Metal Bank Limited (ASX:MBK), headquartered in Australia is involved in the business of exploration and development of mineral properties. The company is led by the board of highly qualified personnel having rich experience in the mining business. The board is always on a lookout for bulk tonnage targets with multi-million-ounce potential.

Inés Scotland who is leading as the Chairperson, has a vast experience of more than 20 years within which she also held the command of Citadel Resource Group, Utah Copper, Rio Tinto, Ivanhoe Australia, Lihir and many more. Whereas, Tony Schreck, Managing Director, has led major exploration projects for more than 25 years. Guy Robertson, Executive Director is also richly experienced at key financial positions in multiple companies for over 30 years.

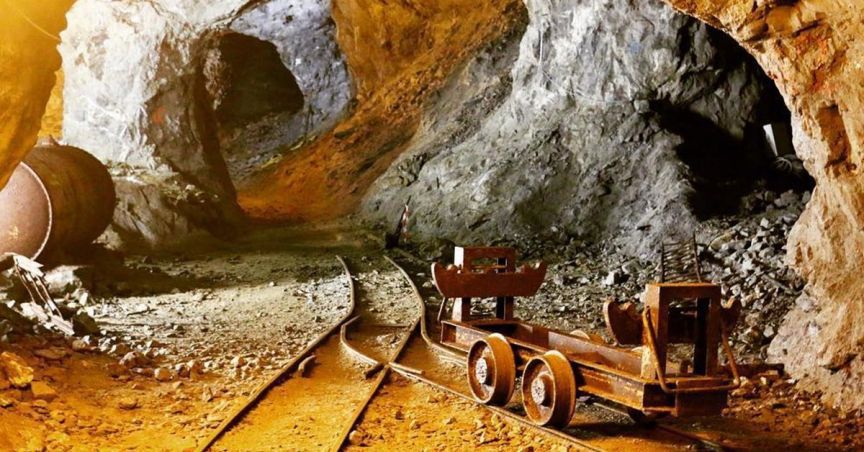

Currently, the company is operating on the three Gold projects in Eastern Australia namely; Triumph project, Eidsvold project and 8 Mile project (all of which are 100% company-owned).

Triumph Project

This projectâs exploration is the highest priority of the company where it has discovered a large underexplored gold system through greenfields. This gold system is 15km2 large which is 95% concealed beneath shallow alluvium. This large gold system was previously unrecognised and therefore could be the best opportunity to go ahead of the crowd to generate and drill test tier one and two targets.

Recently, the company identified four high priority bulk tonnage targets after the completion of an additional analysis of Triumph Project IRGS potential. These include Bonneville, Advance, Bald Hill East and Big Hans.

Eidsvold Project

This is 250km2 area, located between the Cracow 3Moz and Mt Rawdon 2Moz gold mines and is is virtually unexplored due to the under-sediment cover to the extent of 85%. Detailed airborne geophysics is being used by the company, helping in targeting the large gold systems hidden by sediment cover around a historical goldfield.

As of now, the project is 100% by the company, but it is pursuing a joint venture interest in the project.

8 Miles Project

8 Miles Project consist of 255km2 of exploration licence application near the Mt Rawdon gold deposit in south-east Queensland. Previously wide-spaced stream sediment geochemical data collected during the 1980âs and 1990âs supports the current multiple alteration targets identified from reprocessed airborne geophysics data.

The company has also discovered large 2km² breccia system within the 7km2 hydrothermal system which was not previously recognized.

Financial Performance

The revenue of the company dropped marginally from $55,943 million in FY17 to $53,694 million in FY18 (year ended 30 June 2018), a drop of 4%. Due to this, we have seen an increase in the loss for the year which was reported at $779,000 million from the previously reported loss of $541,340 million in FY17. However, the Balance sheet has shown a relatively good picture for the company. The total Assets of the company has risen from $8.62 million in FY17 to $11.07 million in FY18, a healthy rise of more than 28%. However, the liabilities have risen from $213,000 in FY17 to $233,701 in FY18 which is negligible compared to the increase in the assets in absolute term.

For the quarter ended 30 December 2018, the company has recently reported A$263K (YTD outflow of A$ 797K) operating cash outflow, with no investing and financing activities. The cash and cash equivalents stood at A$2.184 million at the end of the quarter. The company is anticipating A$300K cash outflows for the current quarter.

Stock performance       Â

As of 5th March 2019, the stock closed flat at A$0.11 on ASX. The prices have fallen continuously from A$0.42 odd levels to the CMP of A$0.11, but this downfall seems to have ended as the stock is finding difficult to make any new lows from the past few months. This consolidation phase after a downtrend generally marks the end of the current trend and a new potential positive trend in the price is expected to emerge.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.