Australian healthcare industry challenges include an ageing population, increased rate of chronic diseases, emergence and integration of new technologies, etc. Some important Australian companies, which are working on integrating âSaaSâ model in the medical division and providing state-of-the-art facilities in curing fatal diseases such as breast cancer, among others, are Volpara Health Technologies Limited and Proteomics International Laboratories Ltd. Letâs see how the recent development of these companies are impacting their stock prices.

Volpara Health Technologies Limited (ASX:VHT)

Volpara Health Technologies Limited (ASX:VHT) helps in the early detection of breast cancer by utilising AI technology. It is based in Wellington with around 70 engineers and 25 US sales staff. Its Volpara® Density and Volpara® Live! provide automated, objective evidence for clinical decision support. Its Volpara® Enterprise provides cloud-based trend analytics to help manage breast imaging clinics. The company moved to SaaS three years ago, which is not just a business model, but an entire cultural change by the company for the good.

The companyâs software is witnessing rapid uptake in the US market with 39 Mn screenings per annum. At the end of March 2019, around 7% of US women were screened at end of FY19, used Volpara software. The Annual Recurring Revenue (ARR) increased by 86% (over year) to NZ$6.6 Mn at the end of FY19. The gross margin was reported at ~83%, with a relatively fixed cost base. VHTâs moat includes clinical validation, âmarqueeâ clinics, intellectual property and regulatory approvals.

VHT raised around ~$55 Mn and acquired 100% of Seattle-based MRS Systems Inc. (âMRSâ) for ~US$14.6 Mn. It has been able to capture US market share close to 20%, with around 1,700 breast imaging clinics and around 50 employees. The company expects its financial year 2020 annual recurring revenue to be approximately US$4.5 Mn.

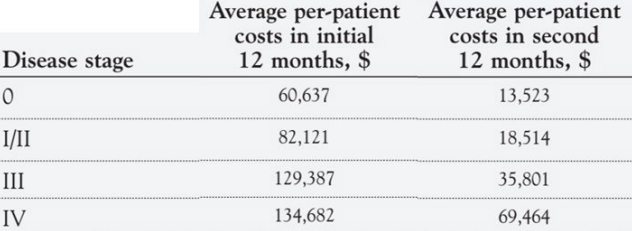

As per the company reports, treatment costs are high and outcomes are worst for the late stage cancer. The five year survival rate is 99% when breast cancer is diagnosed while still localised to the breast, 85% for regional disease, but only 27% when distant metastases are present. For the period from 2008 to 2014, the distribution of localised, regional, and distant metastases was 62%, 31%, and 6%, respectively.

Comparison of Treatment Costs for Breast Cancer, by Tumor Stage (Source: Company Reports)

VolparaDensity Primer is an automated system with an objective of scoring density for each patient. The company has over 300 publications, with the software which has worked on images from Karachi to New York. As per the study, breast density is the most significant risk factor on a population basis, where 39% of breast cancer in premenopausal women and 26% of breast cancers in postmenopausal women are attributable to having BI-RADS C or BI-RADS D breast density. The breast density and clinical risk factors may explain more than half of breast cancer cases.

The company reports suggest that the randomised controlled trials (RCTs) are essential for populations. The first results were presented at ECR 2019 by Professor Carla van Gils. The trial uses VolparaDensity and focuses on Volpara âExtremely Denseâ, underway since 2010.

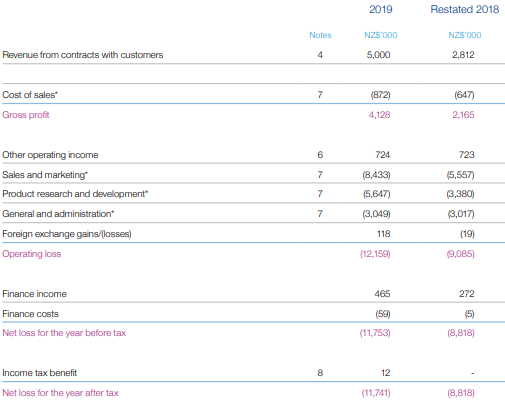

In its 2019 Annual Report, VHT highlighted that its Annual Recurring Revenue rose from NZ$3.6 Mn to NZ$6.63 Mn, an increase of 86%. Its Total Contract Value signed rose from NZ$11.2 Mn to NZ$15.8 Mn, an increase of 41%. The accounting revenue from customers rose from NZ$2.8 Mn to NZ$5.0 Mn, an increase of 78%. The gross margin rose from 77% to 83%. The net loss rose from NZ$8.8 Mn to NZ$11.7 Mn, which is an increase of 33%, reflecting increased expenses associated with the expansion of both the US sales team to capitalise on open leads and the Wellington engineering team to propel product innovation.

Income Statement (Source: Company Reports)

Stock Information

The share of Volpara Health Technologies, at market close on July 26, 2019, traded at $1.520, up 0.997%, with the market capitalisation of ~$326.57 Mn. Today, it touched dayâs high and dayâs low at $1.575 and $1.515, respectively, with a volume of 850,662 (daily average). Its 52 weeks high and low price stands at $1.932 and $0.745, respectively, with volume of 604,317 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 95.52%, 22.20%, and -15.82%, respectively.

Proteomics International Laboratories Ltd (ASX:PIQ)

Proteomics International Laboratories Ltd (ASX:PIQ) expanded partnership with Linear Clinical Research, securing two new analytical services contracts to perform pharmacokinetic testing of novel autoimmune disease drugs further validated Proteomics Internationalâs analytical services capabilities. The combined value of the contracts has been estimated at $418,000 and comprises clinical studies in phases. Phase I clinical studies will examine the safety performance of novel auto-immune disease drugs for two China-based pharmaceutical companies, with the studies to be undertaken over the next three to 10 months. Proteomics International continues to grow its demanded, analytical services business whilst concurrently commercialising its ground-breaking predictive test for diabetic kidney disease, PromarkerD. The company continues to develop existing regional PromarkerD licensing agreements, whilst actively pursuing newly identified opportunities.

Dr Richard Lipscombe, PIQâs Managing Director, stated that the management is excited by the continued development of the companyâs commercial partnership with Linear Clinical Research. The contract further validates Proteomics Internationalâs pharmacokinetic testing capabilities and highlights the growth potential of its analytical services business. These specialist services will continue to present opportunities to generate valuable revenues, which will help offset the cost of developing and commercialising the companyâs portfolio of pioneering diagnostics.

In a previous update, PIQ announced that it issued 100,000 fully paid ordinary shares upon the exercise of unquoted options exercisable at $0.25 per option on or before 17th July 2019, raising $25,000 before costs (Consultant Options).

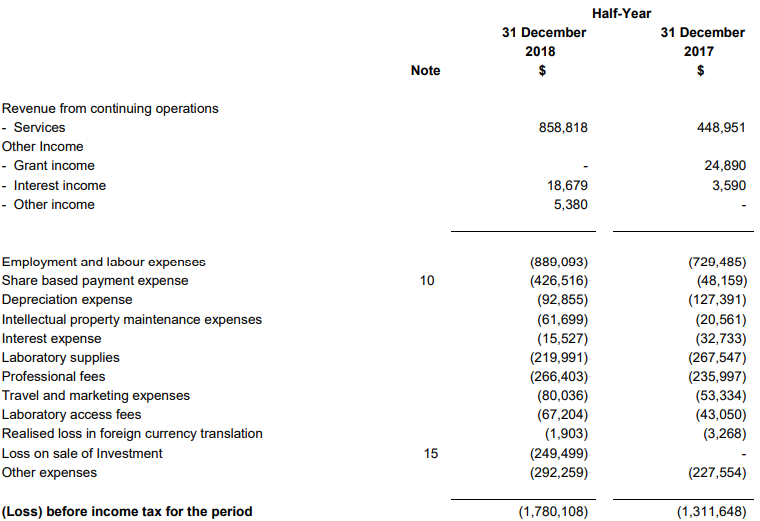

H1 FY19 (ended on December 31, 2019) Key Highlights: Revenues from ordinary activities increased by 91% to $859K as compared to the previous corresponding period. The revenue results can be attributed to the strong growth from analytical services centred on biosimilars and pharmacokinetic testing.

The net loss from ordinary activities after tax attributable to members increased by 36% to $1,780K as compared to the previous corresponding period. It includes both the accounting loss of $249,499 on sale of the companyâs investment in CPR Pharma Services Pty Ltd and a share based payment expense of $426,516.

There was a net cash inflow for the half year of $608,678 (2017 half year: net cash outflow $84,868), increasing the company's cash reserves to $2.93 million. In light of its strong cash position, Proteomics International has continued its elevated expenditure (as compared to FY 2018) in the following areas:

- Development spending relating to the rollout of the Laboratory Developed Test (mass spectrometry) version of PromarkerD;

- R&D spending relating to the completion of the immunoassay (kit) version of PromarkerD;

- Business development and commercialisation costs for the rollout of PromarkerD.

The net tangible asset backing per ordinary security for the period was reported at 5.6 cents as compared to 0.58 cents in the previous corresponding period.

H1FY19 Income Statement (Source: Company Reports)

Stock Information

The share of Proteomics International, at market close on July 26, 2019, traded at $0.345, up 1.471%, with a market capitalisation of ~$27.43 Mn. Today, it touched dayâs high and dayâs low at $0.350 and $0.340, respectively, with a volume of 97,000 (daily average). Its 52 weeks high and low price stands at $0.490 and $0.215, respectively, with a volume of 96,258 (yearly). Its absolute return for the past 1 year, 6 months, and 3 months are 33.33%, -1.45%, and 25.93%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.