Rare earths exploration and production companies are currently hot deal among investors. The increasing use of rare earths, particularly in the production of powerful magnets and electronics has boosted the confidence of investors in rare earth companies. Currently, China is the biggest supplier of rare earths however, it is believed that in the coming years China will transition into a net importer of rare earths. If this transpires, it will create a gateway of opportunities for rare earths companies that operate outside China.

In the current scenario, rare earths explorer, Krakatoa Resources Limited (ASX: KTA) with its recently acquired highly prospective Mt Clere Rare Earth Project, located in Western Australia, is well positioned to capitalize on the strong market outlook and demand for REEs.

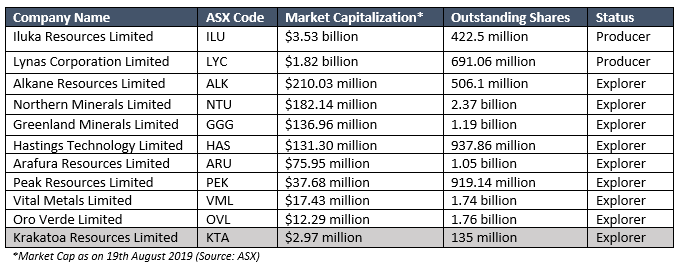

For comparison, an ASX snapshot of listed REE companies appear below:

Now letâs look at the financial performance of Krakatoa Resources.

Interim Results: The company released its interim financial report for the half-year ending 31st December 2018 on 6th March 2019. For the half year period, the company reported a total comprehensive loss of $303,422 a significant improvement over the loss of $492,548 reported in the previous corresponding period (pcp). The basic and diluted loss per share was decreased to 0.26 cents in H1 FY19 from 0.49 cents reported during the same period a year ago.

At the end of the half year period, the company had current assets of $290,029 and current liabilities of $40,292. The Current Ratio stood at 7.20x in 1HFY19, which is significantly higher than the industry median of 1.88x, demonstrating the companyâs decent liquidity position as compared to the broader industry and its ability to address the short-term obligations. Also, this liquidity level further strengthens the confidence that KTA would be able to make prudent deployment towards its strategic business objectives. Assets/Equity ratio stood at 1.03x in 1H FY19, which is slightly lower than the industry median of 1.68x, suggesting that the company is less dependent on debt when it comes to financing its assets.

Annual Results: Krakatoa Resources published its annual report for the year ended 30th June 2018 in September 2018. The company spent the year focusing on the acquisition and exploration of resource-based projects.

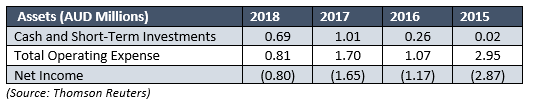

During the year, the company spent $202,585 of cash on exploration and evaluation activities and spent $50,000 as payments for exploration assets. In the last five years, the company has witnessed substantial improvement in cash balance, growing from $0.02 million in FY15 to 0.69 million in FY18, demonstrating a CAGR growth of 226%. Over the years, the companyâs operating expenses have also decreased, from $2.95 million in FY15 to 0.81 million in FY18. In FY18, the company reported a net loss of $0.80 million, a significant improvement, when compared to the loss of $2.87 million in FY15.

The companyâs financial performance in the last few years indicate that it is on the right path and is well positioned to progress with the development of its Mt Clere Rare Earth Project.

To further strengthen its balance sheet, the company had recently completed a placement, raising $385,000 (before costs) to perform exploration activities on its existing projects, with special focus on the Mt Clere Rare Earth Project.

Overview of Mt Clere Rare Earth Project: In the June 2019 quarter, the company acquired 100% interest in the Mt Clere Rare Earth Project (E52/3720 and E52/3722) via direct license application, subject to grant.

Located around 200 kilometers northwest of Meekatharra, in Western Australia, the project is believed to contain multiple targets, including REE and thorium in enriched monazite sands. Various exploration programs have been completed by BHP, Astro Mining NL, and All Star Resources Plc, all of which delineated several prospective areas for thorium and rare earths element mineralization.

Between 1985 and 1987, BHP conducted a comprehensive programme of stream sediment sampling, heavy mineral sampling as well as mineralogical analysis across the eastern portion of the Project. At that time, BHP was targeting Pb-Zn-Ag mineralization and was not focussed on REE.

A sufficient amount of monazite in pan concentrates, was confirmed in more than 20% of the 176 samples and around 47.4% of the samples returned a relative abundance exceeding 30% monazite. The anomalous samples have not been investigated further and the REE distribution within the monazite have also not been assessed.

The petrographic analysis of 20 samples sites across the Mt Clere Rare Earth Project area confirmed the accessory occurrences of Titanite and Allanite, both of which are indicative of REE (rare earth elements) prospectivity.

Astro Mining NL, which was not looking for REEs at the time, also revealed some important observations:

- Extraordinarily high monazite (up to 48%) was independently confirmed in heavy mineral concentrates taken by Astro Mining NL;

- The extremely high levels of thorium are apparent in the airborne radiometric imagery, form prime targets for Chinese-type ion adsorption clays;

- Heavy mineral concentrates also included very high zircon (up to 60%), ilmenite (up to 29%) and leucoxene (up to 20%);

The REE prospectivity of the project was further confirmed by All Star Minerals Plc, which unveiled following observations:

- Heavy mineral concentrate produced from alluvium returned up to 0.46% Ce, 0.25% La, 0.12% Th, 1.4% Zr and 9.9% Ti;

- Numerous REE anomalies returned in limited shallow auger drilling, including sample EBA052: 1050ppm Ce, 660ppm La, 112ppm Pr, 360ppm Nd and 43ppm Sm

Stock Performance: On 19 Aug 2019, KTAâs stock were trading at a price of $0.022 with a market capitalization of circa $2.97 million (as at AEST: 1:42 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.