Investors, generally, prefer to diversify risk by allocating their capital in different stocks. A study has depicted that the level of diversification is more among the younger and low-level income investors. Diversification helps investors in reducing their risk and increasing the level of return. In this article, three stocks operating in different sectors have been discussed. Let us have a look at their recent developments.

Lycopodium Limited

Lycopodium Limited (ASX:LYL), headquartered in East Perth, Australia, is an engineering consultation company, offering a complete range of services and catering to a broad range of commodities, geographies and clientele. The company was listed on the Australian Stock Exchange in 2004. On 28th August 2019, Lycopodium declared full-year results for the financial year ended 30th June 2019, mentioning FY19 as a busy and successful year in the markets in which the company operates.

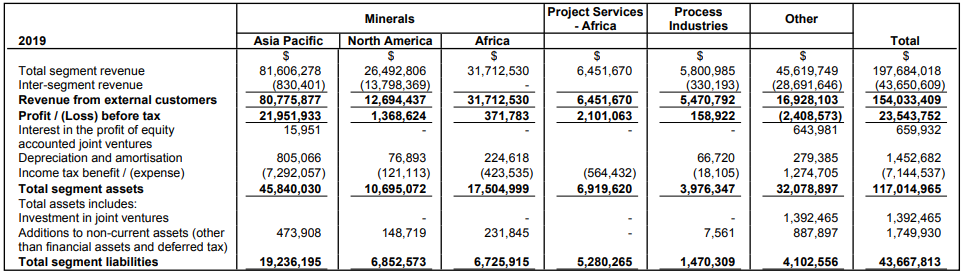

Below are the highlights of the companyâs financial performance during FY2019

- Total revenue dipped by 20.8% year-on-year to $154 million

- Profit before tax dipped to $23.54 million in FY19 from $26.85 million in FY18

- Profit after tax declined by 10.8.% to $16.51 million

- Total cash & cash equivalents at the end of the financial year 2019 stood at $60.45 million

- Total dividend for the reported period was 30 cents per share

Segment Information

- APAC region emerged as the major contributor ($81.61 million) towards the companyâs FY19 revenue followed by Africa and North America, with $31.71 million and $26.49 million in revenue, respectively

- PBT for APAC, North America and Africa stood as $21.95 million, $1.37 million and $0.37 million, respectively

- Total segment Assets for APAC ($45.84 million), Africa ($17.50 million) and North America ($10.61 million)

Source: Companyâs Report

Meanwhile, the company has announced a final fully franked dividend of $0.15 per fully paid ordinary share related to the six-month period ended 30 June 2019, with a record date of 27 September 2019 and payment date of 11 October 2019.

Stock Performance

On 30 August 2019 (AEST 03:50 PM), the stock of LYL was trading at a price of AUD 5.750, trading flat, with a market cap of around AUD 228.46 million and approximately 39.73 million outstanding shares. The 52-week high and low value of the stock is at AUD 6.140 and AUD 4.040, respectively. In the last one month, three months and six months, the stock has delivered returns of 2.68%, 20.29% and 15.23%, respectively. The stock has an annual dividend yield of 5.22% and a PE multiple of 11.69x.

Hawkstone Mining Limited

Hawkstone Mining Limited (ASX: HWK) is a mineral explorer, engaged in exploration and development work in the United States and South Africa. On 28th August 2019, the company announced an increase of 15% in the Big Sandy lithium exploration target, located northwest of Phoenix, the state capital of Arizona in the United States.

Few highlights of the development are as follows:

- Additional exploration resulted in a 15% increase in the exploration target size for the Big Sandy sedimentary lithium project.

- The company completed the phase 2 diamond drilling project and all the results received with the objective of estimating a maiden JORC compliant resource by end-September 2019.

- HWK has planned a further drilling for Block B and Block C in the Northern Mineralised Zone (NMZ) and Block 1 in the Southern Mineralised Zone (SMZ)

Summary of Exploration Target Ranges at Varying Thicknesses (Source: Companyâs Report)

Stock Performance

On 30 August 2019 (AEST 03:54 PM), the stock of HWK was trading at a price of AUD 0.012, down 7.692% from its previous close, with a market cap of around AUD 8.97 million and approximately 690.32 million outstanding shares. The 52-week high and low value of the stock is at AUD 0.034 and AUD 0.011, respectively. In the last one month, three months and six months, the stock has delivered negative returns of 23.53%, 45.83% and 23.53%, respectively.

Valmec Limited

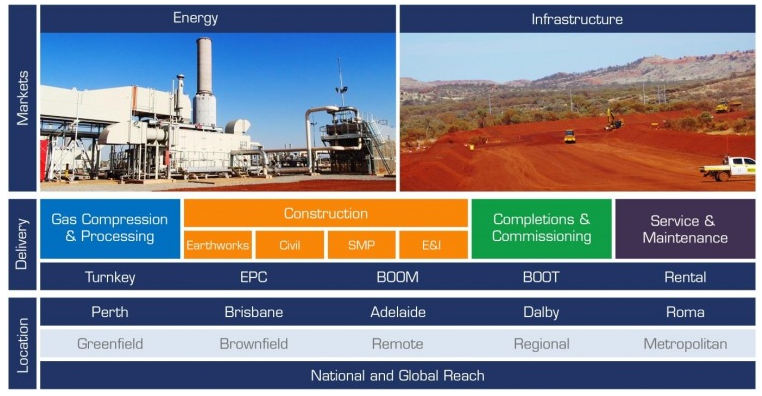

Valmec Limited (ASX:VMX) is an Australian diversified energy and infrastructure services group, offering equipment, in addition to construction, commissioning and maintenance services. The company caters to clients in the energy, oil & gas and infrastructure sectors.

VMX Snapshot (Source: Companyâs Report)

On 28th August 2019, the company released its full year result for the year ended 30 June 2019. Key highlights of the companyâs financial performance during FY2019

- Revenue grew by more than 6.3% to $110 million compared to the previous corresponding year

- The company posted record EBITDA of $8.06 million, representing an increase of 64% when compared with the same period a year ago.

- Sales revenue increased by 6.7% to $110 million

- Reported NPAT for the year was $3.5 million, a substantial increase from the previous year

- The service segment accounted for 50% of group earning from 42% of the total revenue

- The cash and cash equivalents at the end of FY2019 stood at $3.82 million

- The company entered FY20 with an order book of ~80 million along with a pipeline of construction and services opportunities worth more than $595 million

Outlook

The company leveraged a strong gas thematic in FY19, which is expected to continue into FY2020/2021. VMX expects EBITDA to strengthen during FY20, in accordance with growing targeted revenues, aided by an increasing pipeline of construction opportunities, as well as further development of its asset service initiatives. Increased revenues, stronger EBITDA margins and reduced interest costs are likely to further drive reported net profit after tax (NPAT) during FY2020. Moreover, the company is anticipating growth in larger project activity to continue and cash reserves to gradually strengthen backed by margin realisation and recurring revenue contributions.

In the month of June 2019, Valmec announced to have secured a contract with Newmont Goldcorp Services Pty Ltd and an award from Australian Gas Infrastructure Group (AGIG). Few Highlights of the contracts are as follow:

Newmont Goldcorp Services Contract

- Under the contract, the company would support Newmont Goldcorp Services on their proposed Tanami Expansion (TE) 2 Project in the Northern Territory in Australia.

- The company is likely to complete most of the work by November 2019.

- A complete decision related to funding the TE 2 Project is likely to be made in H219.

- The Newmont contract represents the first step towards VMXâs future growth strategy in gas and infrastructure sectors within the region.

AGIG Contract

- VMX also shortlisted for delivering the first hydrogen production facility in Australia.

- The project to be located in Tonsley in South Australia is valued at $4.5 million

- The company would provide EPC

Stock Performance

On 30 August 2019 (AEST 03:56 PM), the stock of VMX was trading at a price of AUD 0.285, trading flat, with a market cap of around AUD 35.83 million and approximately 125.72 million outstanding shares. In the last three months and six months, the stock has delivered returns of 29.55% and 16.33%, respectively. The stock has a PE multiple of 10.07x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.