dividend amount paid to shareholders of $48.1 million.

The capital base of the company witnessed an improvement in 2018, with syndicated bank debt financing of $500 million. The amount was used to refinance the $200 million bank debt facility with the remaining amount to be used to refinance the $270 million Singapore bond facility in the month of May 2019. The additional capital was provided through this refinancing.

Coming to the trading performance for 2019. The management stated its key expectations for FY2019, wherein occupancy growth for FY19 is expected to be in the range of 1% to 2%. Wage efficiency is expected to continue the performance seen in 2H18. Incremental earnings from 2018 acquisitions are expected at $10 million, and FY19 net investment costs are expected at $2 million, which is related to the opening of greenfield centres in 2019.

At the current market price of $2.870, the stock is trading at price to earnings multiple of 18.780x. The stock has generated a return of ~27% in the last one year. 52-week high and low price for the stock stands at $3.635 and $1.880, with an annual average volume of 2,200,536. The annual dividend yield for the stock came in at 6.04%, with a market capitalisation of $1.37 billion.

IDP Education Limited (ASX:IEL)

IDP Education Limited (ASX: IEL) is involved in the international students placement into education institutes in Australia, the USA, UK, New Zealand and Canada. The company also provides services such as counselling, application processing and pre-departure guidance. Additionally, IEL administrates and distributes the (IELTS) International English Language Testing System tests. IEL co-owns IELTS with the British Council and Cambridge Assessment.

The company recently notified to ASX that Gregory Charles West sold off 25,000 Ordinary Shares of IEL for the consideration of $445,485.

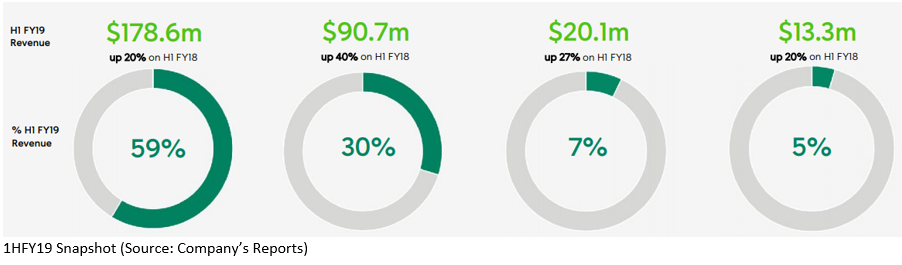

1H19 Performance: The company posted a strong rise in earnings for the period with NPAT (net profit after tax) growth of ~34% to $40.7 million as compared with $30.5 million in 1H18, largely driven by a 26% rise in the top line with each product line delivering robust volume growth.

Top line for English Language Testing saw a growth of 20% with IELTS testing volumes growing by 18% for the period. Revenue from the Student Placement segment witnessed a robust growth of 40%, underpinned by solid growth in volumes to the UK and Canada with a rise in the average price. Revenues from Digital Marketing and Events saw a decent growth of 27% with Hotcourses being the key driver for the growth.

Improved gross margin was broadly due to strong student placement revenue growth. Depreciation for the period was higher with the amortisation of the CapEx program related to the student placement digital platform, which started in the month of June 2018. For the period, NPAT margin of 13.4% was due to the improvement seen in gross margins and overheads growing at a lower rate as compared to the top line.

With positive ForEx movements, the constant currency revenue growth for 1H19 came in at 23% as compared to the actual reported growth rate of 26%. Constant currency NPAT saw a growth of 30% against the actual reported growth rate of 32%.

A significant proportion of the groupâs assets are intangible in nature totalling $140.1 million, including software, goodwill, identifiable intangible assets related to the businesses acquired and capitalised development costs. These assets are excluded from the calculation of net tangible assets per share.

At the current market price of $18.130, the stock is trading at a price to earnings multiple of 75.110x, with a market capitalisation of $4.69 billion. The stock has rallied 80.61% in the last one year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.