CoAssets Limited (ASX: CA8), established in 2013, started as a crowdfunding platform to match investors to exclusive deals, is a public company based in West Perth, with outbound offices in Australia, China and Hong Kong, and primarily engaged in three businesses - Online Funding, Corporate Lending and Financial Technology Advisory, thereby creating a wide range of opportunities across different industries. The Group has 574,000+ registered clients and users, ranging from entry-level retail investors to high-net-worth individuals and institutions.

The three revenue drivers of the Group are explained below.

Online Funding: In Singapore, the Group operates an online funding platform through CoAssets Pte Ltd (wholly-owned), which has a CMS Licence to deal in securities. Besides, CoAssets also operates an online funding platform in China through CoAssets China, a joint venture company with its local Chinese partners.

Corporate Lending: The Group provides corporate lending through its wholly-owned subsidiary, CoAssets International Pte Ltd. plus it also runs an accredited investor fund called the CoAssets Stirling Fort Absolute Return Fund (CASFAR).

Financial Technology Advisory: CoAssets also invest in fintech companies that enhance its online financial offering and through its cutting-edge technology-based solutions, the clients are able to utilise the best of opportunities that the regional financial markets have to offer.

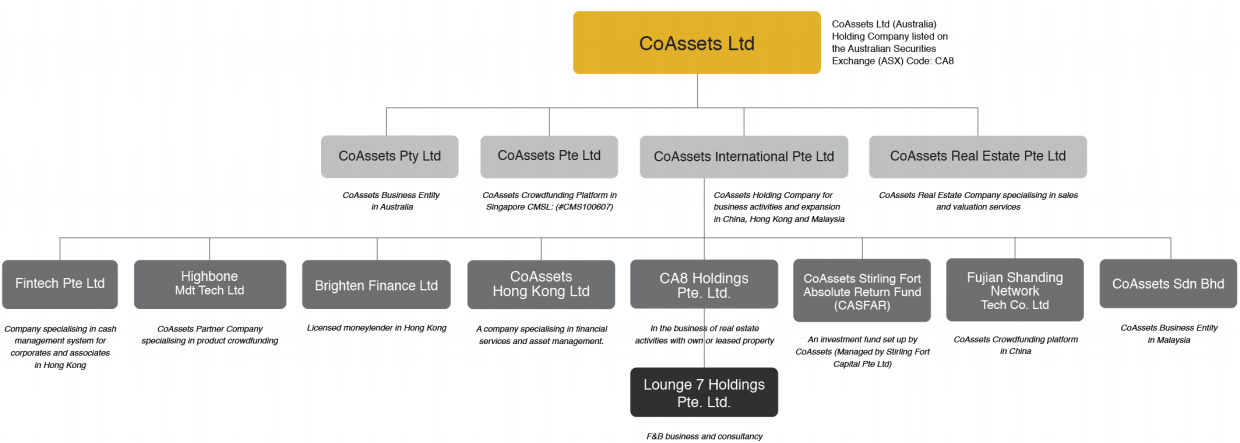

The Groupâs corporate structure is illustrated as follows â

Source: Half-Yearly Report 2019

Below is the mapping of CoAssetsâ product offerings based on revenue drivers and geographical presence

Source: Half-Yearly Report 2019

Leadership Changes

On 1 July 2019, CoAssets announced the appointment of Mr Aaron Garry as an independent non?executive director of the company, effective from 1 July 2019. This followed the resignation of Mr Nicholas Ong, an independent non-executive director of the company, on the same day.

Mr Ong joined CoAssets in 2015 as a non-executive Chairman and immensely contributed to driving the companyâs growth â particularly during its transition as an ASX listed company and guided the Management Team to achieve consistent profitability.

Mr Garry is a highly qualified senior financial and compliance specialist with more than 12 years of relevant experience acquired from working for various blue-chip companies within the financial services industries across Australia and the United Kingdom. Also, he is currently the Managing Director of ABN Australia, a business formation and compliance company.

CoAssets also added that the Group was actively searching for a suitable additional non?executive director as a long-term replacement for Mr. Ong.

Quarterly Update

Recently, CoAssets released its Quarterly Report for the three months to 30 June 2019. During the concerned period, there were cash inflows of SGD 527K from operating activities (March 2019 Quarter: cash outflows of SGD 2.76 million), primarily on account of large receipts from customers (SGD 2.46 million) and interest received (SGD 1.02 million), net of expenditure in advertising and marketing (SGD 107K), leased assets (SGD 360K), staff costs & corporate costs (SGD 1.61 million), as well as other costs of finance paid (SGD 871K).

The financing activities further supplemented the cash inflows with ~SGD 3.22 million (March 2019 Quarter: cash inflows of SGD 5.99 million) resulting from proceeds from borrowings (SGD 7.76 million) minus the repayment cost of borrowings (SGD 4.54 million).

On the contrary, the Groupâs investing activities in the June 2019 quarter were characterized by net cash outflows of SGD 3.61 million, lower than SGD 5.64 million of cash outflows recorded in the prior March 2019 quarter.

The Group had a net cash and cash equivalents of SGD 3.998 million in hand (March 2019 Quarter: SGD 3.989 million). Going forth, CoAssets anticipates cash outflows of SGD 2.3 million for the next quarter.

Interim Financial Results - Half Year Ended 30 Dec 2018

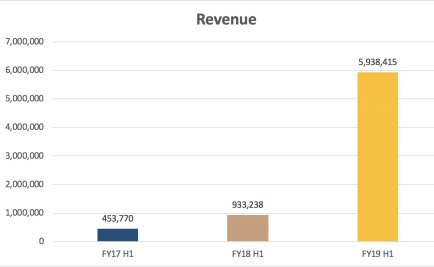

CoAssetsâ results so far have been quite encouraging and provide a sound foundation as the company aims for greater heights. In its Interim Report for Financial Year 2019 (FY19 H1), the Group posted Revenue from ordinary activities at ~SGD 5.94 million, which is a staggering increase of 536% over SGD 933,238 recorded in the prior corresponding period (pcp) ended 30 December 2018. The Profit from ordinary activities after tax attributable to members was also up 98% to SGD 999,293.

Around 54% of the corporate lending and online funding business were from Singapore, which continues to be a key market, while Hong Kong is an up-and-coming region. However, for the first half of 2019, operations in Hong Kong had surpassed China, perhaps due to certain regulatory constraints in the latter.

Source: Half-Yearly Report 2019

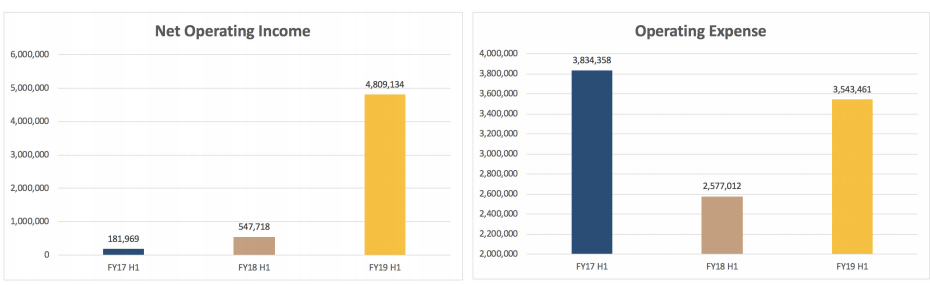

The Groupâs Net Operating Income for FY19 H1 also significantly improved by 778% to ~SGD 4.81 million from SGD 547,718 in FY18 H1. While the total comprehensive income for FY19 H1 amounted to SGD 817,467 (FY18 H1: SGD 431,697).

The operating expenses of the Group increased by 38% to ~SGD 3.54 million on account of more business activities undertaken during the period. Also, the Funding for the Group in FY19 H1 was SGD 42.80 million (up 55.20% on SGD 27.58 million in FY18 H1).

Source: Half-Yearly Report 2019

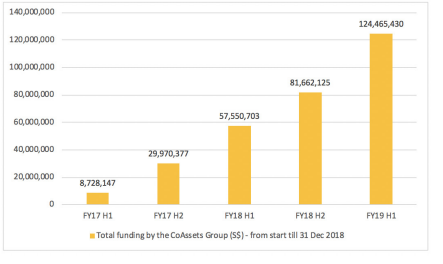

Since the onset to 31 December 2018, the Groupâs cumulative funding from all business units was over SGD 124.47 million. In FY19 H1 alone, the Groupâs funding was more than SGD 42.80 million, an increase of 55.20% compared to SGD 27.58 million in the pcp.

Cumulative funding by CoAssets Group (SGD) from the onset till 31 Dec 2018; Source: Half-Yearly Report 2019

CoAssetsâ Total Assets for FY19 H1 were valued at around SGD 38.28 million, up 83.09% on ~SGD 20.91 million recorded in FY18 H1 while the Net Assets for FY19 H1 were SGD 11.21 million, up 13.15% on SGD 9.88 million in the pcp.

To date, CoAssets has raised more than SGD hundred million and funded projects in over ten countries worldwide. The Group also secured Gold Winner of 2014 OPP Awards for Best Innovation, Top 100 Winner for the 2014 Red Herring Asia and has been a finalist for MAS Fintech Awards 2016

Stock Performance

CoAssets has a market capitalisation of around AUD 28.91 million with approximately 206.48 million shares outstanding. The CA8 stock last traded at AUD 0.140 on 5 July 2019 and has delivered a positive return of 40% in the last six months.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.