Today, the Australian stock market plunged by 1.32 per cent, settling the day trade at 6075.1. Yesterday, the benchmark index ended at 6,156.3. Other than the energy sector, all other sectors ended in the red zone.

As per the latest government report, the total number of cases reported in Australia in the last 24 hours is 388. The retail data suggests that the panic buying has returned among consumers. Earlier it appeared that Australia could control the virus well, but the latest rising new cases and community transfer puts a grim picture of reality.

On Tuesday, the US stock market witnessed mixed performance with NASDAQ composite down by 0.81 per cent, Dow Industrials was up by 0.60 per cent, and S&P 500 surged by 0.17 per cent.

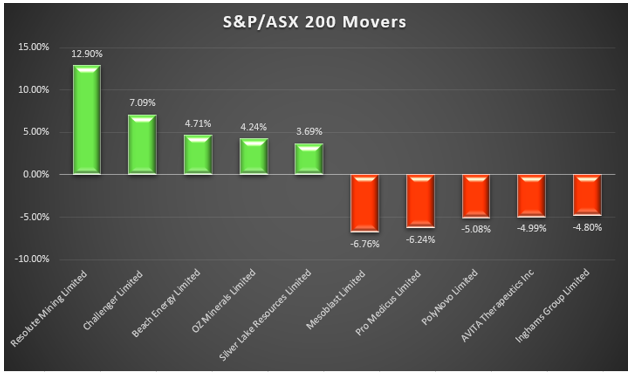

The stocks that performed the best today are:

- Resolute Mining Limited (ASX:RSG), which traded at AUD400 and was up by 12.903 per cent on the back of its 2020 quarterly report presentation which shows guidance of 430koz at USD 980/oz AISC maintained for 2020; and

- Challenger Limited (ASX:CGF), which traded at AUD 4.680 and was up by 7.094 per cent.

The weak performing stocks in today's market are:

- Mesoblast Limited (ASX:MSB), Which traded at AUD 3.450, down by 6.757 per cent; and

- Pro Medicus Limited (ASX:PME), which traded at AUD 24.490, down by 6.24 per cent.

See the graph here for the top five best and weakest performing stocks in today's market: