In order to earn steady earnings, investors generally go for Dividend Stocks. And in a country like Australia, where interest rates are low, the dividend stocks are considered as one of the best investment that investors can make to earn steady earnings. In light of this, letâs take a look at five dividend stocks, which are currently trading on ASX.

Westpac Banking Corporation (ASX:WBC)

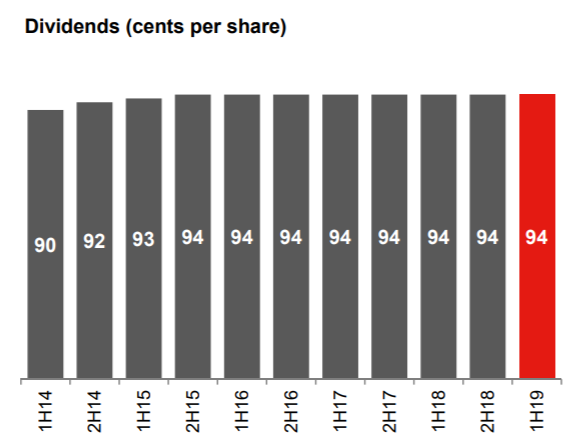

One of the Australiaâs leading banks, Westpac Banking Corporation (ASX: WBC) recently determined a dividend of 94 cents per share for the six months ending 31st March 2019, to be paid on 24th June 2019. The Record Date for the dividends was 17th May 2019. In todayâs scenario, where the whole financial industry is under pressure, mainly due to increased scrutiny from regulators and government agencies, the bank was able to maintain its dividend from 94 cents per ordinary share fully franked, representing a payout ratio of 98%.

Dividend Summary (Source: Company Reports)

In 1H FY19, the company earned a reported profit of $3,173 million, down 24% on the previous corresponding period, reflecting both the operating environment and higher restructuring and remediation provisions.

The Bank recently completed a detailed self-assessment of Westpacâs Culture, Governance and Accountability (CGA) and highlighted that it has an analytical and consultative culture that can slow down decision-making process.

Stock Performance: In the past six months, Westpacâs stock has provided a return of 16.33% as on 27th June 2019. At market close on 28th June 2019, WBCâs stock was trading at a price of $28.360, up 0.782% during the dayâs trade, with a market capitalisation of $98.21 billion. It 52 weeks high price stands at $30.440 and 52 weeks low price at $23.300, with an average volume of ~11,235,370. The companyâs stock is having an annual dividend yield of 6.68 percent (as per ASX).

Australia and New Zealand Banking Group Limited (ASX:ANZ)

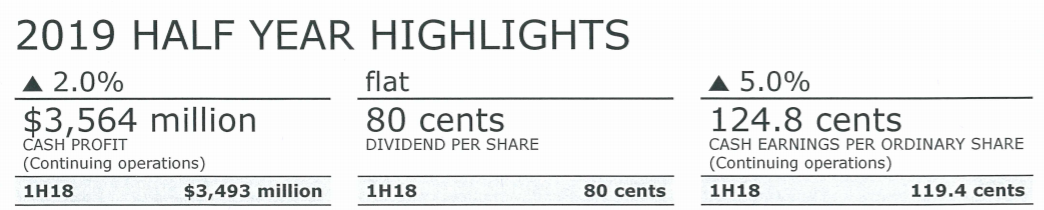

Australia And New Zealand Banking Group Limited (ASX: ANZ) is one of the top four banks in Australia in terms of market capitalization and scale. Despite the fact that banking sector in Australia is facing strong headwinds, ANZ bank has been able to make strong progress in simplifying its business and strengthening its balance sheet, which helped it in delivering solid results for customers and shareholders. For the first half of FY19, the bank delivered a statutory profit of $3.17 billion, which was 5 per cent lower than the previous corresponding period (pcp). Despite the decrease in profit, return on equity increased slightly to 12.0% while cash earnings per share was up by 5%, driven by the bankâs actions to reduce shares on issue through $3 billion buy-back.

For the half year, the bank has announced an interim dividend of $80 cents per share to be paid on 1st July 2019, with a Record Date of 14th May 2019.

(Source: Company Reports)

With the introduction of a single home loan origination system, the bank is now trying to improve its momentum in Australia.

Stock Performance: In the past six months, the companyâs stock has provided a return of 18.78% as on 27th June 2019. At market close on 28th June 2019, WBCâs stock was trading at a price of $28.210, down 0.599% during the dayâs trade, with a market capitalisation of $80.41 billion. It 52 weeks high price stands at $30.390 and 52 weeks low price at $22.980, with an average volume of ~ 5,515,087. The companyâs stock is trading at PE multiple of 12.950x, with an annual dividend yield of 5.64 percent (as per ASX).

JB Hi-Fi Limited (ASX:JBH)

Australia's leading home entertainment retailer, JB Hi-Fi Limited (ASX: JBH) announced an interim dividend of 91 cents per share fully franked, up 5.8% from the previous corresponding period. The dividend is representing a dividend payout ratio of 65%, which appropriately balances the distribution of profit to all shareholders.

In the first half of FY19, the company earned a net profit after tax (NPAT) of $160.1 mn, which was 5.5 percent higher than pcp. The company reported total sales growth of 4.2%, EBIT growth of 4.8% and EPS growth of 5.4% in H1 FY19 as compared to pcp.

In FY19, the company is expecting its total sales to be $7.1 billion.

Recently, the company announced that Cameron Trainor has been re-appointed as Managing Director of the JB Hi-Fi business and Lynda Blakely has been appointed to the role of Group HR Director. Besides this, highly experienced Simon Page has been appointed to the position of Group Technology Director.

Stock Performance: In the past six months, JB Hi-Fiâs stock has provided a return of 16.25 percent as on 27th June 2019. At market close on 28th June 2019, JBHâs stock was trading at a price of $25.850, up 0.388% during the dayâs trade, with a market capitalisation of $2.96 billion. It 52 weeks high price stands at $28.650 and 52 weeks low price at $20.300, with an average volume of ~556,896. The companyâs stock is trading at a PE multiple of 12.240x, with an annual dividend yield of 5.32% (as per ASX).

Wesfarmers Limited (ASX: WES)

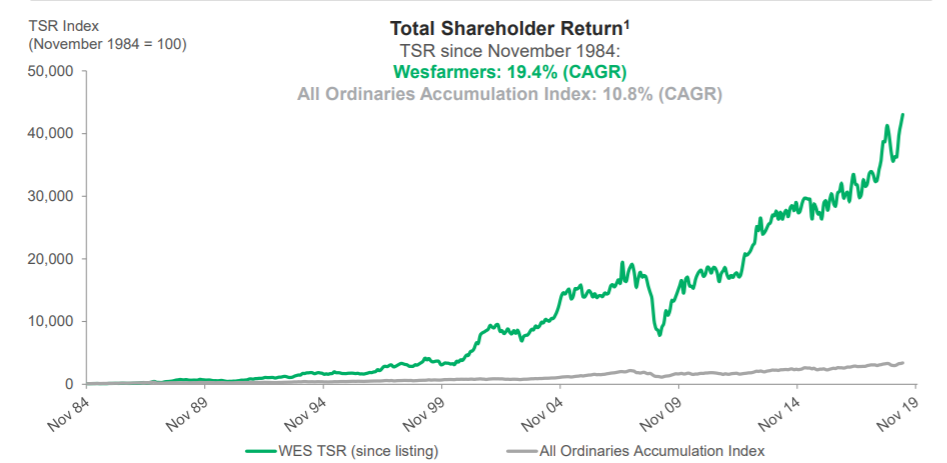

Australiaâs leading retailer, Wesfarmers Limited (ASX:WES) has been following the strategy of providing satisfactory returns to its shareholders, as depicted in the graph below.

Total Shareholder Return (Source Company Reports)

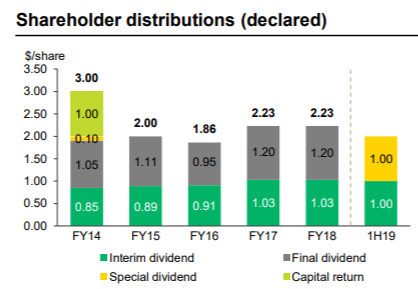

Between FY14 and FY19, the company has distributed ~$16 billion of cash to the shareholders with capital returns.

Shareholder distributions (Source: Company Reports)

For the half year period, the company declared a fully franked ordinary interim dividend of $1.00 per share and alongside, the company has also declared a fully franked special dividend of $1.00 per share. For the half year period, the company recorded net profit after tax (NPAT) of $4,538 million, with NPAT from continuing operations of $1,080 million, up 10% on pcp. During the half year period, the company successfully reduced net financial debt by $3,256 million to $324 million.

Stock Performance: In the past six months, Wesfarmers Limitedâs stock has provided a return of 16.77% as on 27th June 2019. At market close on 28th June 2019, WESâs shares were trading at a price of $36.160, down by 1.175 percent during the intraday trade, with a market capitalisation of $41.49 billion. It 52 weeks high price stands at $38.800 and 52 weeks low price at $29.537, with an average volume of ~ 2,292,235. The companyâs stock is trading at PE multiple of 7.490x, with an annual dividend yield of 6.01% (as per ASX).

Woodside Petroleum Ltd (ASX:WPL)

Australiaâs leading natural gas producer, Woodside Petroleum Ltd (ASX: WPL) delivered a fully franked full year dividend of US$1.44 per share in 2018. During the year, the companyâs NPAT increased by 28% on 2017 to $1.36 billion and generated $3.3 billion of operating cash flow, up 32% on 2017.

Stock Performance: In the past six months, Woodside Petroleum Ltdâs stock has provided a return of 19.61% as on 27th June 2019. At market close on 28th June 2019, WPLâs stock was trading at a price of $36.360, down 2.127% during the dayâs trade, with a market capitalisation of $34.78 billion. It 52 weeks high price stands at $39.380 and 52 weeks low price at $29.330, with an average volume of ~ 2,178,131. The stock is trading at PE multiple of 17.700x, with an annual dividend yield of 5.38% (as per ASX).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.