In the recent past National Australia Bank Limited (ASX:NAB) has gained a lot of traction among the market experts on the backdrop of changing landscape of the financial sector, and on the dividend paying trend of the company on sustainable basis. Let us look at the companyâs financial and stock performance comprehensively.

National Australia Bank Limited (ASX: NAB) is primarily involved in banking and business banking services. The major segments of the bank include Business and Private Banking, Consumer Banking and Wealth Management, Corporate and Institutional Banking, Customer Products and Services, and NZ Banking.

NAB has recently issued A$1,000,000,000 subordinated floating rate medium term notes (MTN), which will be due in May 2029. The subordinated MTNs convert into fully paid ordinary shares of the issuer, where the Australian Prudential Regulation Authority determines this to be necessary on the grounds that the issuer would otherwise become non-viable.

The issue of subordinated MTNs by the issuer will not have a material impact on the issuerâs financial position. If a non-viability trigger event occurs and the issuer issues ordinary shares, the impact of the conversion on the issuer would be to increase the issuerâs shareholdersâ equity. The number of Ordinary Shares issued on conversion is limited to the Maximum Conversion Number. The Maximum Conversion Number is 200.4008 Ordinary Shares per subordinated MTN (with a denomination of A$1,000), based on an Issue Date VWAP of $24.95.

The bank will pay interest of $0.72803507 on NABHA-HYBRID 3-BBSW+1.25% PERP SUB EXCH NON-CUM STAP securities on 15th August 2019. The Ex-Date and the Record dates for the same are 30th July 2019 and 31st July 2019, respectively.

On the financial performance front, the reported net profit attributable to owners of NAB increased by $111 million or 4.3% to $2,694.0 million. The net profit attributable to owners of NAB, excluding the impact of discontinued operations, increased by $30 million or 1.0%, with discontinued operations reflecting losses relating to customer-related remediation and additional costs associated with the life insurance business sale.

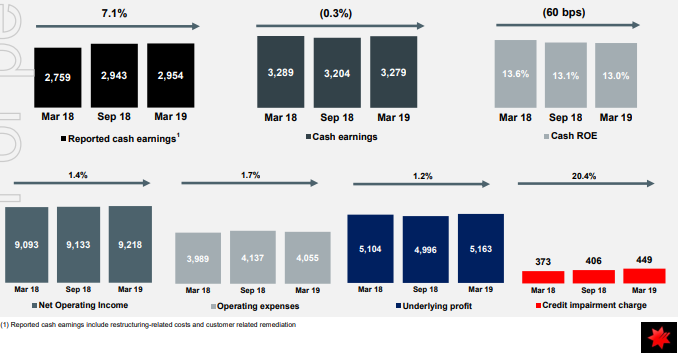

Group Financial Performance (Source: Company Reports)

Group Financial Performance (Source: Company Reports)

The Bankâs cash earnings increased by $195 million or 7.1%, including the impact of customer-related remediation of $325 million in the March 2019 half year and restructuring related costs of $530 million in the March 2018 half year. Excluding these items, cash earnings decreased by $10 million or 0.3%.

Among the key ratios, the Common Equity Tier 1 Ratio (CET1) is up by 20 bps to 10.40% as compared to September 2018 and is placed well to exceed APRAâs strong target of 10.5% by January 2020. Further, the liquidity coverage ratio of the bank stood at a quarterly average of 130.0%, along with a net stable funding ratio of 112%.

On the operational performance front, the expenses growth of the bank is slowing down, and as compared to 2H18, declined by 2% as the bank was able to capitalise on the benefits of transformation. Going forward, NAB expects to continue to target broadly flat expense growth for FY19 and FY20, excluding large notable expenses such as customer-related remediation and restructuring-related costs.

The stock of National Australia Bank Limited was trading at $26.490, with a market capitalisation of $74.5 billion as on 31st May 2019. It has yielded a YTD return of 12.15% and exhibited returns of 7.55%, 5.20% and 4.54% over the past six months, three months and one-month period, respectively. Its 52-week high price stands at $29.00, and the 52-week low price stands at $22.520, with an average trading volume of ~6.97 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.