The Australian stock market has rebounded on Wednesday with the benchmark index closing at 6052.9, gaining 1.88 per cent as compared to Tuesday, where the market closed at 5941.1. All sectors have ended in the green zone. Consumer discretionary, Health care, Information technology, and materials sectors, each increased by more than 2 per cent.

In the US stock market on Tuesday, NASDAQ Composite was up by 0.94 per cent, Dow Industrials surged by 2.13 per cent, and S&P 500 increased by 1.34 per cent. The US market climbed higher on Moderna's announcement that its vaccine produced neutralizing antibodies in all 45 patients in its early stage human trial.

Australia has reported 284 new cases in the last 24 hours. The nation is struggling with the second wave of infection, mostly through community transfer. Victoria state is under stage 3 stay at home restrictions. Sydney's pub cluster is adding to the fear of community transfer through freight driver who visits the pub often.

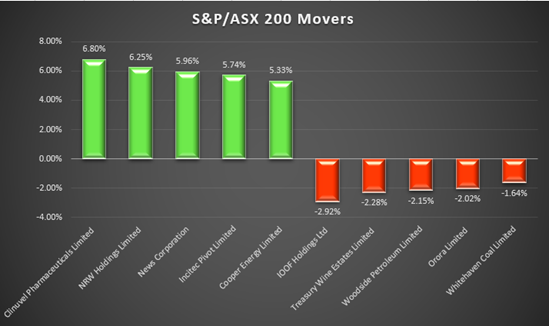

The top-performing stocks for today's market are:

- Clinuvel Pharmaceuticals Limited (ASX:CUV), which was up by 6.803 per cent when traded at AUD 23.550.

- NRW Holdings Limited (ASX:NWH) today grew by 6.25 per cent when traded at AUD 1.700.

The worst-performing stocks for today's market are:

- IOOF Holdings Ltd (ASX:IFL), which traded at AUD 4.990, down by 2.918 per cent.

- Treasury Wine Estates Limited (ASX:TWE), which traded at AUD 11.140, down by 2.281 per cent.

Have a look at the graph below to view five best and worst-performing stocks in today's market: