Havilah Resourcesâ shares surged over 7% on 25th June after the company confirmed the exceptionally thick 488 m intersection of iron formation in the Grants Basin Iron Ore Project.

Havilah Resources Limited (ASX: HAV) is an ASX-listed metal and mining company with multi-commodities minerals portfolio, focused on drilling copper, gold, cobalt and iron ore in the northeast region of South Australia. Besides, the company seems to be well positioned to be a key player in South Australiaâs copper and future battery metals industry.

In the market announcement dated 25 June 2019, Havilah Resources presented the final laboratory assays for GBDD014, diamond Drillhole completed earlier this year at Grants. The results confirmed the intersection of 488m at 24.57% Fe (126 m - 614 m), in line with the previously announced indicative handheld Niton XRF results of 486 m @ 24.06% Fe (127 m - 613 m).

The investors viewed the assay results quite positively; the stock price rushed up 11.538% to trade at $0.145 as at 25 June 2019 (02:12 PM AEST).

HAV informed that this diamond drillhole supports preliminary metallurgical testwork while also providing the partial twinned drillhole assay data to allow comparison between the diamond core assays and the adjacent reverse circulation (RC) assays in drillhole GBRC008.

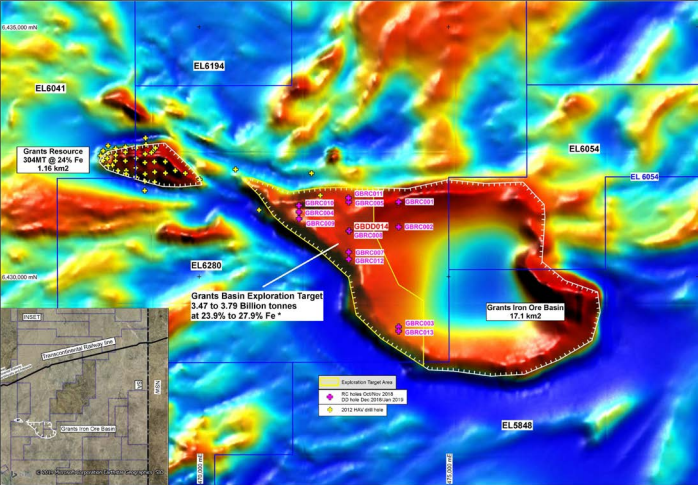

Overview map showing diamond drillhole GBDD014 in the Grants Basin (Source: Company Announcement)

Overview map showing diamond drillhole GBDD014 in the Grants Basin (Source: Company Announcement)

Dr Chris Giles, Havilahâs Technical Director, stated that the âthese assays are broadly consistent with the assays in the adjacent reverse circulation drillhole, demonstrating that Havilah results have now been confirmed by two different drilling methods as well as by two different assaying methods.â

The Grant iron ore project is located approximately 12 km of the sealed Barrier Highway and the transcontinental Railway to Port Pirie and Whyalla. As per the 3D modelling report, the deposit forms a homogeneous hull-shaped body of iron ore. It covers an area of approximately 130 hectares with iron ore up to 180 metres thick from the surface, thereby reflecting the extremely favorable open pit mining characteristics of the Grants iron ore deposit.

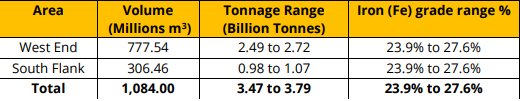

Havilahâs management informed that the companyâs wide-spaced drilling has so far covered just one-fourth of the Grants Basinâs area based on its aeromagnetic data interpretation. Moreover, the results from this drilling program allowed the company to form an estimate (announced on 5 April 2019) of an initial Exploration Target for the Grants Basin of 3.47 to 3.79 billion tonnes iron ore at a grade of 23.9% to 27.6% Fe.

HAV Grants Basin Iron Ore Initial Exploration Target (Source: Company Announcement)

The estimation was reportedly based on drilling performed and funded by SIMEC as part of their due diligence program to evaluate the commercialisation potential of Havilahâs Grants and Maldorky iron ore projects. With the solid initial target, the SIMIC Mining and Havilah have been more confident in their objectives to further explore the potential of this new iron ore discovery.

HAV now aims to carry out an infill resource drilling program, aimed at defining a JORC resource as part of the planned PFS, added Dr Giles.

Funding secured from SIMEC Mining: Havilah secured up to $100 million funding from SIMEC Mining, a member of international group GFG Alliance. The financing establishes a strategic partnership with GFG, which owns significant iron ore export facilities and can substantially provide Havilah access to global capital markets.

As per the company, the parties have agreed to process the funding through successive equity placements in Havilah at a premium of up to 35% over 3 yearsâ time frame. If this equity placement goes through, GFG would own a 51% stake in Havilah. The funding would provide a financial backup to Havilahâs work programs for its copper tenements in Mutooroo Copper Cobalt District and iron ore assets in Maldorky & Grants.

Positive prefeasibility study of Kalkaroo: Driven by its copper strategy enhanced by cobalt, Havilah Resources achieved positive projects economics in the independent pre-feasibility study (PFS) of Kalkaroo. This translates the estimated pre-tax NPV7.5% of $564 million and IRR of 26% at USD$2.89/lb copper, USD$1,200/oz gold, at an exchange rate of AUD$: USD$0.75.

As per the report prepared by independent mining consultant RPMGlobal Asia Limited (RPM), the PFS results are highly favorable to support the companyâs large-scale open pit copper-gold mine at Kalkaroo in north-eastern South Australia, near Broken Hill.

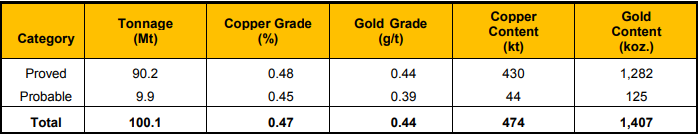

RPM estimated total Ore Reserves of 100.1 million tonnes with 90% of the reserves of proven status in accordance with the guidelines of the JORC Code. It includes Proven 90.2 million tonnes and Probable 9.9 million tonnes of Ore Reserves that contains 474,000 tonnes of copper and 1.41 million ounces of gold.

HAV Ore Reserves estimate at Kalkaroo (Source: Company Announcement)

HAV Ore Reserves estimate at Kalkaroo (Source: Company Announcement)

The consultant, therefore, stated: âThere is sufficient confidence in the Mineral Resources for them to be utilised for Detailed Feasibility planning with no further exploration drilling.â

Kalkaroo, located in the Curnamona Craton, South Australia, is a polymetallic project with multiple ore processing routes. The primary Kalkaroo deposit reportedly comprises structurally controlled replacement style stratabound chalcopyrite and pyrite sulphide mineralisation that is amenable to standard sulphide flotation methods to produce a high-quality copper concentrate.

With an Estimated C1 cost of USD$1.67/lb and pre-production Capex of $332 million, the Kalkaroo operation is anticipated to deliver on average 30,000 tonnes per year of copper metal and 72,000 ounces per year of gold.

Havilahâs right to mine is secured by three Mineral Leases and two Miscellaneous Purposes Licences covering Kalkaroo, that were recently granted by the Department for Energy and Minerals. Havilah also owns 100% of the surrounding 998 km2 Exploration Licence 5800, which allows for expansion of the mining area via new Mineral Lease or Miscellaneous Purposes Licence applications if required.

The study has also mapped the mining plan that includes three long years to focus on mining the softer oxidised saprolite gold, native copper and chalcocite ore types at an annual production rate averaging around 4 million tonnes per annum, which is the nominal capacity of the oxide ore processing plan. Havilah believes that there is an outstanding potential to carry out further drilling down dip, along strike in a major mineralised fault zone, which could result in expansion of current resource base.

Company Overview

Listed on ASX in 2002, Havilah Resources was formed by two founding shareholders, geologist Dr Chris Giles and Dr Bob Johnson. The companyâs key projects include Kalkaroo Copper-Gold Project, Mutooroo Copper-Cobalt project and Iron Ore Projects in Maldorky & Grants.

Havilah has well-established copper sulphide ore processing technology and several options for cobalt recovery, including Open Pit Mining, Sulphide Floatation, and Ore Crushing/ grinding. The groupâs investment proposition is driven by its target to establish the largest undeveloped copper sulphide resources with cobalt upside in Australia.

HAV is currently trading at A$0.140 (As at 2:30 PM AEST, 26 June 2019)

Also Read: Havilah Announced Board Structuring And Succession Update

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.