Australia-based consulting systems integrator, K2fly Limited (ASX: K2F) announced on 9 January 2020 that it had concluded an agreement with The National Trust of Australia to novate the license of The Keeping Place (an Infoscope solution) to the new entity called The Place of Keeping Ltd.

The Place of Keeping Ltd is the new indigenous owned and controlled not-for-profit company that has been established to own and manage The Keeping Place.

The new entity will actively work with several Aboriginal groups, corporations and Native Title Representative Bodies within Australia to onboard and establish these groups on The Keeping Place platform. As part of the novation agreement, a fee of $ 180,000 was paid to K2fly as the final instalment of the license agreement. K2fly will continue to partner with The Place of Keeping to maintain and support the new implementations of the software for the communities in which it serves on a base annuity of over $ 50,000 per annum.

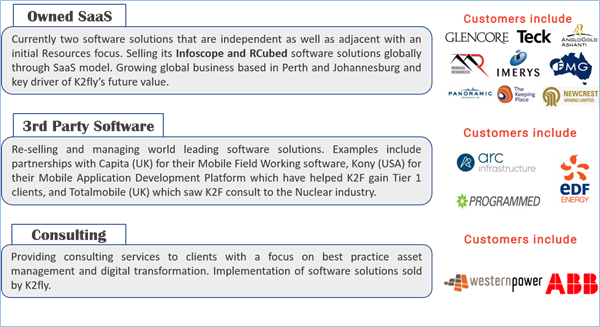

Business Segments

Read More: K2fly Reports Highest Ever Invoice Value for Q2 FY20

K2F Trades at 52 Week High

K2fly has a market capitalisation of approximately $ 21.89 million with ~82.59 million shares outstanding. On 9 January 2020, the K2F stock was trading at AUD 0.280, zooming up 5.66% by AUD 0.015 with ~ 55k shares traded at AEDT 01:42 PM. The K2F stock price hit a new 52-week high of AUD 0.285 during the day’s trade.

Besides, K2F has delivered positive returns of 51.43% in the last six months, 60.61% in the last three months and 23.26% in the last one month.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. The above article is sponsored but NOT a solicitation or recommendation to buy, sell or hold the stock of the company (or companies) under discussion. We are neither licensed nor qualified to provide investment advice through this platform.