All praises to Australian specialty metals explorer King River Resources Limited (ASX:KRR) that has been successfully advancing its project-centric activities in the face of growing turbulence by COVID-19.

KRR, which is focused on the discovery and development of mineral deposits, including vanadium, copper, gold and silver, has effectively progressed the different activities of the Pre-Feasibility Study concerning its flagship property- Speewah Specialty Metals (SSM) Project.

ALSO READ: PFS Highlights into King River Resources’ Speewah Specialty Metals Project

Recently, the Company realised fruitful results concerning the recovery of High Purity Alumina (HPA) from its flagship project, which is used as the precursor material in the booming markets of lithium batteries and LED lights, semiconductors and laser.

Apart from the SSM project, King River also wholly owns Western Australia-based Mt Remarkable Project, situated ~200 kilometres southwest of East Kimberley’s Kununurra region. In the metals and mining sector, having a well-balanced portfolio of projects that are at different phases not just ensure cash flow but also provide insulation against market risks.

Exploration Activities Concerning Mt Remarkable Gold Project

At the Mt Remarkable Gold Project, along the epithermal quartz veins, KKR has identified many surface locations assaying high mineral values. The Company has targeted Trudi Veins and Reconnaissance Veins as an integral component of its gold exploration endeavours at the project.

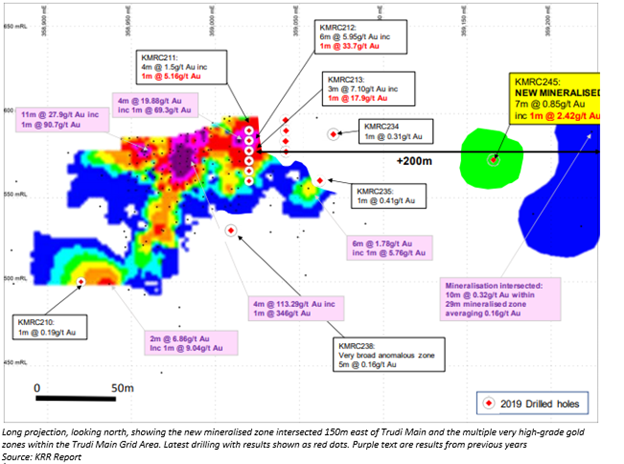

King River Resources’ RC drilling programme in the December 2019 quarter at its high-grade Mt Remarkable gold project incorporated 39 RC drill holes that were drilled for 2,677 metres. Multiple high-grade gold results at the project from previous drilling programme have also been achieved.

The December quarter drilling primarily targeted the high-grade Trudi vein along with veins identified during reconnaissance exploration taken up during the year 2019.

Trudi Vein Drilling Program

The drilling was carried out in the extensions to the two new high-grade gold zones found at the east end of 2018 Trudi grid drilling and depth extensions to high-grade mineralisation at Trudi. The drilling area also incorporated Trudi Vein’s east strike extensions up to 700 metres beyond the 5m grid drilling where KRR interpreted three possible vein positions extending under a rock-containing hill, which is now interpreted as a cover unit.

The Company has completed 17 holes for 1,368 metres targeting Main Grid area and Trudi East extensions, all of which have returned results, with the best ones including –

- 6m @ 5.95g/t Au from 20m including 1m @ 33.7g/t Au

- 3m @ 7.1g/t Au from 26m including 1m @ 17.9g/t Au

- 7m @ 0.85g/t Au including 1m @ 2.42g/t Au

Reconnaissance Veins

In the exploration targeted at Reconnaissance Veins, the Company drilled 22 RC holes for 1,309 metres, targeting newly discovered, anomalously mineralised veins discovered during reconnaissance work undertaken in 2019.

Significant structure and quartz adularia veining were intersected at the three locations at reconnaissance work, including the Central Dome, Jeniffer and Camp North areas. At the newly discovered mineralised quartz adularia vein, namely, three of the four holes drilled intersected significant gold mineralisation up to 0.64g/t Au.

With the heightened uncertainty and intensified fear of global recession amidst the coronavirus pandemic, gold prices are seeing considerable surge. The higher gold price is very conducive for gold players across the value chain in general and for the Company’s Mt Remarkable Gold Project in particular.

Stock Performance - By the end of the trading session on 17 April 2020, KRR stock closed at $0.034 per share, inching upward by 6.25% intraday. The share price of the Company in the past one month and three months surged by 39.13% and 60%, respectively. On a year-to-basis, the stock return was noted at 52.38%.