The equity market of Australia ended in red on 12th June 2020, and S&P/ASX200 tumbled 112.8 points to 5847.8. During the last five days, the index has lost 2.52%. Most of the sectors on ASX ended in red such as S&P/ASX 200 Industrials (Sector), which moved down by 112.7 points to 5,851.5. S&P/ASX 200 Materials (Sector) closed the session at 13,232.6, reflecting a fall of 227.3 points or 1.69%. All Ordinaries settled at 5959.9, indicating a decline of 1.97%.

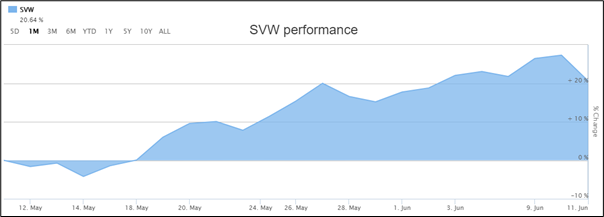

On ASX, the share price of Seven Group Holdings Limited (ASX: SVW) went up by 1.999% to $17.350 per share. The stock of TPG Telecom Limited (ASX: TPM) closed the session at $8.200 per share with a rise of 1.863%.

Stock Performance (Source: ASX)

S&P/NZX50 experienced a fall of 2.23% and ended the session at 10,906. The share price of AFC Group Holdings Limited (NZX: AFC) rose by 100% to NZ$0.002 per share. The stock of Blackwell Global Holdings Limited (NZX: BGI) soared by 50.00% and closed the day at NZ$0.015 per share. However, the share of New Talisman Gold Mines Limited (NZX: NTL) witnessed a fall of 12.50% to NZ$0.007 per share.

Recently, we have written an article on MRG Metals Limited (ASX:MRQ), and the readers can view the information by clicking here.

Seven Group Holdings Limited Rose 1.999% on Australian Securities Exchange

Seven Group Holdings Limited (ASX:SVW), in a recent presentation, stated that it is a leading operating and investment group with total assets amounting $6.9 billion. SVW is uniquely placed to respond to the crisis via industry-leading equipment. The aim of the group is to maximise return to stakeholders via long-term sustainable value creation. SVW has placed its focus on cash flow and funding to drive financial returns. SVW possesses more than $700 million in new funding and $616 million in existing committed undrawn funding. The company has suspended its guidance for FY20 due to uncertainty around trading conditions caused by COVID-19.

TPG Telecom Limited Ended in Green on 12th June 2020

TPG Telecom Limited (ASX:TPM) recently announced that it expects to pay a fully franked cash special dividend in the range of $0.49 per share to $0.52 per share with the record date of 1st July 2020. On 19th May 2020, the company announced that the Australian Securities & Investments Commission has registered the Scheme Booklet for the proposed merger of TPG and Vodafone Hutchison Australia Limited through a scheme of arrangement. Moreover, the proposed merger has been approved by the Foreign Investment Review Board. The stock of TPM is up by 1.863% due to the announcement of a special dividend.

Ingenia Communities Group Raised $28 million through SPP

Ingenia Communities Group (ASX:INA) recently closed its Security Purchase Plan (SPP) and raised $28 million, which was increased from the original target of $25 million due to strong demand from eligible security holders. This amount would further cement the Group’s balance sheet and provide additional funding capacity.