In an era of incredible technological advancement and wide application into almost every aspect of business and life, tech stocks might be a thing for your impending ennobling investment. Modern disruptive technologies, like the Internet of Things (IoT), Artificial Intelligence (AI), Blockchain, and many more, are already transforming the way of life. Since there has been a ready acceptance of these technologies by consumers and businesses, it becomes imperative to discuss about the reasons for investing in the Australian tech stocks, plus, the ASX tech stocks to watch.

The growing anxiety in the market due to the fears of a looming recession and numerous related uncertainties has made the investors uneasy and indecisive about their investment potential. In contemporary times of record-low interest rates in Australia, Brexit, US-China trade war, and other global economic issues, there is an inevitable need for an investor to come out of the biases and develop insights about the future.

As of today, several countries have not been able to completely cope up with the repercussions of one of the worst financial crises in the year 2008. However, tech companies like Facebook, Twitter and Uber have built a remarkable position in the market fuelled by the sizeable decade-long expansion of the tech industry. Tech industry has witnessed a huge transformation, ruining the corporations with weaker business models and creating an unavoidable push for other companies to adapt to the technological advancements.

[ ASX Tech Stocks – Should you be Selective in Constructing Your Portfolio]

Does this mean an investment in the tech industry is unaffected by a recession?

Reasons to Invest in Tech Stocks

A Trendsetter in the Market

With the increasing dependence of the businesses on internet technology, businesses have revamped their models and transformed into tech-oriented businesses. Major tech giants like Google, Amazon, Facebook, Apple, also known as GAFA or the Big Four tech companies, are the evidence to the endurance of the tech companies during one of the greatest recessions a decade ago.

A number of other tech companies have budded post the recession by betting on the technology card. Tech companies have made exemplary progress over the years, introducing some breakthrough technologies to the world. The tech companies carry a huge growth potential as well as potential to transform the orientation of the business as the applications of technologies like AI and IoT are not limited to a handful of companies.

Potential to Capture a Broader Market

The tech companies with a unique technology usually tend to lead the market and gain a firm grip over the market’s major share. This further opens opportunities for the company to exploit additional markets. Facebook initially started as a social media platform, but later ventured into other tech businesses like analytics and artificial intelligence, while also acquiring the related business of tech giant Watsapp.

However, not all tech companies have been able to capitalise over the disruptive opportunities in the market due to reasons like limited resources. Tech companies with disruptive technologies have been witnessed to feed their revenue appetite by gorging up their competitor’s revenues.

Clear Business Models

Before investing in a stock, any investor would begin with the preliminary research to understand the model and fundamentals of the business. A technology-based business might sound difficult to understand for many, but to your relief, many tech businesses are simple to understand. The business of a few tech companies is so simple that an investor can develop a conscience about it and release his hesitation of not looking forward to investing in tech companies.

Holds Ability to Pay Dividends

A view through the lens of Business Life Cycle validates the fact that no business can always keep growing. With “no business” we mean tech companies too. The companies that reach maturity usually adapt to a strategy which is more dividend-oriented and features share buybacks.

With several tech companies already progressing at a higher pace, the dust over the idea that the tech companies are not mature enough to pay dividends has been already blown. Apple stock has a dividend yield of 1.18% as on 14 November 2019.

With disruption and change that technology inevitably brings in social as well as economic aspects of a country, the Australian government plans to contribute to the effective functioning of the country’s innovation system.

ASX-Listed Tech Stocks

Xero Limited (ASX: XRO)

Xero Limited (ASX: XRO) provides its easy-to-use platform, Xero, for small businesses and their advisors around the world, with connections to a thriving network of more than 800 third-party apps and over 200 connections to financial service providers and banks.

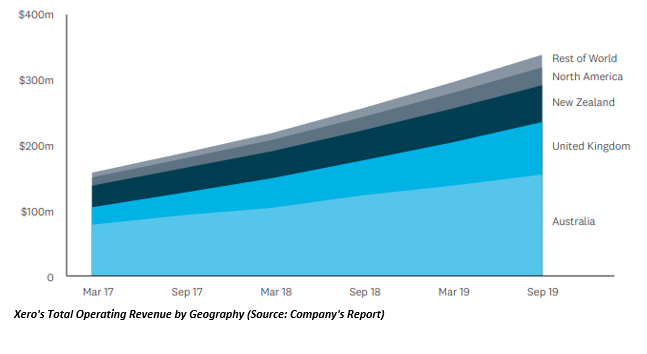

During the H1 FY20 (half-year ending 30 September 2019), Xero reported an increase of 32% in its operating revenue to NZD 338.7 million (33% in constant currency). In addition to this, Xero witnessed a 30% growth in total subscribers to 2.057 million, and the net profit after tax was NZD 29.9 million up to NZD 1.3 million.

During the day’s trade on 14 November 2019, XRO increased by 0.103% and ended at a price of $77.650, close to its 52-week high price of $79.150. XRO has a market capitalisation of $10.97 billion and has delivered a return of 14.60% in the last month.

WiseTech Global Limited (ASX: WTC)

Being a leading developer of software solutions, WiseTech Global Limited (ASX: WTC) provides software solutions to the logistics execution industry globally, with over 12,000 customers in the form of the world’s logistics companies across more than 150+countries.

CargoWise One is the flagship platform of WTC, shaping a vital link in the international supply chain and executing more than 51 billion data transactions on a yearly basis.

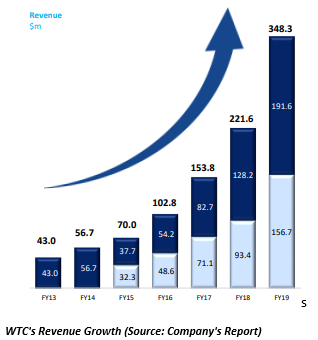

WTC recently reported total revenue of $348.3 million for the year ended 30th June 2019 (FY19), up by 57% as compared to FY18. Besides this, WTC’s net profit attributable to equity holders amounted to $54.1 million for FY19, which represents an increase of 33% on FY18. WTC’s board of directors determined fully franked final dividend of 1.95 cents per share to its shareholders.

At the market close on 14 November 2019, WTC stock closed at a price of $28.630, up by 1.49% intraday, with a market capitalisation of $8.98 billion.

WTC stock has an annual dividend yield of 0.12% and a 52-week high price of $38.800.

Altium Limited (ASX: ALU)

For the financial year ended 30 June 2019, ALU reported outstanding revenue growth of 23% to USD 171.8 million across all business units and key regions. In addition to this, ALU stretched its profit margins to record levels with a 41% increase in net profit after tax to USD 52.9 million and growth in earnings per share (EPS) of 41%.

During the day’s trade on 14 November 2019, ALU stock closed at a price of $34.03, up by 2.3% intraday, with a market capitalisation of $4.36 billion. ALU stock has an annual dividend yield of 1.02% and a 52-week high price of $38.490.

Bottomline

The above discussed stocks have shown striking performance in times of global financial and economic environment with a persistent threat of a looming recession. Robust business models and unique technology with growing utility across borders has further fuelled the staggering results of these companies.

In order to tackle recession, an investor would need to know a few ways to combat recession.

The ever-increasing dependence of humans on technology has given rise to various schools of thoughts, one of them being oriented towards the thought of “reducing the power and presence of technology”. However, the Innovation and Science Australia encourages Australians to view technology transformations as the foundations of renewed growth that can sustain their enviable prosperity and quality of life.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)