Summary

- ETFs have gained popularity over the years because of their unique features and several advantageous for investors, especially for beginners.

- ETFs are a type of financial instrument which have distinctive advantages over mutual funds and trade like stock with unique symbol or ticker.

- ETFs offer a broader investment exposure to the industry for investors who do not want to invest in a market as much as an industry.

- Along with diversification, ETFs can prove to be a good option for hedging against foreign risks.

Exchange traded funds or ETFs are one of the investment vehicles whose popularity has skyrocketed over the last few years, with market standing at billions in assets under management. No doubt, ETFs are a low-cost way to earn a return like an index or a commodity while offering various advantages to investors by helping to diversify their investments.

A lot of beginner investors find ETFs attractive as they offer several benefits like rich liquidity, the broad choice for investment, low investment threshold, diversification as well as low expense ratio etc. Due to these features, ETFs are also considered as suitable for various investment strategies employed by new traders.

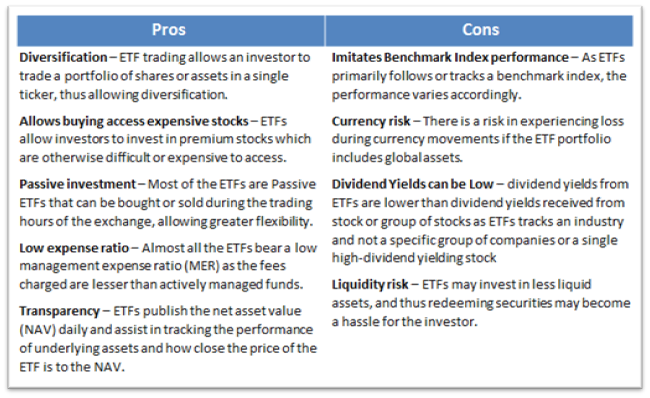

Selected pros and cons of investing in ETFs are summed up as below:

Image Source: Kalkine Analysis

Now, Let us glance through some of the key points to consider while investing in ETFs.

Know the Difference Between ETFs, Mutual Funds And Stocks

A very thin line of difference exists among ETFs, mutual funds and stocks to get a clearer idea of ETFs.

Clearly stating, ETFs are not mutual funds but resemble many features of the same;

- ETFs can be bought or redeemed at the end of each trading session per day at its NAV per share.

- ETFs are traded throughout the trading day at market prices.

Additionally, a big part of ETFs that appeals investors is the lower fees charged by ETFs as compared to mutual funds. Moreover, ETFs have unique ticker symbols that help the investor to track their price activity.

With Stocks, the difference is huge. While a stock represents just one company, ETFs represent a basket of assets for investors to invest.

So, in a nutshell, ETFs may trade like stocks with unique tickers and provide transparency in pricing yet resemble mutual funds and index funds under the hood, which can vary significantly on the basis of their underlying assets and investment goals.

ETFs Can Help To Gain Exposure To An Industry

ETFs offer exposure to a particular industry rather for the investors who do not want to invest in a market. For example, an investor would want to go for a coal mining ETF if it is projected that producing clean coal is the upcoming green innovation.

No matter which sector you choose, it is easy with ETFs to buy an industry ETF and not limiting your investment in sector equities be it technology, financials, utilities etc.

In addition to this, if the portfolio of an investor allows for investment in commodities, an investor can invest in commodities by buying a commodity ETF, without having to invest in commodities.

Allocating A Part Of Portfolio

A powerful tool for investing is asset allocation, which an investor can use for the purposes of diversification through allotting some part of a portfolio to various asset categories, such as stocks, bonds, commodities as well as cash.

Subject to the risk tolerating ability and investment time horizon of the investor, low investment threshold for most ETFs can aid in making investment smoother during the early days of investing.

At a young age, investors might look to invest 100% in equity ETFs with long investment time horizons and risk-bearing ability. However, with growing age risk-bearing abilities might decline, and the investor might be looking to for a less aggressive investment mix.

Hedging the Portfolio

For a beginner, it is important to consider hedging and protect his/her portfolio against downside risk while investing in the market. An investor can choose to begin a short position in a wide market ETFs if they are not familiar with other trading strategies like options trading.

Through offsetting the declines in your portfolio against the gains in the short ETF position, an investor can hedge the investment portfolio against any expected decline in the equity investment.

The mechanics of employing ETFs for hedging might be different than using futures, ETFs can prove to be a comparatively easier and efficient way of hedging for beginners.

Invest ETFs That Are In-Line With Investing Style

Several investors tend to go for large-cap securities, while some might want to invest in value stocks. Moreover, an investor can have various investment styles or strategies, like investing in growth, value or blend, or even large, mid, or small-cap. Pleasingly, there is always an ETF to fit an investor’s style of investing.

Overall, there are numerous investors who are beginning with trading in ETFs. Hence, investors need to be aware of the inside out of investing in ETFs. Notably, no asset can be termed as a perfect vehicle for investment; however, ETFs can be included in an investor’s investment strategy.