Highlights

- Self-managed super fund (SMSF) is an excellent choice for people who have sound financial knowledge and time to manage funds and their allocations.

- The bottom line is that there is no minimum balance requirement for setting up an SMSF.

- While setting up an SMSF is not a complex task, one needs to get clarity on the state authority regulations and have essential financial knowledge so that the money is not being dumped into risk.

Superannuation funds are gaining traction across the globe as a method of saving and investment without or with the most negligible tax implications. Under superannuation funds, people add money to their funds throughout the year. Eventually, such funds help people have a financially strong retirement plan.

With the rising demand for superannuation, the demand for self-managed super fund (SMSF) has been rising. Under SMSF, two-six people start the superannuation fund and manage it independently. They are entirely responsible for the investment and other decisions made regarding the fund.

What is superannuation?

SMSF is an excellent choice for people who have sound financial knowledge and time to manage the funds and their allocations. So, as many ponder upon the thought of opening their SMSF, let’s see how one can proceed on the journey.

MUST-READ: Adding crypto to your self-managed super fund? Three things to keep in mind

How do I start my SMSF?

Start an SMSF

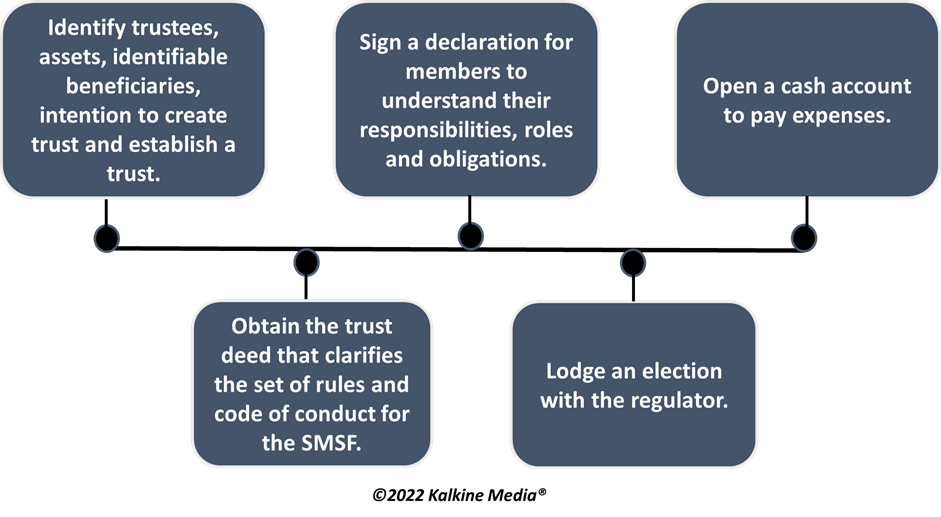

The first step in the journey to set up an SMSF is to establish a trust. The trust needs to be registered by the legal authority of the country. Establishing a trust consist of identifying four factors: trustees, assets, identifiable beneficiaries, and the intention to create a trust.

Once trust is established, one needs to obtain the trust deed. The trust deed is the document that clarifies the set of rules and code of conduct for the SMSF. The deed should answer all the necessary questions like who all the trustees are, investment choice availability, rules for alteration, payment at the time of the death of a member, when and how the fund would be wound up, etc.

The next step is to sign a declaration. Once the deed is framed, the members must sign a declaration that they understand their responsibilities, roles, and obligations under the SMSF. Some of the primary duties of trustees are- setting an investment strategy, managing funds responsibly, acting in the best interest of all members, etc.

Now comes the crucial step, trustees need to lodge an election with the regulator. Once the authorities recognise the trust, it will be registered with relevant superannuation legislation and will be entitled to concessional taxation treatment.

And the last step is to open a cash account to pay expenses such as annual supervisory levy, accounting fees, taxation liabilities, and member benefits.

Source: © Cammeraydave | Megapixl.com

GOOD SECTION: Who is an SMSF investor or holder?

How much super does one need to establish a SMSF?

This is another boiling question as to how much one needs to set up an SMSF. The bottom line is there is no minimum balance requirement for setting up an SMSF. However, ideally, one should have at least AU$200,000 for the super so people can run the fund cost-effectively. However, super funds with AU$500,000 or more balances are cheaper than retail or industry funds, as per The Australian Securities and Investments Commission (ASIC).

The usual costs incurred while dealing with an SMSF are costs including accounting, tax, audit and legal fees, and the costs of financial advice for investments.

All in all, setting up an SMSF is not a complex task. However, one needs to get clarity on the state authority regulations regarding SMSFs, practice constant vigilance and have essential financial knowledge so that the money is not being dumped into risk.