Highlights

- Investing in a managed fund pools your money together with other investors.

- With managed funds, investors can access a professionally managed portfolio of local and global stocks.

- It is necessary to check the associated risks, fund performance and fees of a managed fund before investing.

A managed fund is a kind of investment in which your investment is pooled together with other investors and a fund manager then manages the fund on your behalf.

Investing in a managed fund generally buys you units in the managed investment scheme. The number of units or shares allocated to you depends on the unit or share price at the time of investing.

Do read: How do I start my self-managed super fund (SMSF)?

Why should you invest in a managed fund?

By investing in managed funds, investors can gain access to investment opportunities that they may not be able to access on their own. It is an easy way for investors to access a professionally managed portfolio of local and global stocks. Following are some advantages of investing in managed funds:

Diversification – It helps the investors to look beyond national markets and access different global investment strategies.

Unique opportunities – It offers the investors the access to investment opportunities which are not always available to individual investors

Growth – You can make regular contributions to build an investment portfolio

Experience – Provides access to the expertise of professional and experienced fund managers

There are different kinds of managed funds to opt from and that’s why it is important to understand the risks and returns to choose a fund that meets your needs.

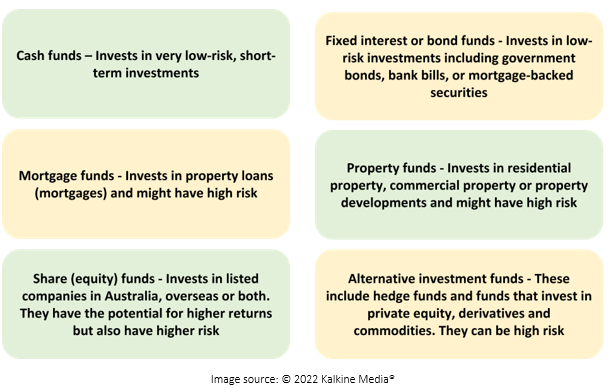

Types of managed funds

Broadly categorising, there are two types of managed funds

Single asset managed funds - invests in a single asset class. For example: Shares, property, or bonds.

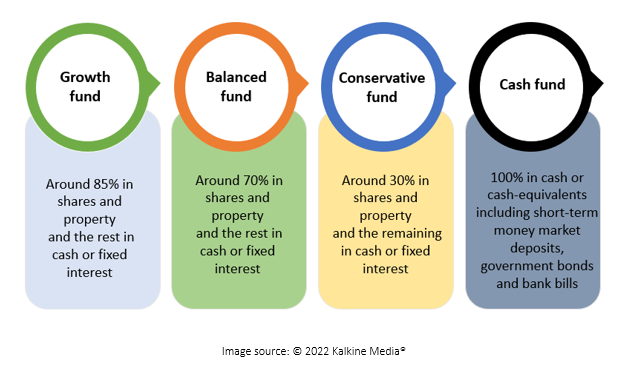

Mixed asset or multi-sector managed funds - Invest in various investments and are labelled based on the investments that comprise most of the fund portfolio.

How to compare managed funds?

Before investing in any fund, one must research and gain sufficient information to compare funds. Here is a checklist

- Check the product disclosure statement of funds. This includes information on the assets the fund has invested, the associated risks, the fees, the benchmark, or the target return.

- Check the fund’s performance over five to ten years against an index fund or other similar funds.

- Always review the risk associated with a managed fund.

- Fees can impact your returns significantly. Therefore, it is a wise idea to check the fees charged by the managed funds. Some common fees are establishment fees, management fees, performance fees, etc.